0 0

Big Institutions Invest in Solana, Boosting Its Infrastructure and Market Position

Solana is witnessing significant interest from institutional investors, marking a shift from being primarily retail-driven to attracting major capital allocations.

Institutional Interest in Solana

- Big firms are actively accumulating Solana, with Forward Industry holding nearly $1 billion in SOL.

- Solana's capabilities in real-world asset tokenization are becoming a key attraction due to its high transaction speed and low fees.

- The Firedancer validator client went live on the mainnet, improving network finality to 150 milliseconds.

- Western Union integrated the Solana network, reinforcing its institutional-grade infrastructure.

- The Spot SOL ETF surpassed $1 billion in total net assets.

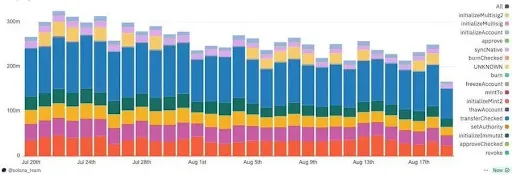

On-Chain Activity Growth

- Solana application revenue reached $2.39 billion, a 46% increase year-over-year.

- Network revenue increased 48 times over two years, reaching $1.48 billion.

- Daily active wallets rose to 3.2 million.

- Nearly $900 million in stablecoins entered the ecosystem on January 6th.

- Solana leads in 24-hour and 30-day DEX volumes and is the top blockchain by market capitalization for tokenized stocks.