9 0

Ripple Acquires Palisade, Expands $4B Institutional Custody Streak

- Ripple has acquired Palisade, a digital asset wallet firm, to expand its institutional custody offerings as part of its $4B investment plan in 2025.

- Palisade will enhance Ripple's Custody service, providing secure and compliant digital asset storage for fintechs, corporates, and crypto-native firms.

- The acquisition supports Ripple's strategy to bridge traditional finance with digital asset management and follow its expansion spree, including previous acquisitions like Hidden Road, Rail, and GTreasury.

- Palisade offers zero-trust architecture, multi-party computation key management, and cross-chain functionality across XRPL, Ethereum, and Solana.

- Ripple plans to integrate Palisade's features into Ripple Payments to improve scalability for subscription billing, on- and off-ramp services, and automated fund sweeps.

Market trends indicate a shift toward wallet technology as key infrastructure, with demand for secure, user-friendly solutions rising among institutions and retail users alike.

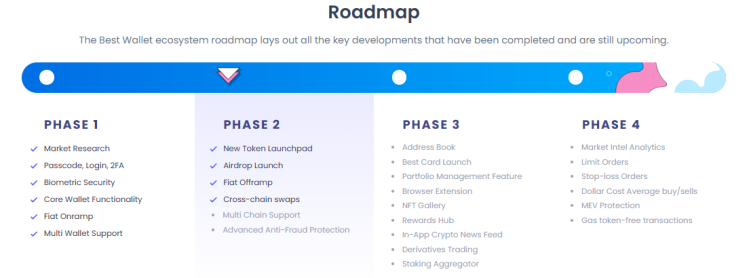

Best Wallet ($BEST), a Web3 wallet ecosystem, is gaining attention with its staking utility, security, and multi-chain support.

- $BEST token offers an APY of 78% for staking, with over $16.8M raised during its presale.

- The project anticipates significant growth, with price forecasts reaching $0.07 by 2030.

- Best Wallet aims to offer MPC-powered custody, integrated dApp browser extension, and cross-chain asset management.

Analysts predict a bullish trajectory for $BEST, driven by increasing demand for wallet infrastructure following major acquisitions like Ripple–Palisade.

Ripple's acquisition of Palisade solidifies its role in institutional crypto custody, highlighting the importance of wallet technology as critical infrastructure for both institutions and individuals in managing digital assets securely.