NeuroWeb Adds 2.4 Million Knowledge Assets on Polkadot Parachains

The AI and Big Data segment in the crypto market declined from $70.42 billion to $63.88 billion, with Filecoin, Fetch.AI, and Injective Protocol among the top losers. In contrast, Neuroweb, an AI project on the Polkadot chain, achieved significant growth, impacting the AI landscape positively.

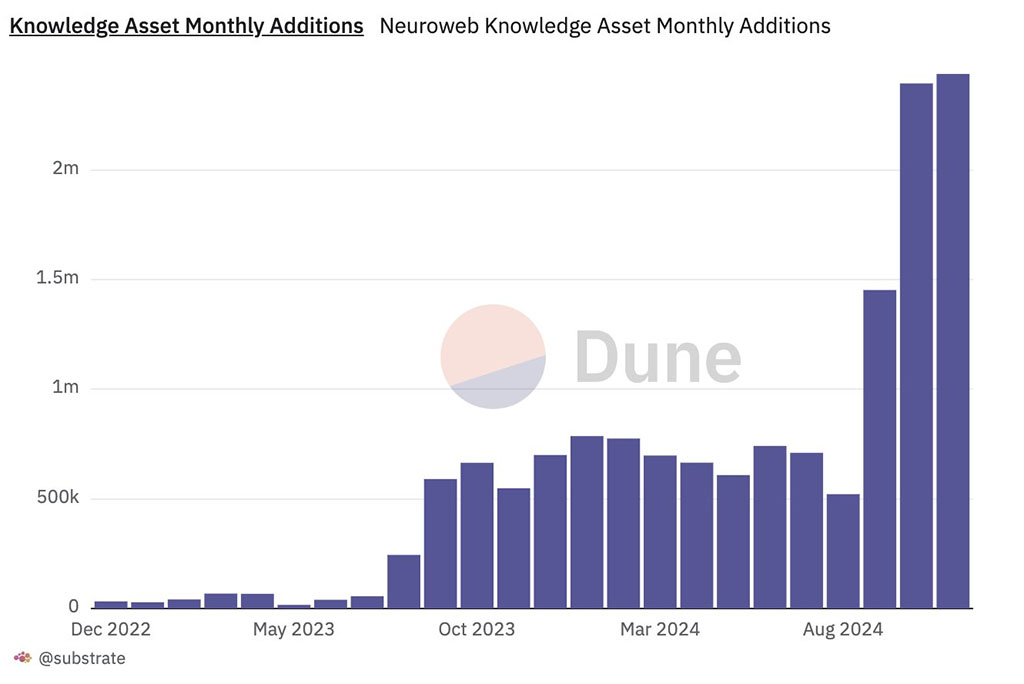

NeuroWeb.AI Adds 2.4 Million Knowledge Assets in November

Neuroweb operates as a parachain on Polkadot, enhancing interoperability and security for its decentralized AI platform. It introduces knowledge mining, allowing individuals or organizations to contribute knowledge assets and become miners.

OriginTrail's Decentralized Knowledge Graph (DKG) underpins NeuroWeb, merging knowledge graph and blockchain technologies to facilitate AI-ready Knowledge Assets, enabling trusted knowledge sharing.

Knowledge Assets are tokenized, structured pieces of information recorded on the blockchain, ensuring provenance and accessibility across applications.

Miners earn tokens for adding new knowledge assets. A recent tweet from Polkadot confirmed that Neuroweb reached a record high by adding 2.4 million knowledge assets in November, exceeding October's figures.

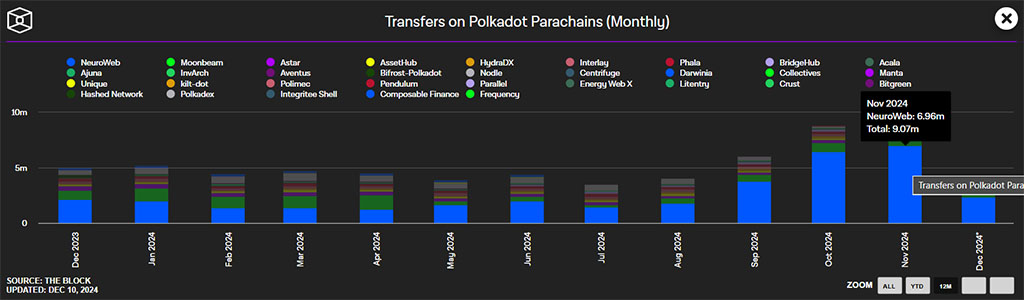

Polkadot Parachain Hits 9.07M Transactions

Polkadot parachains recorded 9.07 million transfers in November, marking a new all-time high. Neuroweb accounted for over 50% of these transactions, totaling 6.96 million.

This surpasses the total of 8.81 million transfers recorded in November, where Neuroweb contributed 6.44 million transfers.

Polkadot Price Analysis

Polkadot's price dropped by 18.45% amid increased selling pressure, failing to break past the 38.20% Fibonacci level at $10.26 and falling below the $10 mark to $8.55. This decline disrupts the recovery rally observed in the previous two weeks, with the price approaching the 100-week EMA line. The weekly RSI has fallen back below the overbought boundary, indicating a minor decline.

Source: Tradingview

Despite the drop, underlying demand suggests a potential recovery. Polkadot rebounded from a 7-day low of $7.577. A lower price rejection alongside a positive crossover in the 20-week and 50-week EMA lines indicates a possible retest of the neckline at $10.26, with a bullish breakout targeting the 50% Fibonacci level at $14.145.