Robinhood Plans to Pioneer Tokenization in the Crypto Space

Robinhood has demonstrated a commitment to crypto over the past year, highlighted by its acquisition of Bitstamp, expected to finalize in the first half of 2024, and its response to the SEC's Wells notice. Johann Kerbrat stated that the firm’s enthusiasm for crypto is boosting its strategy for the upcoming year.

As of November 2024, Robinhood reported $38 billion in crypto assets under custody. In November alone, the company achieved over $3 billion in trading volume, nearly double the volume from Q3. Increased engagement is evident as users are buying on Robinhood and transferring to self-custody wallets or other platforms.

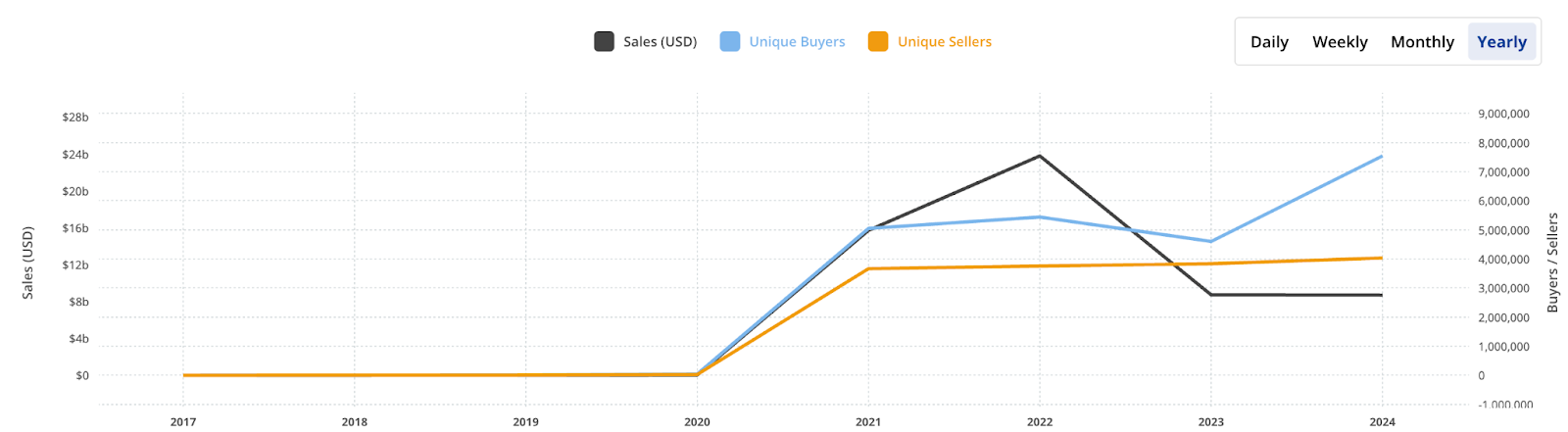

In contrast to 2023, when Robinhood's trading revenues declined, current metrics indicate a recovery. NFT activity has also seen an uptick, with global sales volume at $8.69 billion as of now, slightly below last year's $8.71 billion figure. The average NFT sale price increased to $122 this year from $95 in 2023.

Europe remains a significant focus for Robinhood, marking a pivotal year for EU expansion. The anticipated closing of the Bitstamp acquisition may alter this trajectory. Kerbrat expressed interest in enhancing tokenization efforts, collaborating with Kraken, Paxos, and others to launch the Global Dollar Network based on the USDG stablecoin.

Kerbrat is exploring the intersection of artificial intelligence and crypto, noting potential concerns regarding AI misuse, particularly deepfakes. He believes there are opportunities for combining AI and crypto to address issues like micro-payments and fair data remuneration.