8 0

Ripple Provides Credit Agreement to Gemini Ahead of Upcoming IPO

Crypto firm Ripple has entered a credit agreement with crypto exchange Gemini as part of its upcoming initial public offering (IPO). This agreement allows Gemini to request loans of at least $5 million, with a maximum commitment of $150 million. The initial limit is set at $75 million, which can be adjusted based on agreed metrics.

Key Details of the Agreement

- Gemini may request loans starting from $5 million, totaling up to $150 million.

- Requests exceeding $75 million must be made in Ripple’s RLUSD stablecoin, subject to Ripple's approval.

- All loans require collateral and carry an interest rate of 6.50% or 8.50%, repayable in USD.

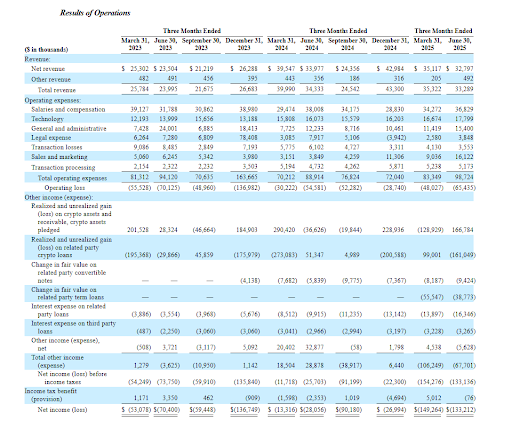

In the first half of 2023, Gemini reported a net loss of $282 million, making Ripple a significant backer for its IPO. Gemini plans to offer shares of Class A common stock under the ticker “GEMI” on Nasdaq, with Goldman Sachs and Citigroup as lead underwriters. The number of available shares and their pricing have not yet been disclosed.

Context of the IPO

- Gemini aims to capitalize on rising demand in traditional finance for crypto assets.

- The IPO follows the successful debut of crypto exchange Bullish, which raised $1.15 billion.