13 2

Polygon Dominates RWA Market With $1.1B TVL, New Dune Report Shows

The Polygon network is establishing a notable position in the tokenization market with over $1.13 billion in total value locked (TVL) from Real World Assets (RWAs).

- Polygon recently deployed its "Rio" upgrade on the Amoy testnet for enhanced future scaling.

- A report by Dune and RWA.xyz highlights Polygon's dominance in the RWA space, holding 62% of tokenized global bonds.

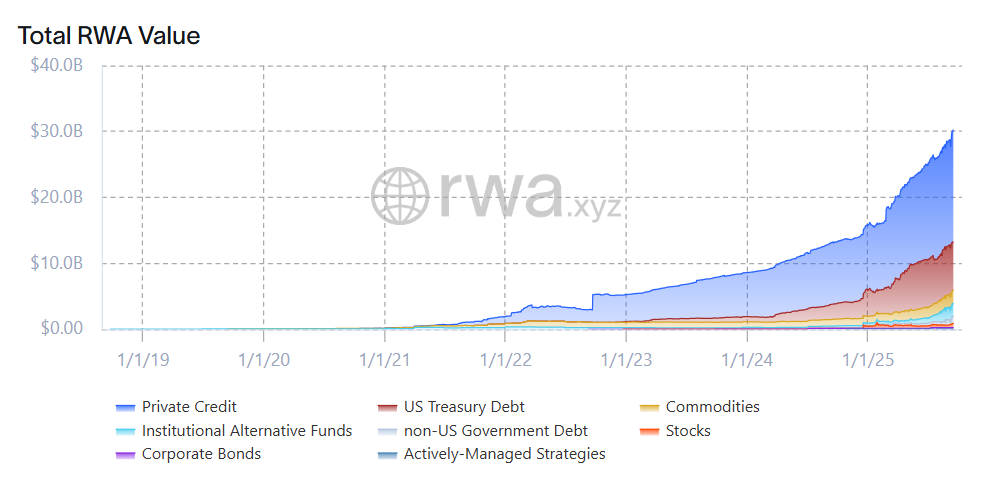

- The tokenized asset landscape has grown 224% since early 2024, driven by U.S. Treasuries and shifting capital into higher-yield assets.

- Integration of RWAs with DeFi protocols is accelerating, transforming them into programmable building blocks for onchain finance.

- Polygon holds a significant share in tokenized U.S. T-Bills at 29% and faces competition from ecosystems like Solana, which reached a $500 million valuation in RWAs.

- Traditional finance is increasingly adopting blockchain, with entities like Nasdaq moving towards tokenized securities trading.

Polygon continues to evolve beyond pilot projects, unlocking liquidity and providing on-chain transparency, as noted by Aishwary Gupta, Polygon’s Global Head for RWA.