3 0

BULLISH 📈 : McHenry Predicts Crypto Regulation Opening Institutional Capital Floodgates

Key Points:

- Patrick McHenry anticipates a strong possibility of crypto regulations being passed during the post-election session, potentially legitimizing digital assets for institutional investors.

- Regulatory clarity could expose technical limitations in current blockchain infrastructures, highlighting the need for interoperability.

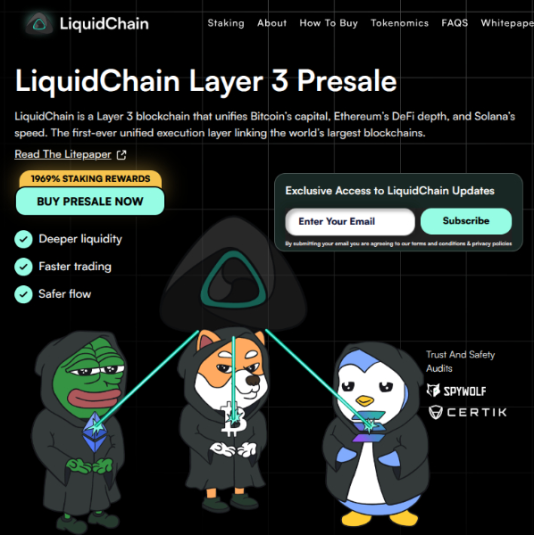

- LiquidChain aims to address this by integrating Bitcoin, Ethereum, and Solana liquidity into a single L3 execution layer, eliminating risky bridges.

Context:

- McHenry believes the post-election 'lame duck' session is an optimal time to pass significant legislation such as the FIT21 Act, which has bipartisan support.

- This potential regulatory clarity is expected to unlock substantial institutional capital that is currently sidelined due to compliance issues.

- The lack of integrated infrastructure creates a challenge for seamless cross-chain operations, necessitating solutions like LiquidChain.

Technical Infrastructure Needs

- Current systems rely on cumbersome bridges and wrapped assets, introducing counterparty risks not acceptable to institutional traders.

- LiquidChain offers a 'Unified Liquidity Layer,' enabling efficient, single-step transactions across major blockchains.

- This architecture allows developers to build applications once and access multiple user bases simultaneously, enhancing capital efficiency.

Market Sentiment and Presale Data

- The ongoing LiquidChain presale indicates growing interest in infrastructure projects addressing liquidity fragmentation.

- $LIQUID token presale has raised over $533K, priced at $0.0136, indicating early market positioning before full protocol deployment.

- The project targets a large market by merging significant liquidity pools from Bitcoin, Ethereum, and Solana.

- 'Liquidity Staking' is emphasized, aligning with anticipated yield-seeking behavior from new compliant capital.