11 2

Institutional Investors Boost Solana Holdings With $28.39M Withdrawal

Solana (SOL) has surged past $240, indicating strong recovery and momentum. Key resistance is at $270, needed to challenge its all-time high. Institutional interest fuels confidence in SOL, with significant accumulation noted.

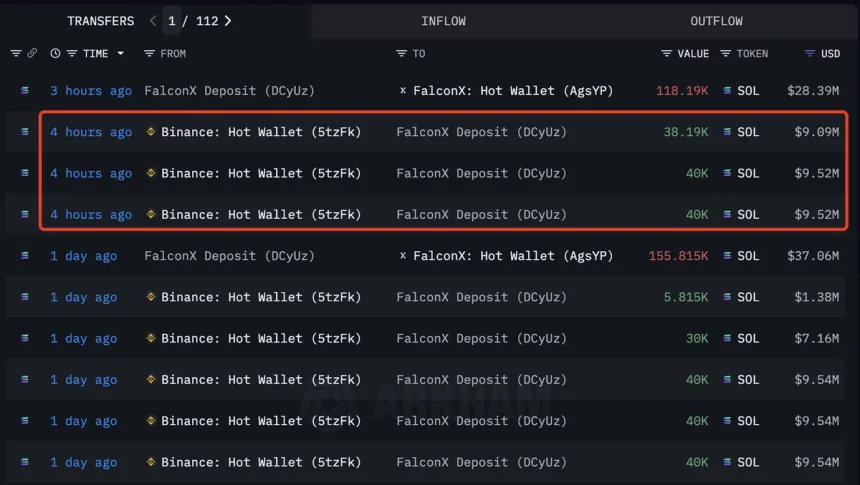

- Institutions like FalconX have made large withdrawals of SOL from exchanges, suggesting long-term confidence.

- Recent data shows a withdrawal of 118,190 SOL ($28.39 million) from Binance, following a $98 million transfer from multiple exchanges.

- Such moves are usually seen as bullish, as assets withdrawn may be held for custody or staking.

The Federal Reserve's recent rate cut has improved market sentiment, benefiting risk assets like Solana. SOL's price is currently $246.69, up nearly 3%, trading above key moving averages.

- 50-week SMA: $180.40

- 100-week SMA: $154.05

- 200-week SMA: $101.71

SOL aims to reclaim levels last seen in late 2021. A breakout above $270 could lead to retesting highs of $300–$320. Failure to maintain this could result in a pullback to the $200–$210 support zone. Despite bullish signs, traders should watch for potential profit-taking due to historical resistance.