19 0

R25 Launches Yield-Bearing rcUSD+ Stablecoin Protocol on Polygon

On November 14, R25 launched its real-world asset and stablecoin protocol on Polygon, introducing the rcUSD+ token. This yield-bearing token is pegged 1:1 to the US dollar and backed by traditional finance assets like money market funds and structured notes.

- The rcUSD+ generates returns for holders from low-risk investments.

- Polygon was chosen for its liquidity, cost-efficiency, and institutional trust.

- The protocol aims to integrate traditional finance yields into DeFi with transparency and oversight.

- Lack of disclosure in key areas: no contract address for rcUSD+, inaccessible official documentation, no security audits, undisclosed yield calculation methodology, and absent team information.

Market Context

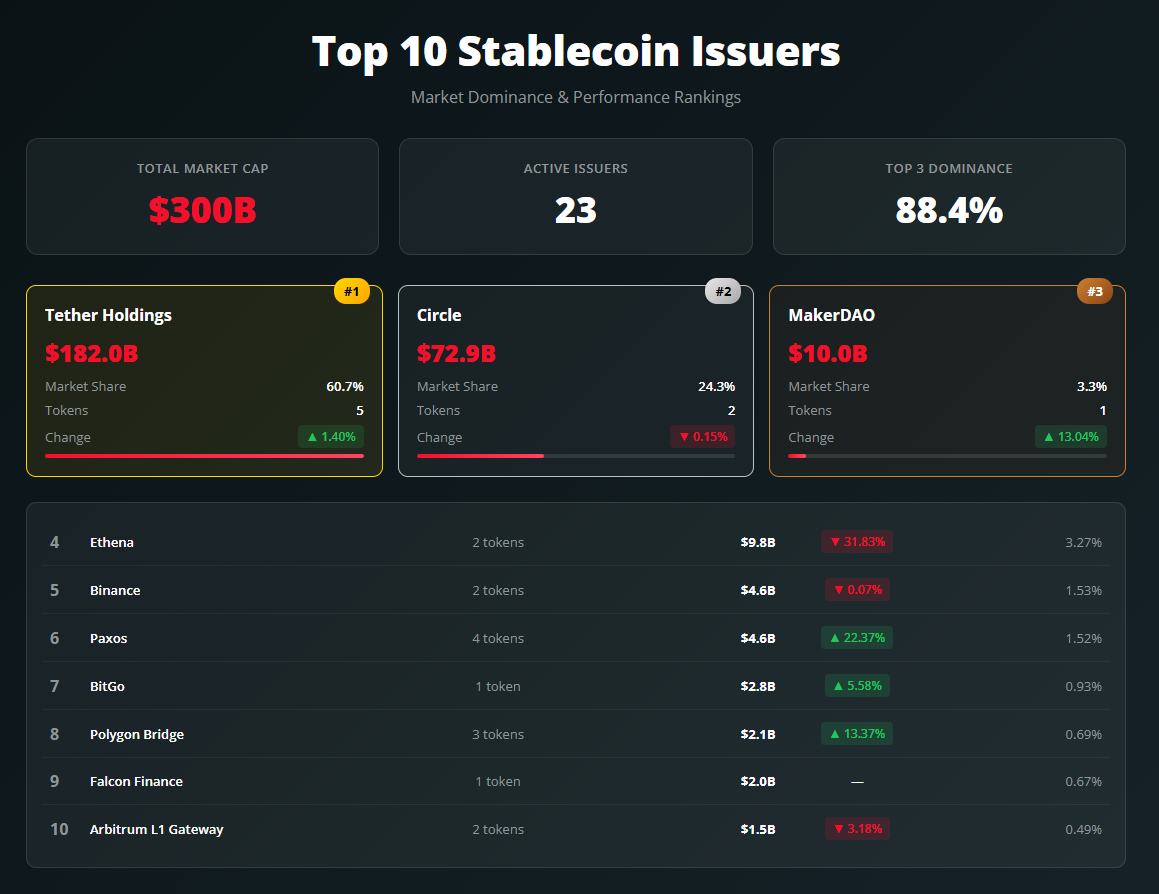

- The tokenized real-world asset market reached $36.06 billion, a 5.91% increase over 30 days.

- Overall stablecoin value grew to $299.76 billion with monthly transfer volumes hitting $4.99 trillion.

- Yield-bearing stablecoins could bridge yield gaps between crypto (8-11%) and traditional finance (55-65%).

- Comparable protocols include Ondo Finance's USDY, Centrifuge's private credit RWAs, and Maple's on-chain credit solutions.

- Real-world asset tokenization is gaining traction globally, highlighted by Hong Kong's Fintech 2030 strategy.