Key Insights from BTC ETF Options Launch This Week

This week, I interviewed Jeff Park, head of alpha strategies at Bitwise Asset Management, regarding the launch of BTC ETF options.

Main Takeaways

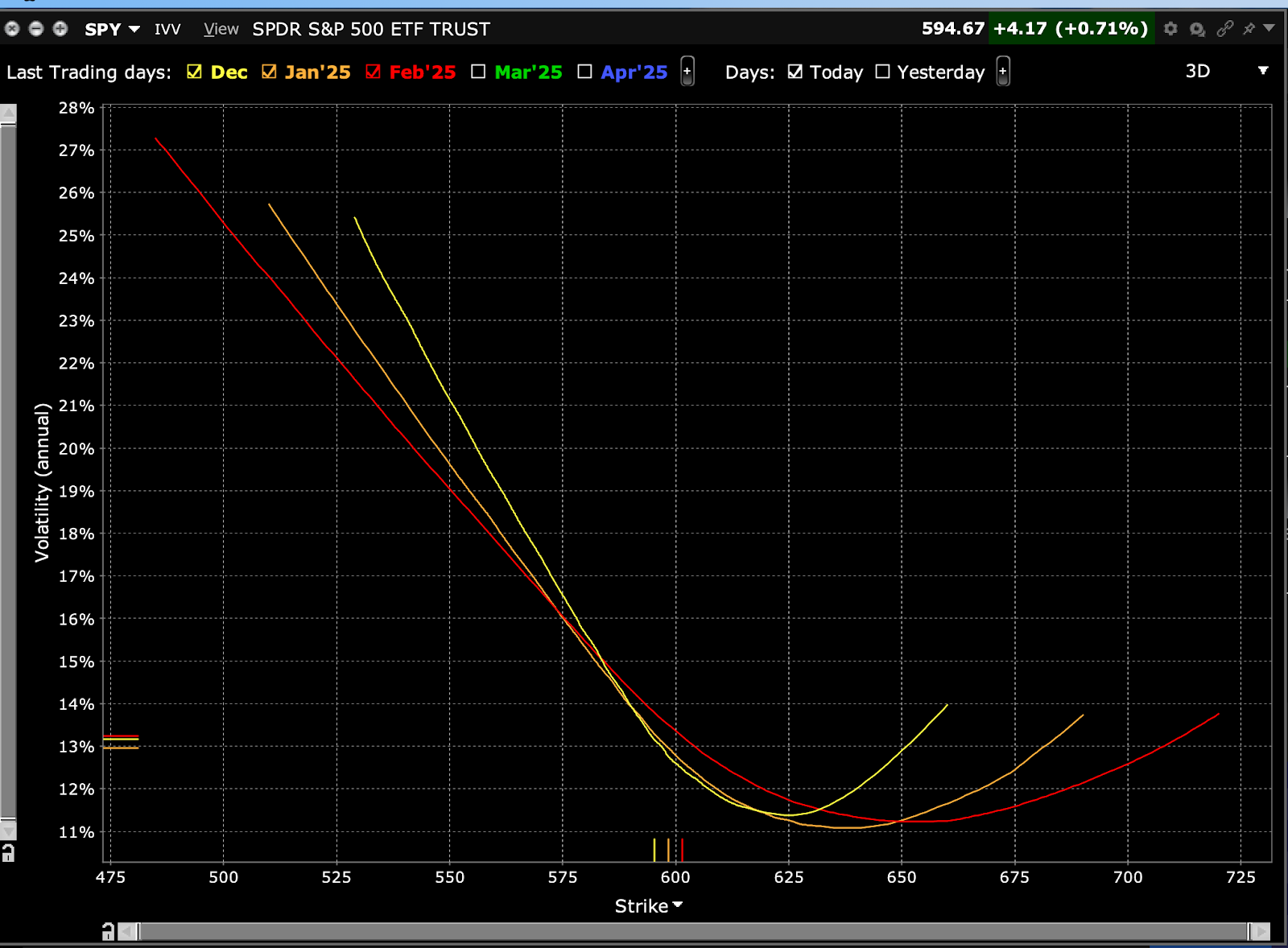

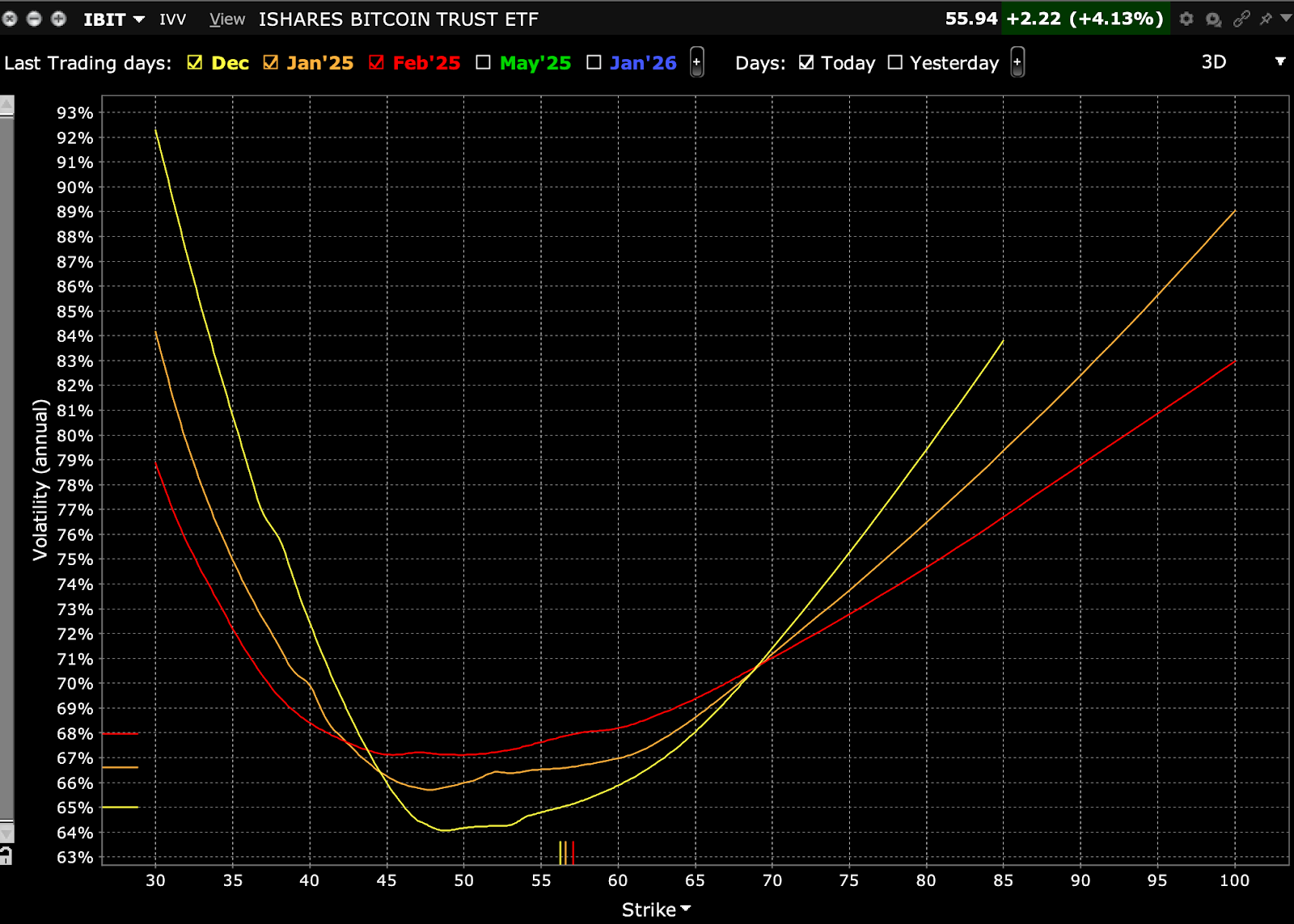

Volatility Smile

In risk assets, puts generally command higher premiums than calls due to hedging demand, resulting in a half smile in volatility. However, crypto exhibits a persistent volatility smile where calls and puts are equally priced:

This persistent smile in Bitcoin arises from its difficulty adjustment, preventing supply adjustments seen in traditional commodities, thus maintaining a unique volatility structure.

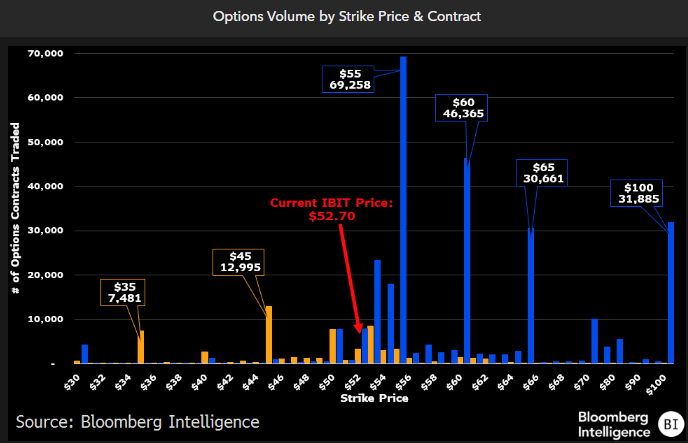

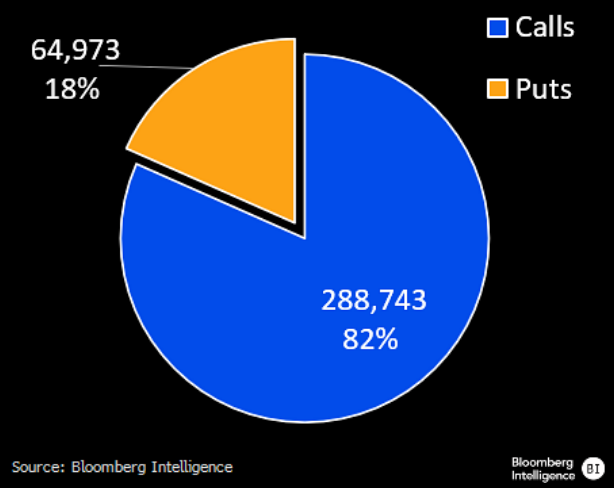

Call Heavy Flow

The majority of options activity has centered on out-of-the-money calls. Data shows that 82% of the first-day options volume on IBIT came from calls:

Deribit vs TradFi Options

Jeff noted that Deribit, a 24/7 crypto options exchange, will likely price BTC options differently from ETF options. Due to theta, or time to expiry, Deribit options should trade at a premium compared to ETF options, which are limited to standard market hours.

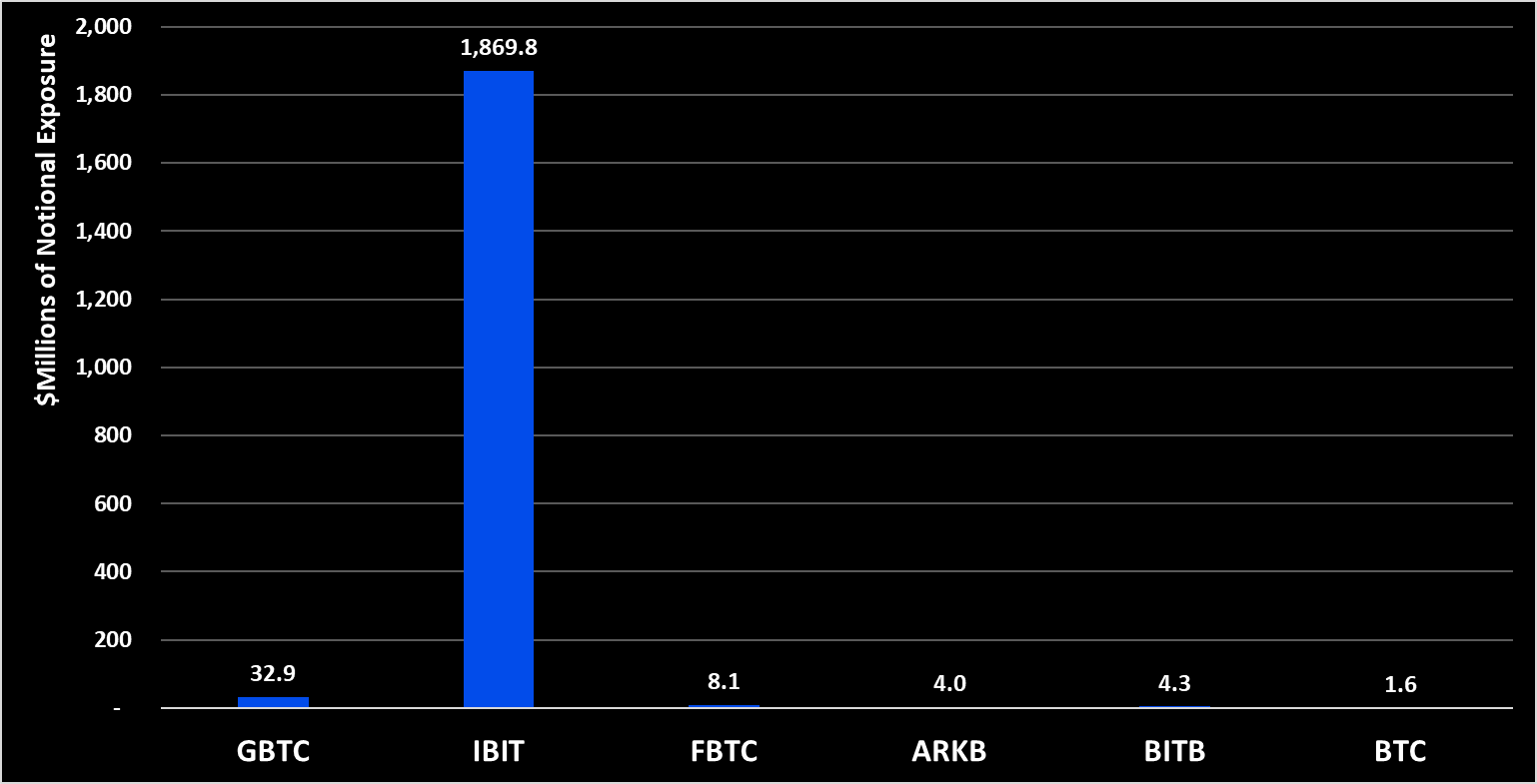

Most on IBIT

Despite the launch of multiple ETF options, most notional exposure remains within BlackRock’s iShares Bitcoin Trust (IBIT), leading to wider spreads in other ETFs due to lower liquidity:

Conclusion

The market structure has significantly shifted with the launch of ETF options. Options flow dynamics are expected to increasingly influence price action, moving beyond the traditional reliance on perpetual futures.