Updated 19 December

Ripple’s Legal Battle with SEC Influences XRP and Crypto Market Dynamics

The cryptocurrency landscape is at a pivotal point as the legal battle between XRP and the Securities and Exchange Commission (SEC) progresses. This confrontation has significant implications for digital asset regulation, especially with the potential impact of Donald Trump's election.

The Evolution of SEC's Cryptocurrency Stance

Under SEC Chair Gary Gensler, the commission has adopted an aggressive enforcement approach toward digital assets, classifying many cryptocurrencies as securities. This strategy has resulted in numerous enforcement actions, particularly affecting Ripple and Coinbase, leading to temporary delistings of XRP by various exchanges.

Stuart Alderoty, Chief Legal Officer at Ripple, has contested the SEC's interpretation, asserting that XRP operates as a digital currency rather than a security. This argument gained traction following Judge Analisa Torres' ruling in July 2023.

Institutional Interest and Market Evolution In XRP

Interest from major financial institutions in XRP has surged since the SEC's initial filing. Investment firms are attracted to XRP's capabilities in cross-border payments, with transaction volumes hitting record highs in Asian markets.

Banks are also developing blockchain strategies that incorporate Ripple's technology, indicating a significant shift in traditional finance's perception of digital assets, with XRP leading this change.

XRP Market Metrics and Performance

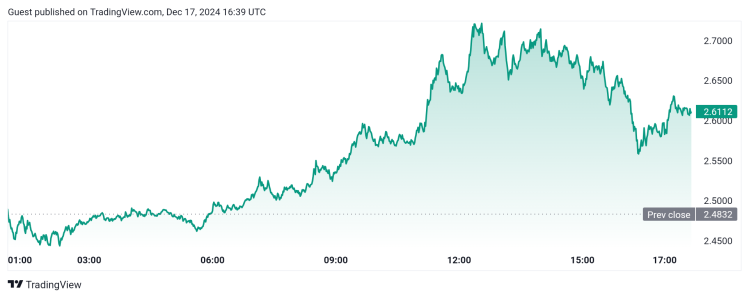

XRP's daily trading volume has consistently surpassed $2 billion post-court victory. Institutional inflows are unprecedented, with investment firms significantly increasing their digital asset allocations. The potential approval of an XRP ETF could further enhance institutional investment channels. After reaching its highest level since 2022, analysts predict continued price growth, noting strong support levels amid market volatility due to crypto enforcement actions.

| Source: TradingView

Technical Analysis and Price Projections

Market analysts offer projections based on technical indicators and fundamental factors, suggesting various scenarios for XRP's price through 2025.

Short-term Outlook

Technical analysis reveals strong support levels at key price points, with resistance zones identified through historical trading patterns. The SEC's appeal continues to affect short-term price movements, creating opportunities for investors.

Long-term Projections

Looking to 2025, analysts consider several factors:

- Potential resolution of the SEC case under new leadership

- Increased institutional adoption driving demand

- Expansion of cross-border payment networks

- Integration with traditional financial systems

The convergence of legal resolution, political change, and market development indicates a transformative period for XRP and the broader crypto industry. The SEC case outcome and possible regulatory shifts could fundamentally alter the digital asset landscape.