NEAR Protocol Achieves 26.81% Revenue Growth in Q4 2024

Market intelligence firm Messari released an analysis of NEAR Protocol's performance in Q4 2024, highlighting resilience amid market challenges.

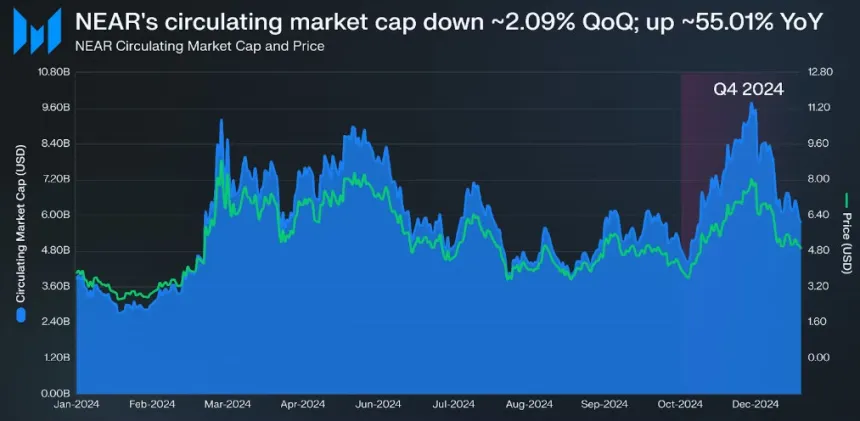

Market Performance

- NEAR token price peaked at $8.19 in December, ending the quarter around $4.91.

- Market cap dropped to approximately $5.73 billion, a 2.09% QoQ decrease.

- NEAR fell ten spots in rankings, now at 21st overall.

Revenue from network transaction fees increased by 26.81% QoQ to about $2.11 million, driven by higher transaction volumes. Average transaction fee rose 15.91% to $0.0031.

NEAR is integral for staking and transaction fees, with a flexible supply model featuring a 5% annual inflation rate. As of Q4 end, 95.12% of total supply was in circulation, with 49.08% actively staked. Staking yielded an annualized nominal yield of 8.95% and a real yield of 4.55%.

Address activity significantly increased: daily active returning addresses rose by 15.82% to 3.55 million, while new addresses surged by 29.05% to 361,046. However, developer activity declined, with core developers down 13.95% to 159 and ecosystem developers down 30.34% to 129.

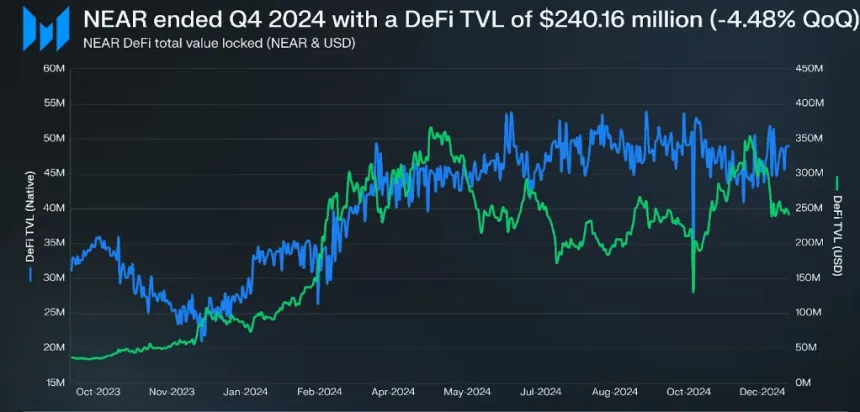

DeFi Developments

- DeFi total value locked (TVL) ended Q4 at approximately $240.16 million, down 4.48% QoQ.

- Liquid Staking TVL decreased by 10.32% to around $250.81 million.

- LiNEAR Protocol's TVL was approximately $132.41 million, down 8.77%; Meta Pool's TVL declined by 11.78% to around $111.70 million.

Daily DEX volume averaged $8.45 million, a 25.40% increase from the previous quarter, with Ref Finance leading at $8.35 million.

NEAR's stablecoin market cap grew to about $683.69 million, reflecting a 1.88% QoQ increase and an 880.71% YoY surge.

Currently, NEAR's price is $3.52, up 10% over the past two weeks, but still 82% below its all-time high.