8 0

BEARISH 📉 : Bitcoin miner fees indicate sustained low network demand

Bitcoin's price has fallen below $83,000 amidst ongoing global market corrections, influenced by broader risk-off conditions in equities and commodities. Investors remain cautious due to high volatility and thinning liquidity.

- On-chain data shows a decline in Bitcoin network activity, with reduced transaction demand and miner fee generation. This indicates subdued speculative interest and organic usage.

- The lack of aggressive selling pressure suggests the decline is driven by distribution rather than panic, allowing prices to decrease with minimal resistance.

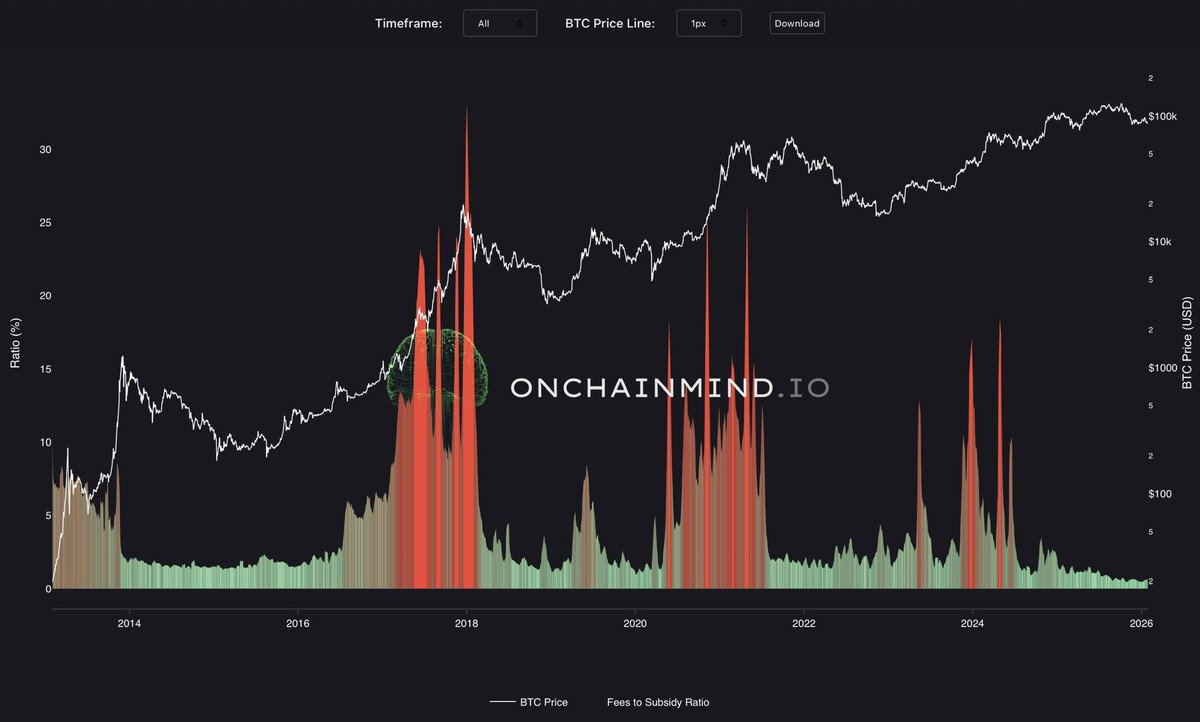

Miner Fees to Block Subsidy Ratio remains below 1%, highlighting low network usage since July. In contrast, this ratio was above 15% during periods of high demand in May. The current low fee environment suggests a bear market phase with reduced participation.

Bitcoin's chart shows a bearish structure with a sequence of lower highs and lows since November. The price is now below key moving averages, indicating loss of long-term trend support.

- The breakdown below the $85,000–$84,000 zone suggests reduced buyer interest, with volume spikes indicating orderly selling pressure.

- If the downside continues, Bitcoin may revisit the $80,000 level, with further support near the low-$70,000 range.