7 0

Investor Focus Shifts Back to Fundamentals in Crypto Token Valuations

The crypto market's permissionless nature complicates token valuation. Key points include:

- Price-to-sales multiples for Layer 1 (L1) tokens like Cardano and Ripple are significantly higher than for value-generating L1s such as Solana (32x) and Ethereum (227x).

- Tokens like OM have seen price gains of 47.6% since a major industry liquidation.

- Investor interest is shifting towards fundamental analysis rather than speculative premiums.

- Funds like Maelstrom and 1kxnetwork are focusing on undervalued projects like Vertex perps DEX and Ronin chain.

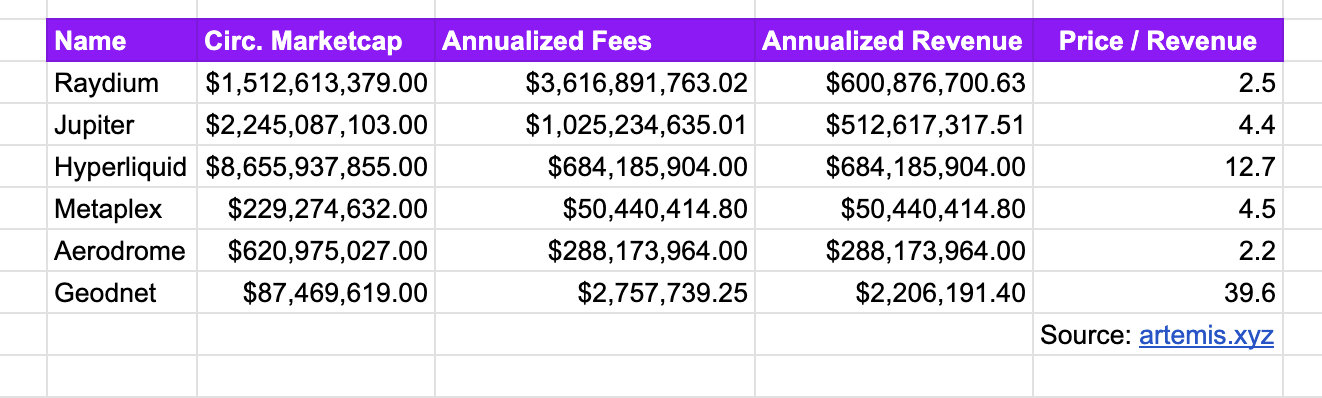

- Projects like Raydium, Hyperliquid, and Jupiter exhibit rational price-to-sales ratios based on cash flows.

- Significant token buyback programs are enhancing perceived valuations; Jupiter's program aims to buy back ~9.4% of its total circulating supply.

- L1 valuations are declining; newer L1s have lower valuations compared to earlier cycles.

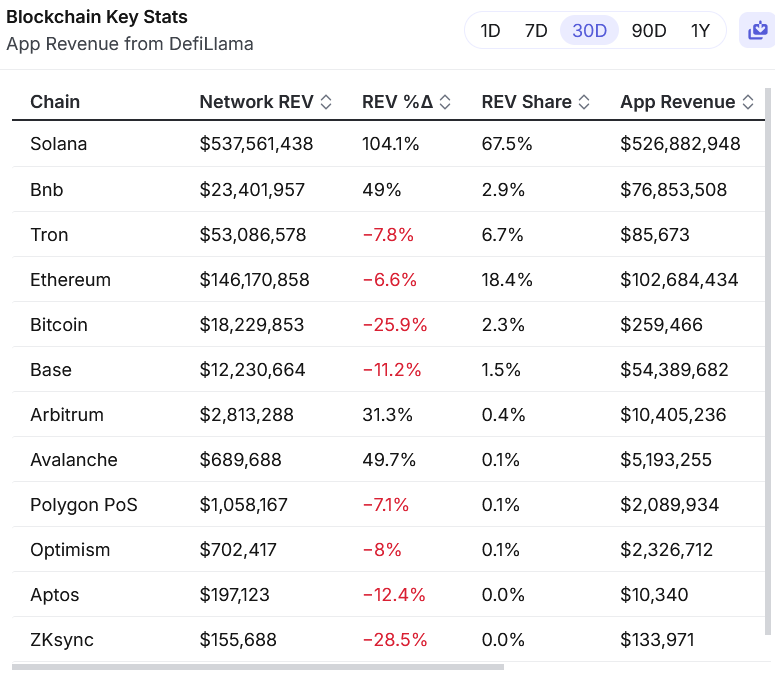

- Application revenues are surpassing those of underlying protocols.

- The focus is shifting from the fat protocol thesis to the fat app thesis amid infrastructure challenges.