6 0

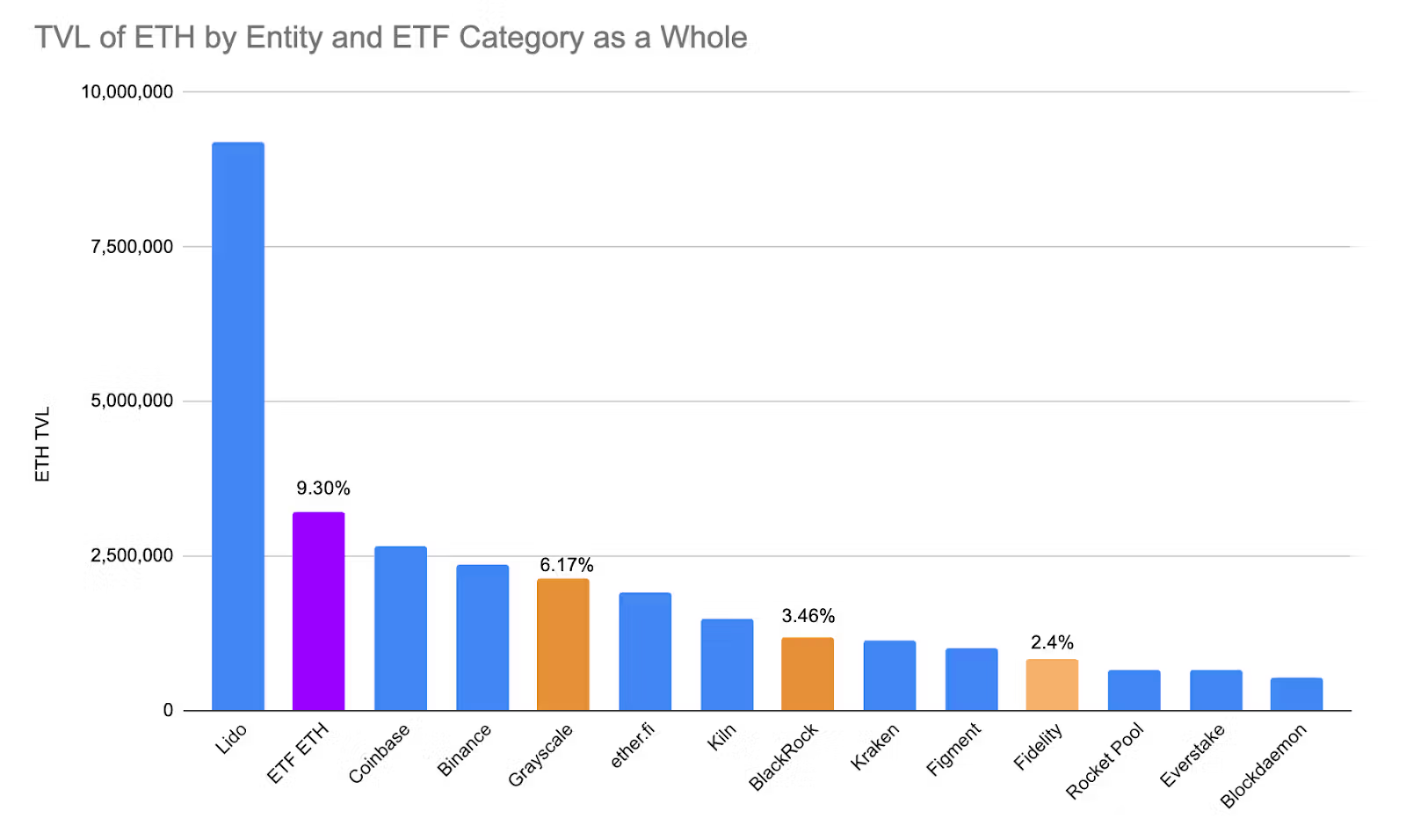

Institutional Funds Hold 3.3 Million Ether Through ETFs

Institutional funds hold approximately 3.3 million ETH, about 3% of the circulating supply, through ETFs. With 27% of ETH staked, ETF holdings could raise total staked ETH by over 10%. The focus now shifts to how institutions will stake.

- If ETH ETF staking is approved, issuers may rely on third-party operators or custodians.

- This could lead to concentrated validator power and a potential oligopoly among centralized operators.

- Lido currently holds over 30% of staked ETH but has more than 500 operators due to the Community Staking Module.

This chart illustrates total ETH held by ETFs, indicating a significant potential for institutional influence in staking.

- ETF issuers have the chance to run their own nodes, promoting decentralization and unlocking economic benefits.

- Current validator fees (5–15% of rewards) are captured by existing operators and protocols like Lido and RocketPool.

- By managing their own nodes, ETF managers can improve fund performance and reclaim that margin.

- Recent acquisitions, such as Bitwise’s purchase of a staking operator, signal a shift towards integrating staking into fund strategies.

This situation presents a pivotal moment for Ethereum: institutions can either enhance centralization or contribute to a decentralized protocol by distributing operations across validators.

With billions of ETH idle and an increasing number of validators, the opportunity for responsible institutional staking is significant.