4 0

Institutional Demand for Solana Surges to Over $591 Million

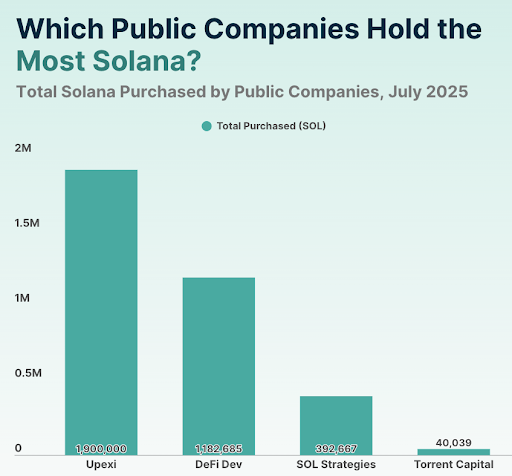

Solana has experienced a significant surge in institutional demand, with publicly traded companies holding over $591 million worth of SOL. Four firms, Upexi, DeFi Developments Corp, SOL Strategies, and Torrent Capital, have acquired more than 3.5 million SOL, marking a notable corporate accumulation.

Key Points

- Upexi leads with 1.9 million SOL purchased at an average cost of $168.63, totaling approximately $320.4 million.

- DeFi Developments Corp holds around 1,182,685 SOL, adding to its position aggressively, valued now at $198.9 million.

- SOL Strategies owns 392,667 SOL, acquired at an average price of $158.12, worth $66 million.

- Torrent Capital has 40,039 SOL, bought at an average price of $161.84, currently valued at $6.7 million.

- These four companies account for about 0.65% of Solana’s circulating supply and 0.58% of its total supply.

Acquisition Strategies

- Upexi built the largest SOL treasury rapidly, reflecting high conviction.

- DeFi Developments Corp added during market dips while maintaining long-term holdings.

- SOL Strategies employed dollar-cost averaging and staking rewards over 13 months.

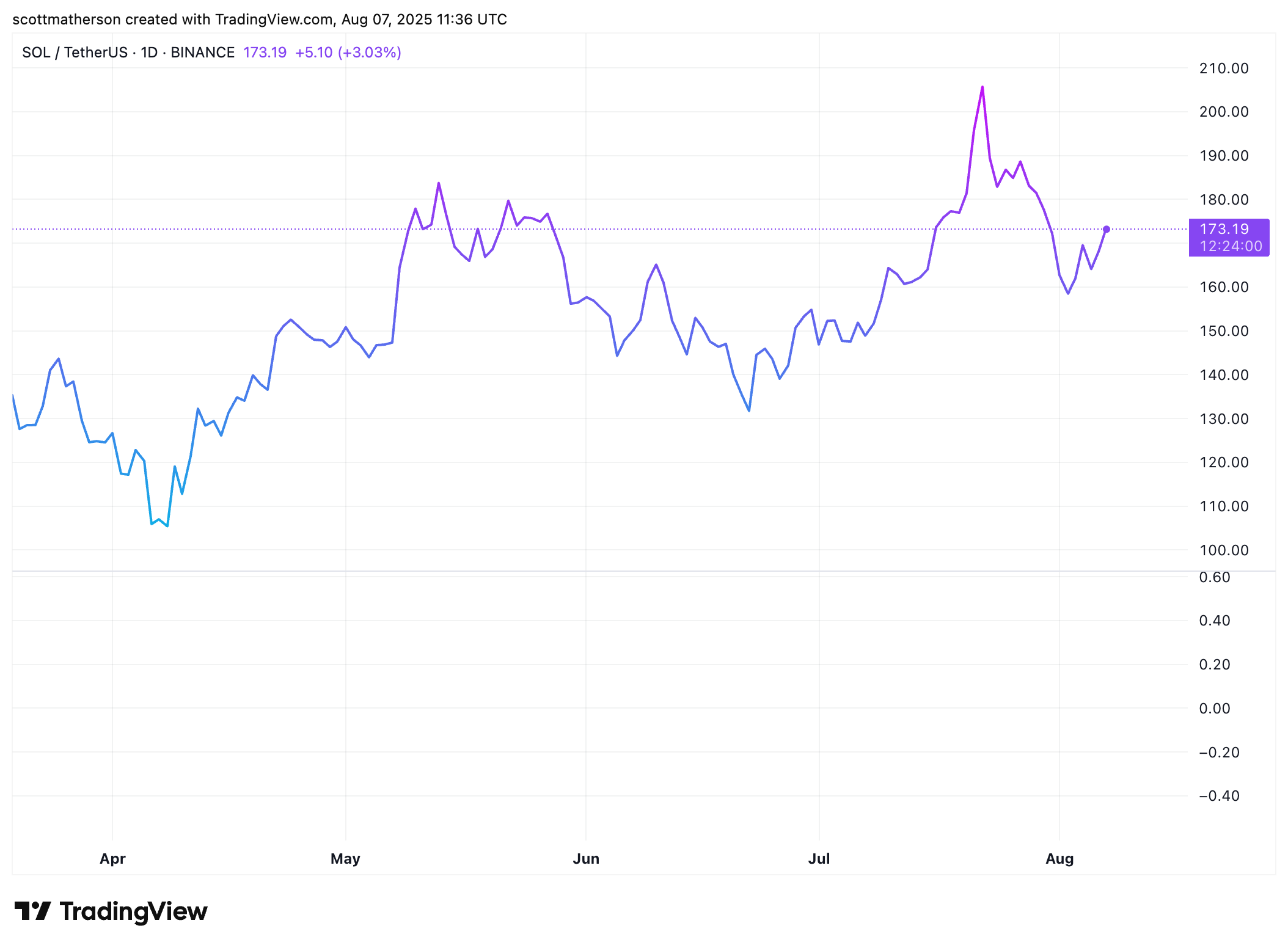

- Torrent Capital timed its purchases strategically ahead of market rallies.