Polkadot Treasury Reserves Hit All-Time Low Amid Ongoing Price Decline

Polkadot ranks among the top 20 blockchains, emphasizing blockchain interoperability. However, DOT prices have not shown significant bullish momentum.

This trend is evident across major smart contract platforms such as Ethereum and Solana.

Polkadot Treasury Reserves at All-Time Lows

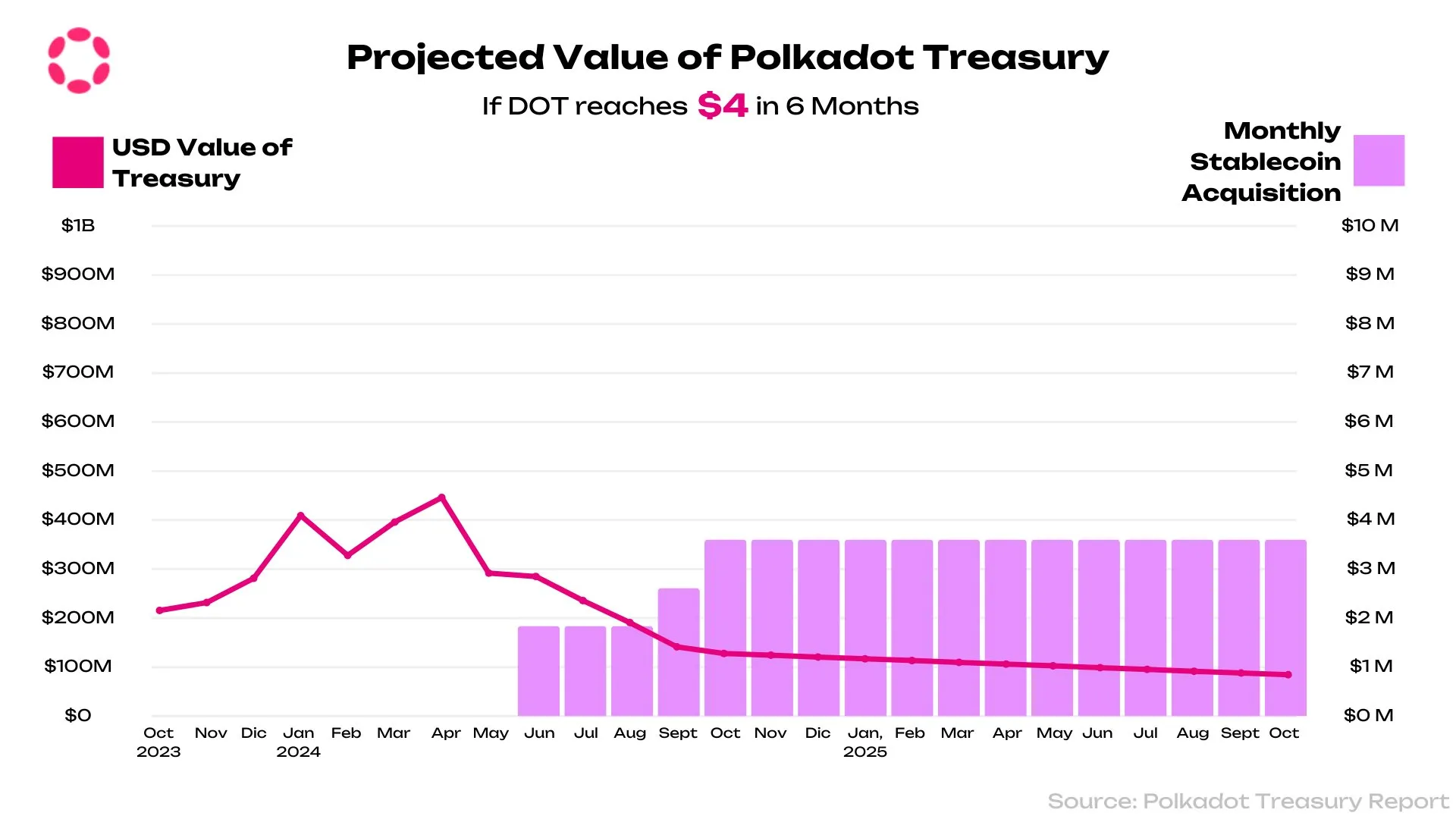

Persistent bearish pressure has driven DOT prices down since they peaked around $10 in Q1 2024, leading to dwindling Polkadot Treasury Reserves.

In early November, an observer noted that these reserves reached all-time lows. If bearish trends from Q3 2024 resume, prices may drop below local support levels.

The daily chart indicates critical support for DOT at approximately $3.8, marking September and October lows. Conversely, strong liquidation pressure exists at $4.6 and $5.

The breakout direction will influence both short- to medium-term trends and the Polkadot Treasury.

Price recovery is crucial for enhancing Treasury reserves. A bullish market would increase reserves denominated in DOT, improving their USD value.

Policy Intervention to Boost Funds

The Polkadot community implemented a policy to reduce inflation, voting to decrease DOT's annual inflation rate from 10% to 8% to enhance Treasury inflows.

This lower inflation, combined with sustained on-chain demand, could stabilize DOT prices. Additionally, 15% of staking rewards will be allocated to the Treasury.

Analysts estimate these adjustments could add 1.5 million DOT to the Treasury, providing essential funds after months of low income.

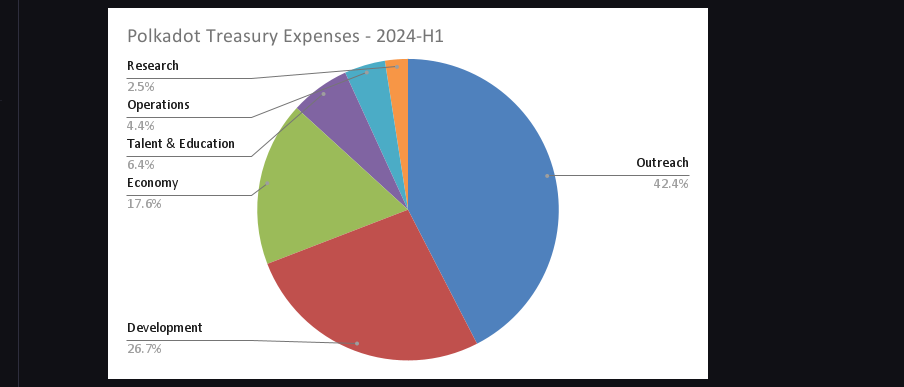

This influx may facilitate better development and partnerships, strengthening the blockchain ecosystem. According to H1 2024 data, the team prioritized outreach and allocated nearly 27% of funds to development.

Overall, the team spent $87 million, or about 11 million DOT, during the first half of the year across various sectors including research, operations, talent, and economic initiatives.