QCP Capital Projects Bitcoin Could Reach $100K-$120K Amid Risks

QCP Capital, a leading digital asset trading firm, projected Bitcoin (BTC) could reach $100K-$120K. The firm cites strong price movements following the US election and the potential creation of a US Bitcoin Strategic Reserve as factors influencing this outlook.

QCP Capital stated in its daily market update that Bitcoin's significant rally post-election supports the belief that reaching $100,000–$120,000 is feasible.

BTC Short-Term Risks

The firm noted an increase in selling call options (indicating bullish expectations) and buying put options (indicating bearish expectations) by major players, suggesting they are cashing out from their 'Trump Trade' positions while hedging against potential declines.

QCP Capital observed, "Implied volatility has been falling during the upward movement as many large players sold calls into the rally. With each new high, our desk noted the market's trend of selling calls and buying puts to hedge downside risk." This behavior partly explains the recent price stagnation above $93K and the subsequent pullback. At the time of writing, BTC was priced at $88K, reflecting a 6% decrease from its all-time high (ATH).

Source: BTCUSDT, TradingView

Presto Research echoed QCP Capital's sentiment, noting slow demand from traditional finance (TradFi). Analysts pointed to declines in MicroStrategy’s MSTR and Coinbase’s COIN as signs of unwinding the 'Trump trade.' They remarked on the current all-time high and potential unwinding of long BTC positions, alongside ETF inflows showing signs of slowdown, though the duration of this trend remains uncertain.

Soso Value data indicated that US spot BTC ETFs experienced a daily net outflow of $400.67 million on Thursday.

Insights from BTC Options Market

Despite short-term risks, large players in the BTC options market anticipated significant price fluctuations, maintaining an overall bullish bias.

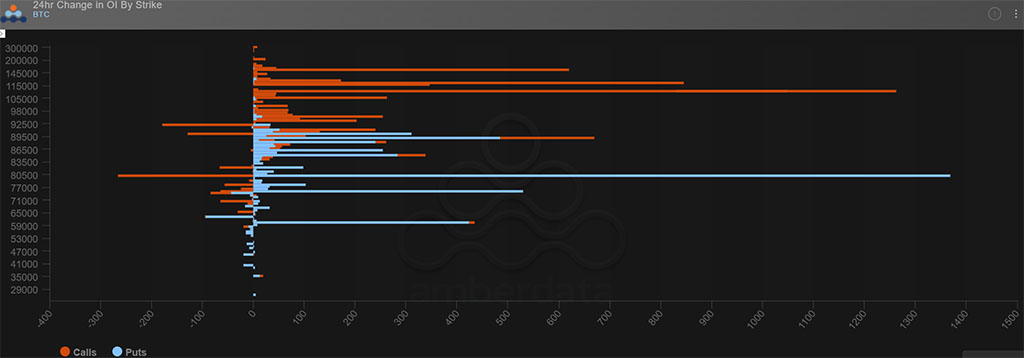

Source: Amberdata

Recent changes in open interest (OI) for call options were concentrated at $95K, $105K, $110K, and $120K, indicating these levels as potential upside targets. Conversely, significant OI in puts at $80K and $75K suggests these levels may provide support during a prolonged pullback.

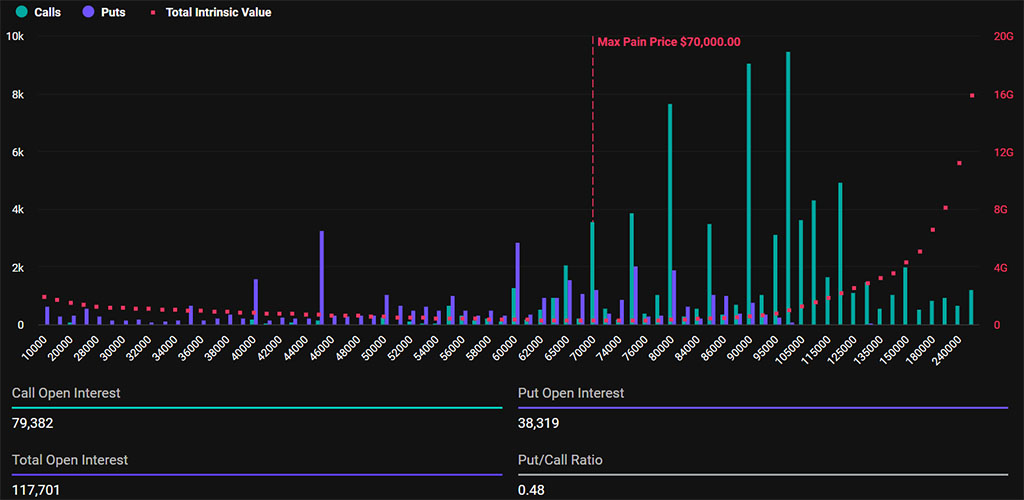

Source: Deribit

Options expirations for late November and December appeared bullish, with the December 27 expiry showing a Put/Call ratio of 0.48, indicating more bullish bets than bearish ones.