12 1

On-Chain Data Indicates Potential Bitcoin Price Bottom Formation

The Bitcoin market has been experiencing significant sales since mid-October, yet recent on-chain data suggests a potential future uptrend.

Key Indicators of a Potential BTC Reversal

- Futures Taker CVD: The metric shows a shift from dominant sell zones to neutral zones. This indicates that leveraged short positions are exiting, suggesting weakened speculative pressure.

- Spot Taker CVD: Despite a decline in speculative sellers, this metric remains in the red, indicating ongoing coin sales by Bitcoin holders.

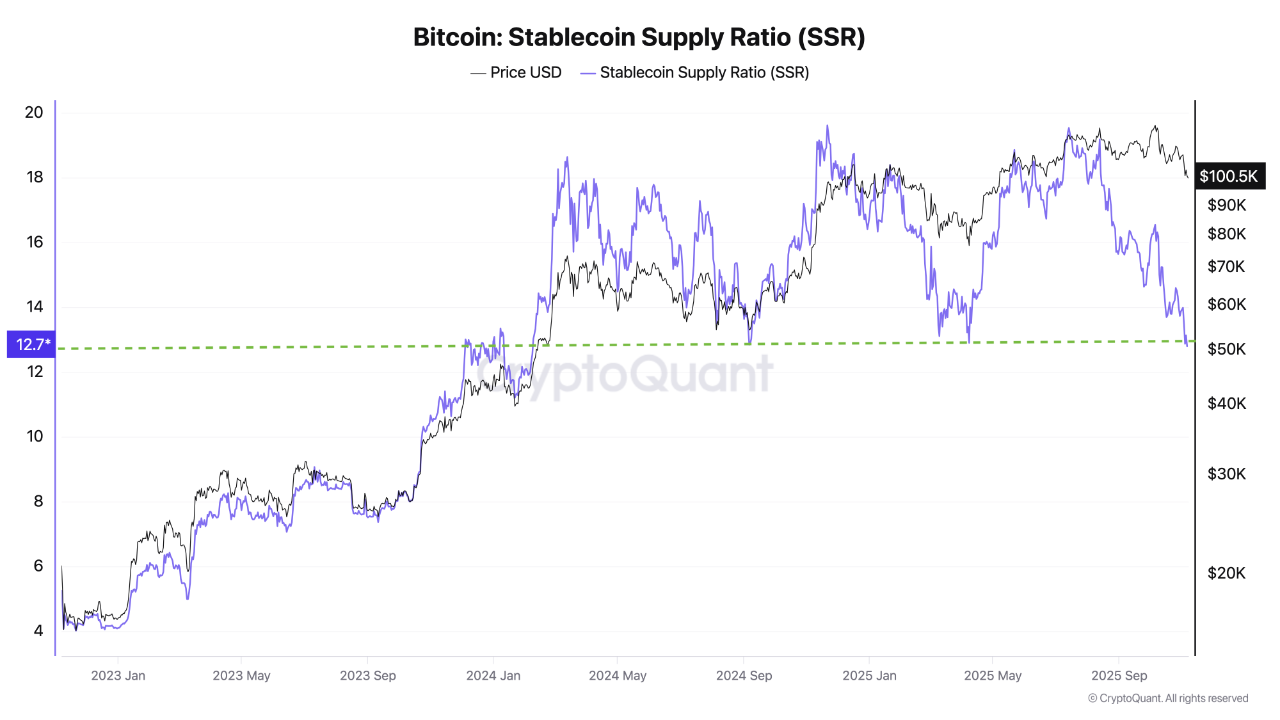

- Stablecoin Supply Ratio (SSR): The SSR is at a low, indicating more stablecoins relative to Bitcoin. This suggests increased potential buying power, historically preceding price rebounds.

- Adjusted Spent Output Profit Ratio (aSOPR): Currently around 1.0, a level previously associated with major price reversals.

Current Bitcoin Price

The current Bitcoin price is approximately $102,510, marking an increase of over 1% in the last 24 hours.

These metrics point to possible bottom formation and a subsequent price rebound for Bitcoin.