Ripple (XRP) Faces $1.2 Billion in Short Positions Post SEC Settlement

Ripple (XRP) Price Update

Ripple's price surged to $3.50 last week, the highest since 2021. Key factors include:

- US Fed Chair Jerome Powell signaled potential rate cuts at the upcoming FOMC meeting on September 17.

- The SEC and Ripple resolved their legal dispute, concluding appeals with Ripple agreeing to a $125 million penalty.

- The court ruled that XRP is not classified as a security in secondary market transactions.

Despite these developments, XRP's performance lagged behind Bitcoin and Ethereum, which reached new all-time highs of $124,000 and $4,890, respectively. XRP fell short of its $3.84 target, trading at $3 after a 4% retracement.

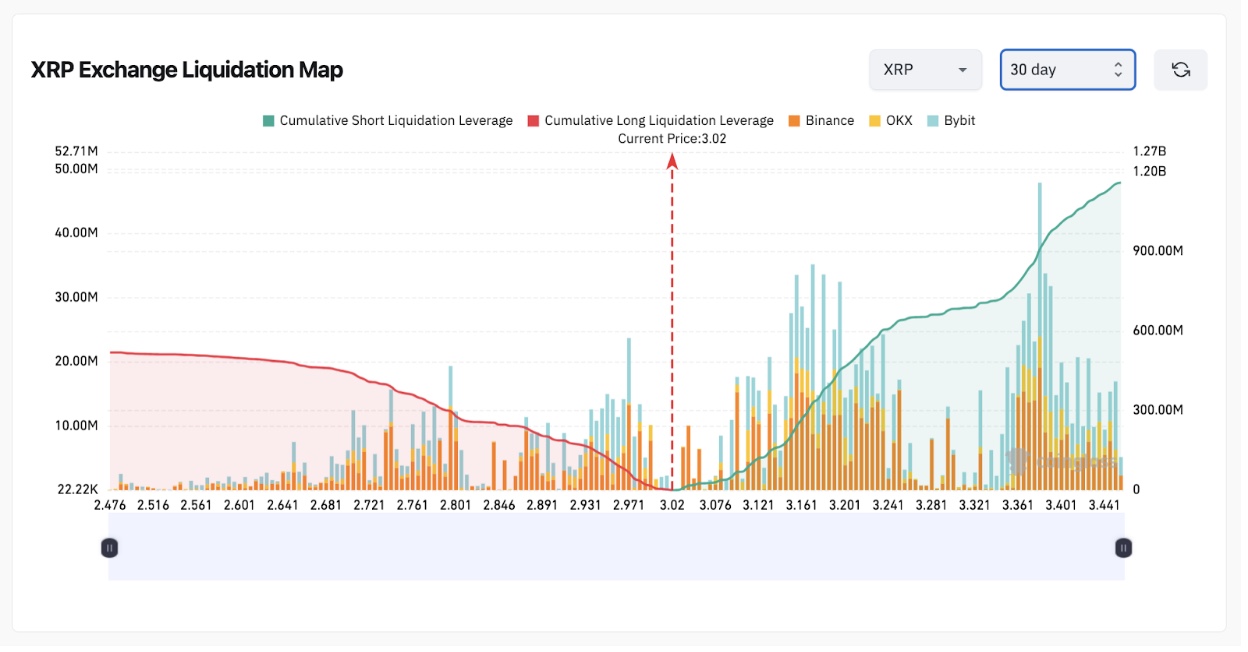

Derivatives data indicates short positions in XRP at $1.16 billion, significantly higher than long positions at $519 million. This suggests profit-taking among bullish traders and highlights potential downward pressure unless bullish triggers emerge.

XRP Price Forecast

XRP is currently consolidating around $3.01. Technical indicators reflect indecision:

- Short-term moving averages converge, creating resistance between $2.99 and $3.05.

- MACD remains negative, indicating weak bullish momentum.

To regain upward momentum, XRP must surpass $3.10 convincingly, aiming for $3.50 and possibly $3.84. A failure to hold above $3.00 could lead to declines toward $2.88 or $2.70.

Market Shift to Speculative Tokens

As XRP faces bearish pressure, interest is shifting towards high-risk tokens like SUBBD ($SUBBD), which has raised $1.05 million of its $1.26 million cap in presale.

The token offers utilities such as access to AI-enhanced content and staking rewards. Its presale price is set at $0.05625 per token.