Jupiter DAO Approves $860 Million JUP Token Incentive Plan

The Jupiter DAO community governing the Solana-based decentralized exchange, Jupiter, has approved an $860 million incentive plan. This decision was part of the “Jupuary” airdrop initiative and signifies a major change in the JUP token's environment.

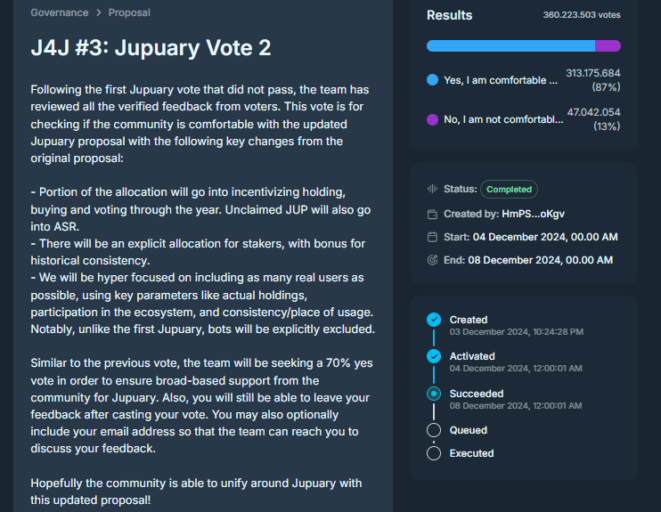

The proposal allocates $860 million in JUP tokens over two years. Initially met with resistance, it was revised and reintroduced after failing to gain community support in the first vote. The plan aims to reward Jupiter users annually based on their activity from the previous year.

To prevent tokens from reaching short-term “airdrop farmers,” protections have been established. These individuals often exploit protocols for quick rewards without long-term commitment. Jupiter's founder, known as “Meow,” stressed the importance of rewarding genuine users instead of opportunists.

Meow Outlines JUP Token Distribution Strategy

Meow stated the goal is to direct JUP to individuals likely to become long-term members, avoiding allocations to farmers or niche-focused users. A significant portion of the tokens will promote holding, purchasing, and active community participation.

“We will be hyper focused on including as many real users as possible, using key parameters like actual holdings, participation in the ecosystem, and consistency/place of usage. Notably, unlike the first Jupuary, bots will be explicitly excluded,” said Meow.

A snapshot of eligible users was taken in November. Qualifying users can check their eligibility status through a link to be released later this month. Tokens will be distributed in January, adhering to the annual Jupuary tradition.

JUP Token Dips Despite Bullish Sentiment

<pDespite the excitement from the vote’s approval, the JUP token experienced an 8.24% decline in the last 24 hours. However, trading activity increased by 25%, and weekly performance shows a 3.80% gain. This recent dip reflects ongoing uncertainties and a loss of immediate momentum.

Signs of bullish sentiment are emerging. Exchange Netflow data indicates fewer JUP tokens are being deposited on exchanges, suggesting that investors prefer to hold their tokens rather than sell. This reduction in circulating supply could potentially increase the token's value.