MicroStrategy Invests $17.5 Billion in Bitcoin Over Two Months

MicroStrategy is currently a major player in the cryptocurrency market. The company has spent $17.5 billion on bitcoin in two months, primarily funded by buyers of its zero-percent convertible bonds.

MicroStrategy’s strategy involves accepting cash and investing it into bitcoin, providing liquidity for exposure to the asset.

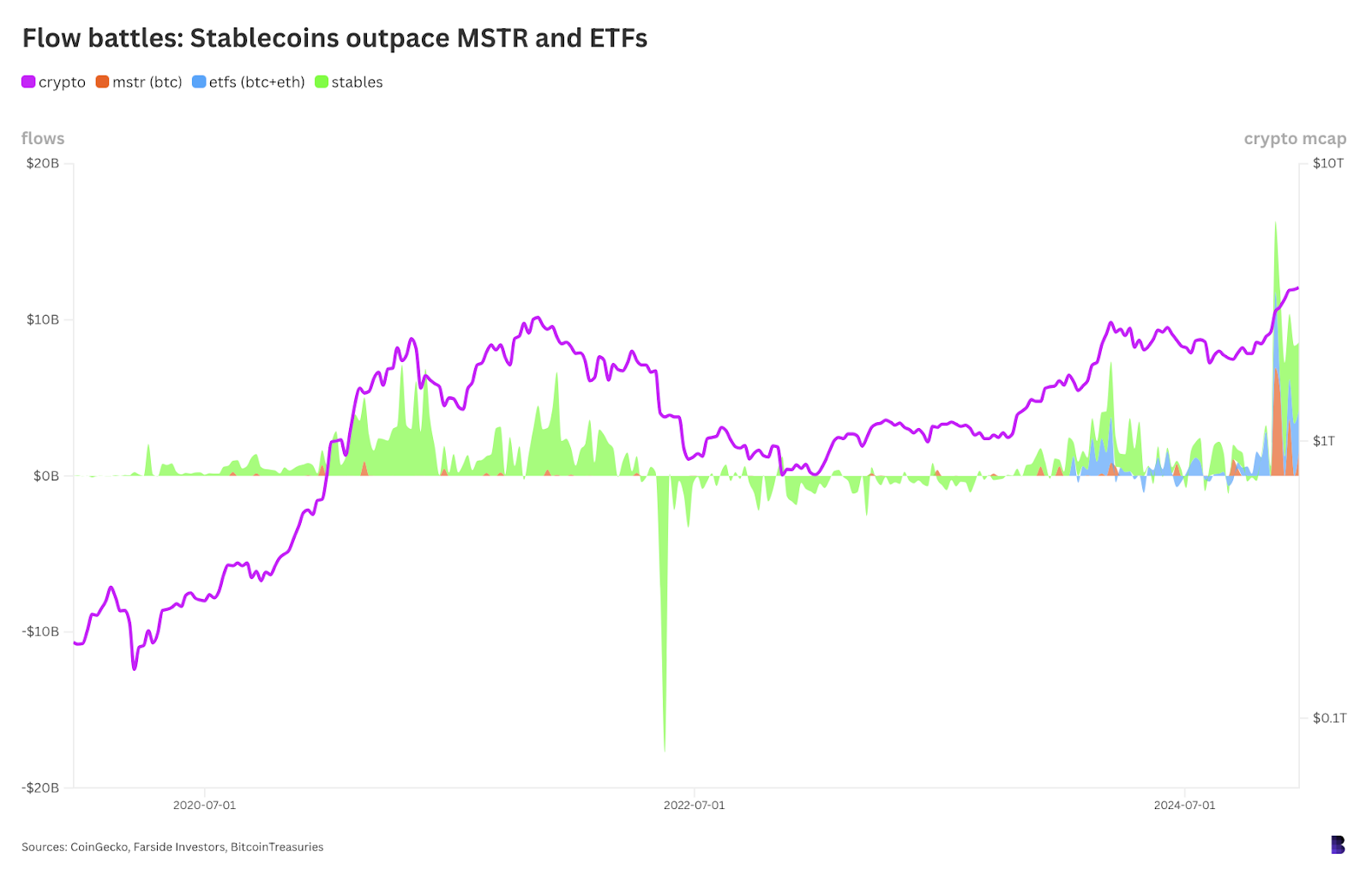

During this period, US bitcoin ETFs have seen $16.5 billion in net inflows, while ETH ETFs have gained $3 billion. ETFs operate similarly, taking investor funds to purchase equivalent amounts of bitcoin or ether, passing exposure to shareholders after deducting fees.

Since mid-October, stablecoin issuers have minted an additional $30.8 billion tokens, with over 92% going to USDT and USDC. Stablecoin managers typically accept US dollars, invest in short-dated Treasuries and issue new tokens equivalent to the cash received.

While stablecoin flows differ from ETF inflows or MicroStrategy’s cash pipeline, they reflect a widespread interest in entering crypto markets through various channels.

This results in nearly $68 billion entering the market in nine weeks, marking a significant liquidity wave.