Long-Term Bitcoin Holders Sell 827,783 BTC Amid 326% Profits

On-chain data indicates that long-term Bitcoin holders have been selling as their profits have increased significantly following a price surge.

Bitcoin Long-Term Holders' Profit Realization

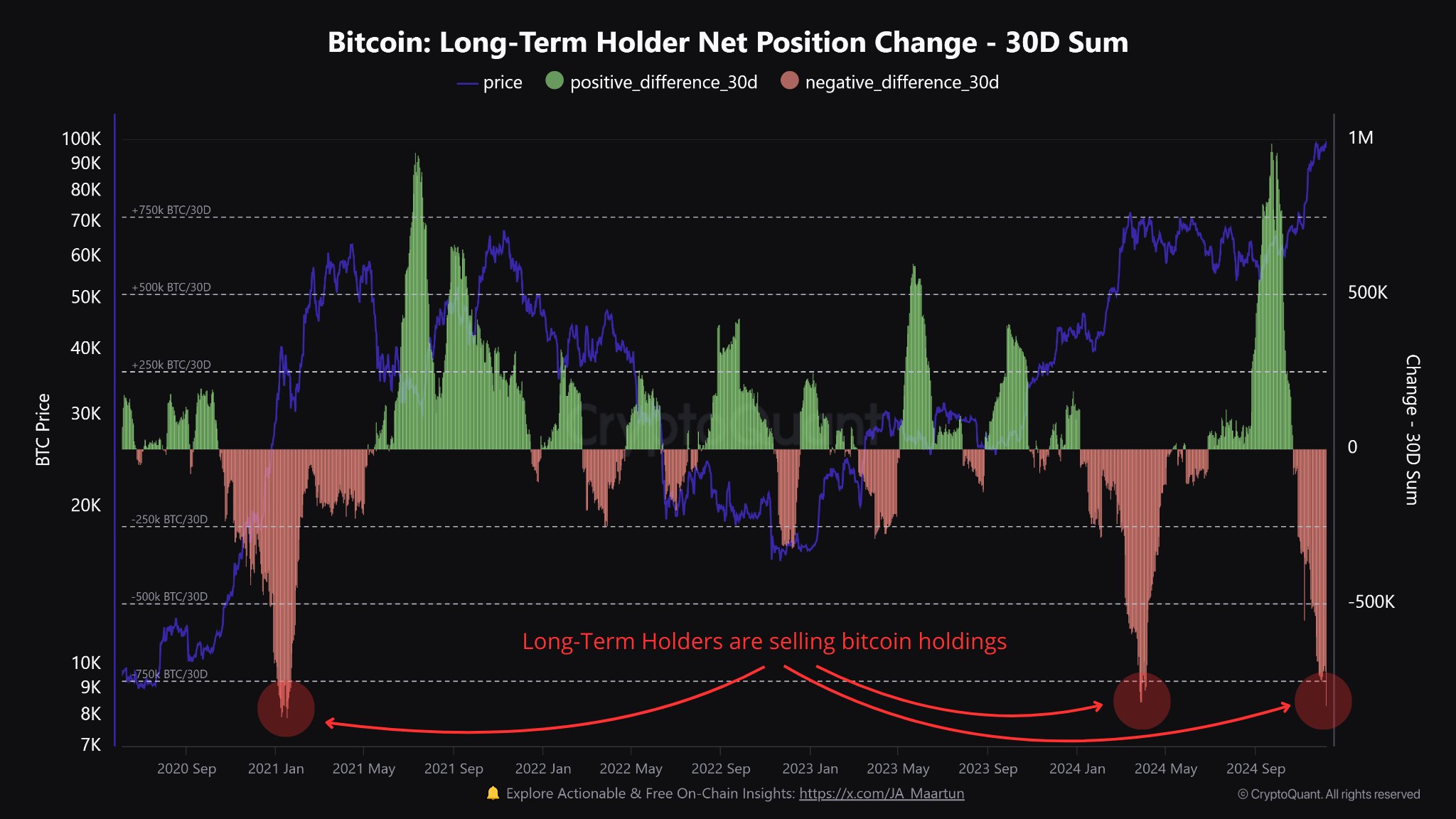

According to CryptoQuant analyst Maartunn, long-term holders (LTHs) of Bitcoin, defined as those holding for over 155 days, have sold considerable amounts in the past month. This group typically holds onto their investments through market fluctuations, unlike short-term holders (STHs) who react quickly to market changes.

The recent selling by LTHs suggests a pivotal moment in the market, indicating even the most steadfast investors are cashing out under current conditions. The ongoing bull run has prompted some LTHs to realize profits, as shown in the chart below depicting the 30-day change in LTH supply.

The graph reveals a significant negative change in Bitcoin LTH supply over the past month, indicating active selling from these holders. In total, LTHs have transferred 827,783 BTC during this period, with many transactions likely reflecting sales intentions.

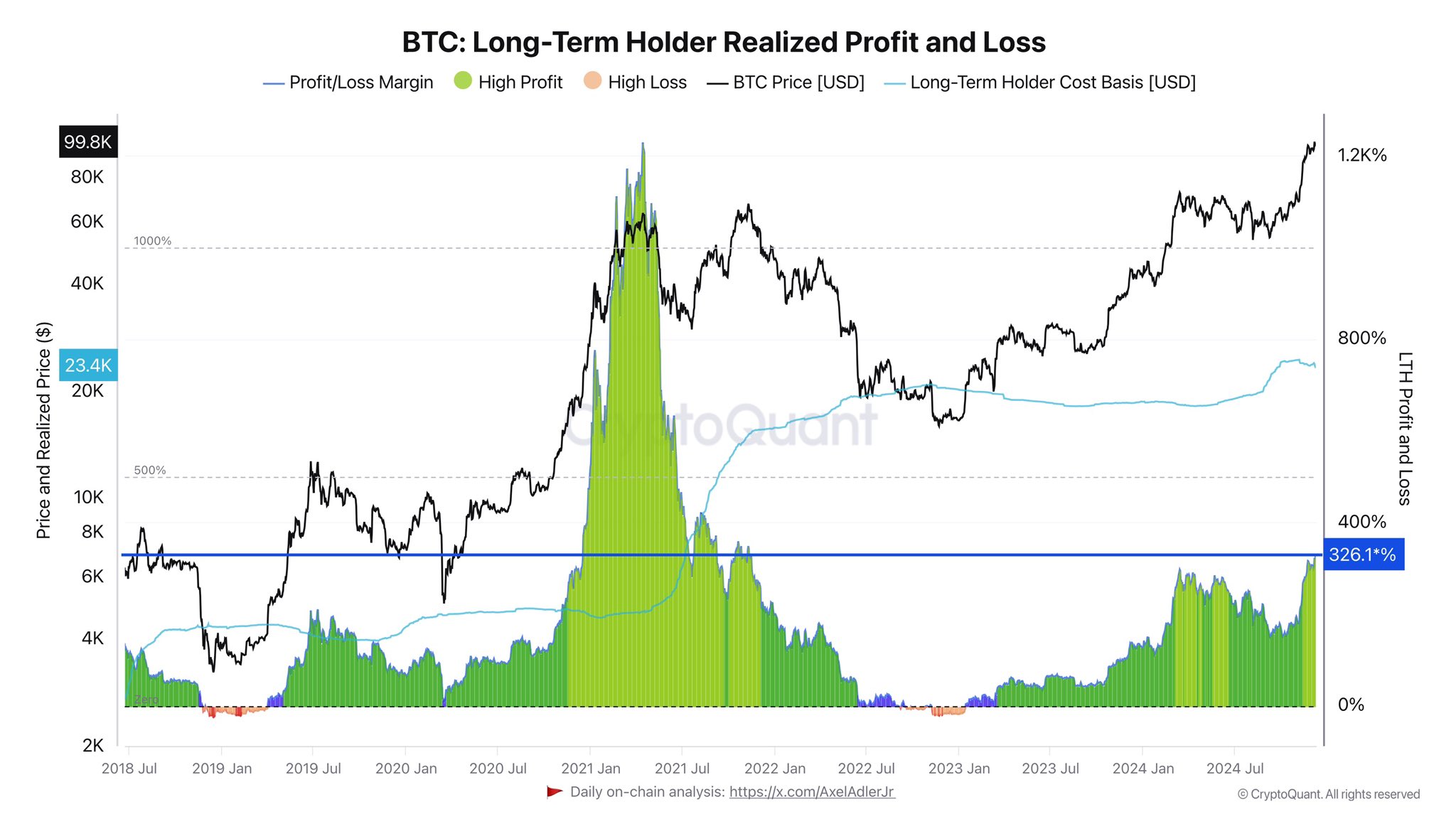

The motivation behind this selloff is linked to the group's profit margins. As noted by CryptoQuant's Axel Adler Jr., LTHs are enjoying average profits of 326%. The accompanying chart illustrates that while current profits are substantial, they remain lower than those observed during the 2021 bull run.

This does not necessarily imply that the current rally will yield lower gains overall, but it signals potential limitations compared to previous cycles.

Despite substantial selling by LTHs, Bitcoin's price remains relatively stable, suggesting strong new demand is absorbing the selling pressure. The sustainability of this balance remains uncertain.

Current Bitcoin Price

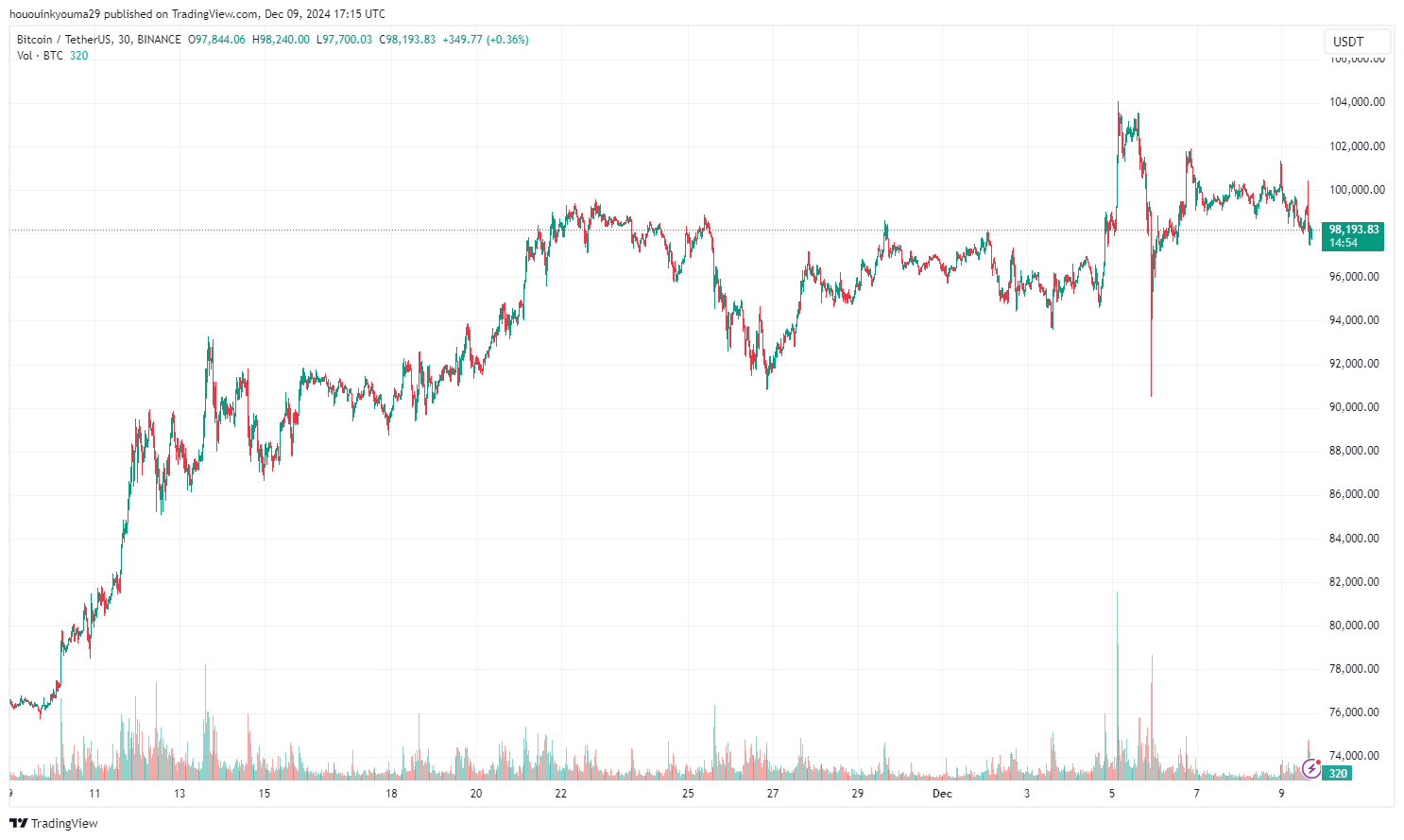

Bitcoin briefly broke out of its consolidation phase earlier this month but has since returned to trading around $98,200.