10 1

Investment Firm Borrows $958M in Stablecoins on Aave for Ethereum

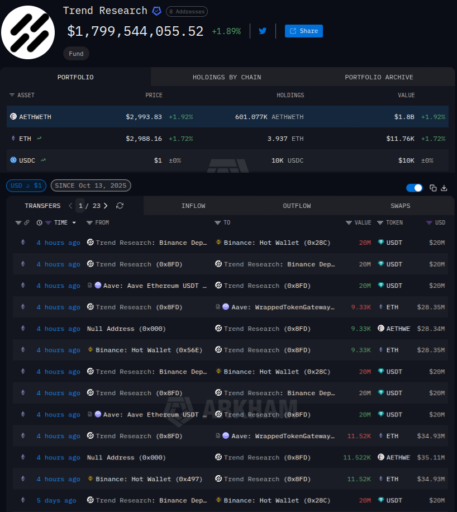

Trend Research's Ethereum Strategy

- Trend Research has a long spot position on Ethereum valued at approximately $1 billion.

- The firm utilizes Aave for borrowing stablecoins, which are used to buy Ether on Binance, and subsequently redeposits the purchased ETH as collateral on Aave.

- As of December 29, Trend Research holds 601,074 ETH worth $1.83 billion, with $958 million borrowed in stablecoins.

- The average purchase price of ETH is estimated at $3,265.

- ETH holdings are managed through Aave's interest-bearing tokens, AETHWETH.

Recent Activities

- On December 29, Trend Research withdrew 11,520 ETH from Binance after depositing 20 million USDT.

- This ETH was deposited on Aave, enabling further leveraged positions.

- A similar transaction pattern occurred with a subsequent 9,330 ETH withdrawal.

Market Context

- ETH struggles to surpass the $3,000 resistance, critical for potential bullish momentum toward $8,500.

- Aave is undergoing significant governance changes, with "token alignment" proposals under discussion.