Safe Unveils Safenet, Aiming to Create Onchain Transaction Processor Network

New cross-chain solutions are addressing challenges posed by Ethereum’s rollup-centric roadmap.

Safe’s Safenet, set for release in 2025, will function as a transaction processor network on existing blockchains, providing execution guarantees for cross-chain transactions.

Safenet's design introduces capabilities aimed at improving DeFi issues like speed, security, and liquidity fragmentation by unbundling execution and settlement, similar to VisaNet’s architecture.

Safenet aims to enhance transaction efficiency, processing transactions in under one second through an intents-based solver network. This performance facilitates near-instantaneous asset movement across different blockchains.

Delays in transferring tokens or interacting with dapps have historically hindered cross-chain activities, leading to a fragmented user experience.

“Safenet addresses DeFi’s biggest challenges: fragmentation, latency, and complexity,” stated Lukas Schor, co-founder of Safe. By utilizing Safenet Processors, users can access instant liquidity and secure, composable transactions across on-chain and off-chain networks.

The network is secured by user-defined policies and a decentralized validator network that stakes the SAFE token, offering protection against risks such as address poisoning and other vulnerabilities.

Validators monitor processor activity and can identify malicious behavior. This oversight, along with user-defined transaction rules, creates a defense-in-depth security layer that minimizes exposure to common threats.

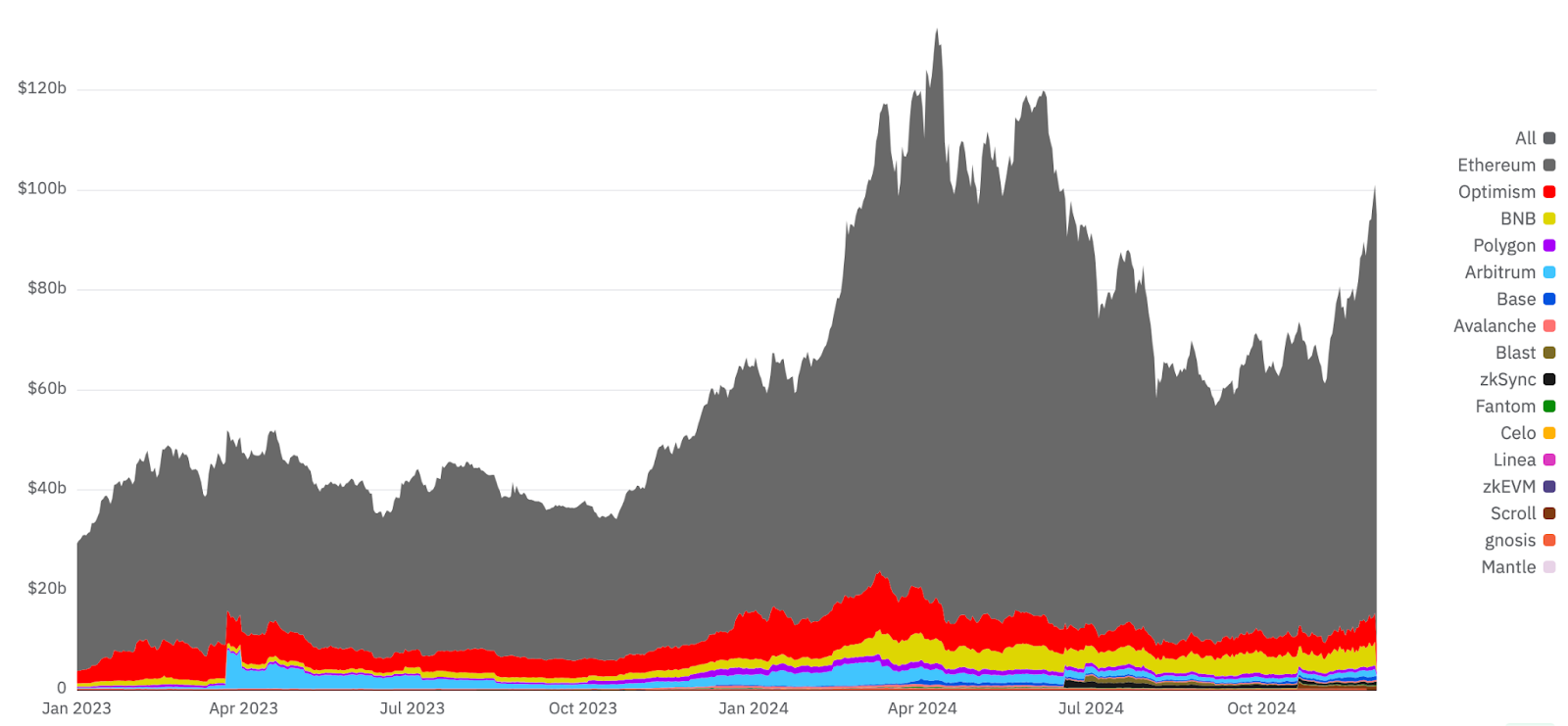

Safenet also unifies balances across chains, simplifying usability. Users will manage their assets through a single view rather than separate wallets or manual bridges. Current Safe wallets secure $112 billion in assets, primarily on Ethereum, and allow switching between multiple networks while deploying the same Ethereum address across various chains, extending beyond EVM-compatible networks to include non-EVM chains like Solana.

Safe aims to connect on-chain and off-chain ecosystems, enabling users to interact with centralized exchanges and payment systems using a unified asset balance. This functionality enhances asset management and expands user engagement options.

According to Richard Meissner, co-founder of Safe, DEX activity constitutes about 5% of the Total Volume Processed (TVP) on Ethereum mainnet by Safe accounts, with the rest comprising asset transfers, treasury management, DAO governance actions, and complex DeFi operations like liquidity provisioning.

Meissner emphasized that Safe's wallet differentiates itself by offering smart accounts, which provide functionalities not available with traditional EOA accounts, including multisig, private key recovery, and automation. Safe anticipates these features will attract businesses to transition more operations on-chain.

A significant aspect of Safenet’s functionality is its integration with ERC-7579, a standard defining modular smart account interfaces and behaviors for interoperability. The adoption of ERC-7579 allows Safenet to facilitate the separation of transaction execution and settlement, mirroring VisaNet's model in traditional finance.

In collaboration with Rhinestone, Safe developed the Safe7579 Adapter to enable compliance with the ERC-7579 standard. This standardization is vital for interoperability, allowing for modules like spending limits, role-based account access, and recovery to be integrated into Safe accounts.

Safenet is scheduled for an alpha release in Q1 2025, initially supporting cross-chain accounts and basic liquidity functions. By mid-2025, it will introduce third-party processors and compatibility with the Safe Apps SDK, enabling new use cases like off-exchange settlement and subscription services.