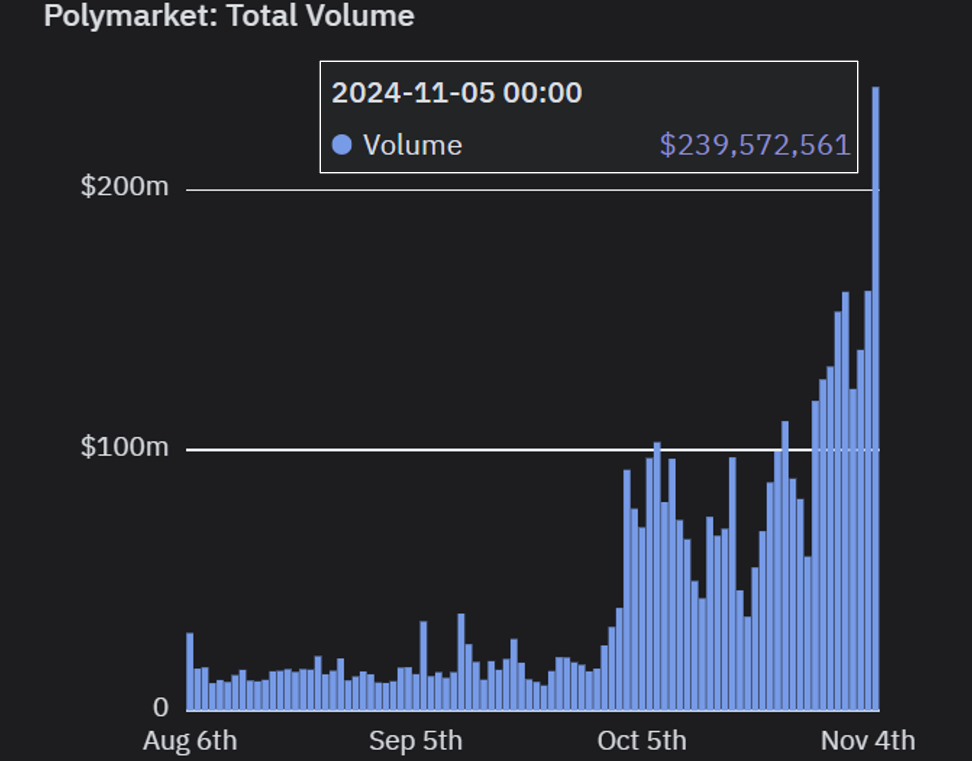

Polymarket Processes $240 Million in Trading Volume on Election Day

On a significant night for Polymarket, the application processed $240 million in trading volumes efficiently.

This performance marks one of crypto's initial mainstream tests for a dapp primarily onchain.

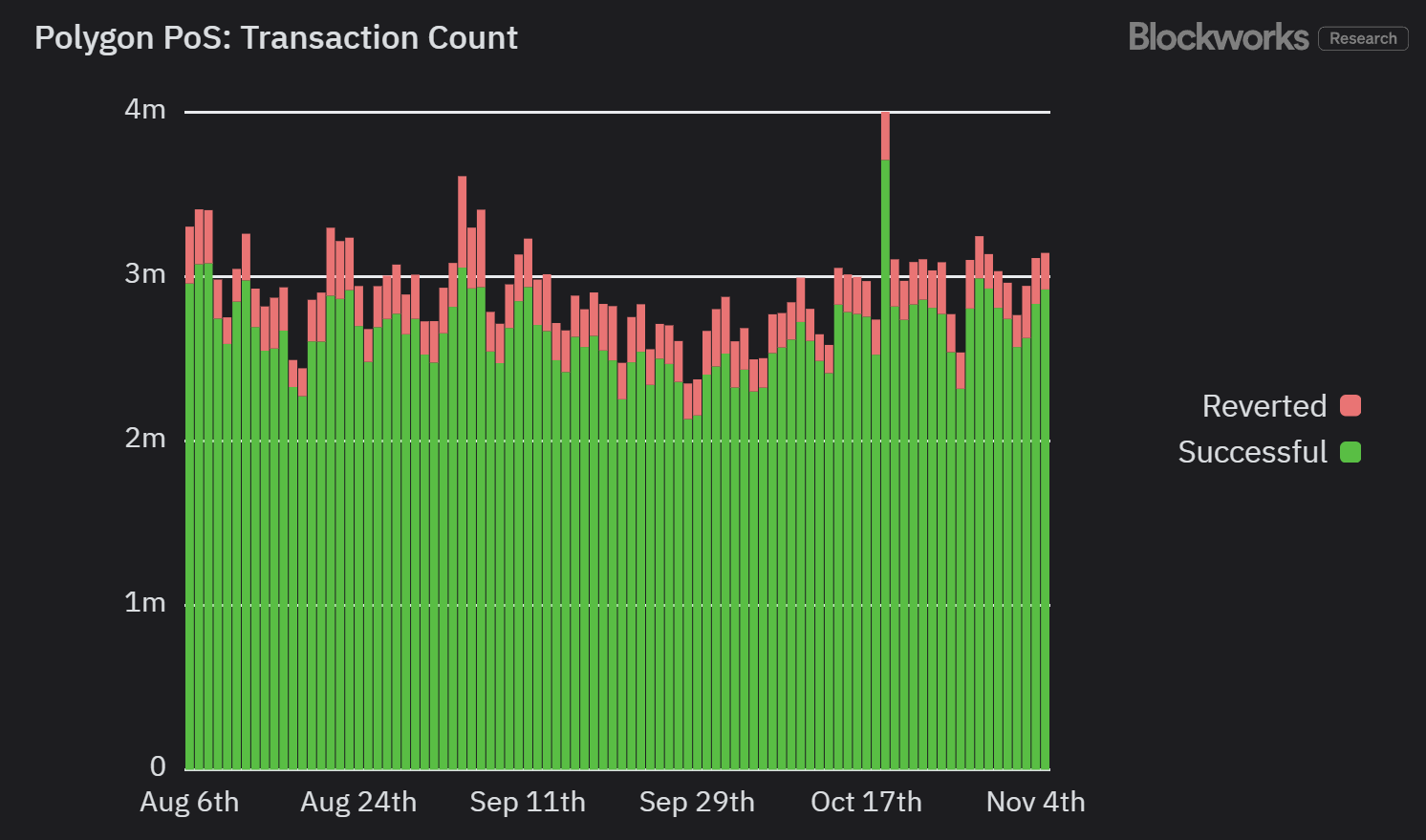

Polymarket operates as a “binary limit order book” (BLOB), a hybrid-decentralized model prevalent in many DEXs. It executes trades on Polygon’s PoS sidechain while matching limit orders occurs offchain.

On election day, Polygon processed 2,921,668 transactions, averaging about 33.8 TPS with a 7% reversion rate, according to Blockworks Research data.

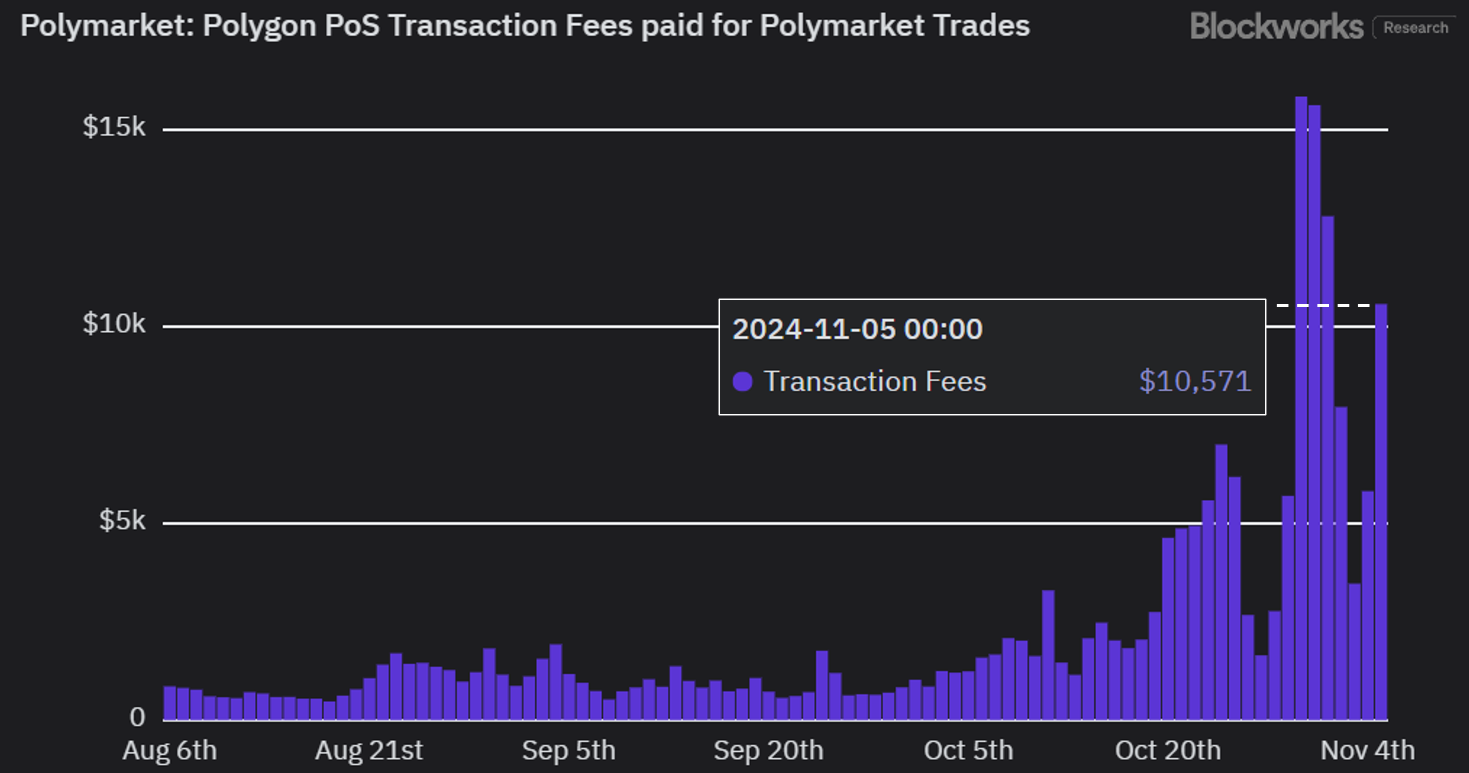

Despite Polymarket's success, little value has accrued to Polygon's POL token, which generated only $10,571 in fees on election day.

The POL token, previously MATIC, is up 7.2% at $0.3 but has decreased by approximately 54% year-to-date.

Polygon's design aims to provide low fees during a time when Layer 2 solutions were limited. The strategy for POL focuses on its utility in staking for various services, including block batching and data availability in 2025.

POL stakers may also earn fee revenue from other Polygon CDK chains within its network.

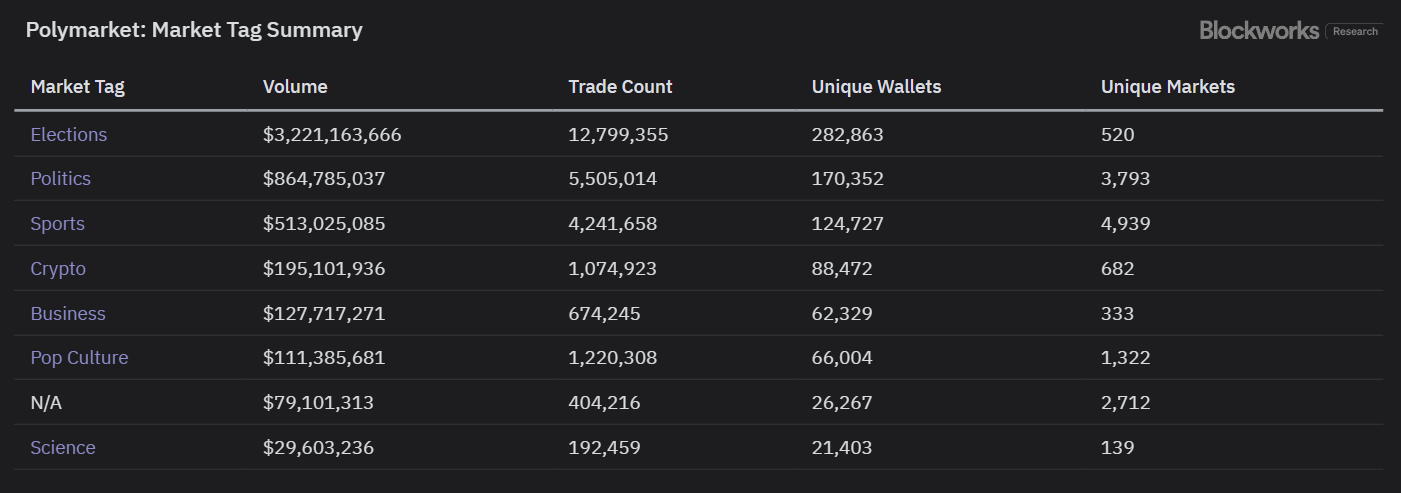

Looking ahead, Polymarket's usage mainly stems from US political elections. Its future success will depend on diversifying into other areas that attract similar mainstream interest.

Sports betting, constituting the third-largest category of open interest on Polymarket, could drive demand; however, this sector is competitive with existing crypto platforms and Web2 options.