SEI Network Achieves 5.31% Price Increase with Key Metrics Surge

SEI has shown notable performance in the past 24 hours, with a price increase of 5.31%, bringing its market cap to $1.88 billion. This growth indicates that SEI is approaching a significant psychological price level.

The network's rising transaction counts and active addresses suggest potential for a substantial rise in 2025. SEI is recognized for its high-speed, efficient, and scalable decentralized applications (dApps).

SEI Network Growth Amid Market Slowdown

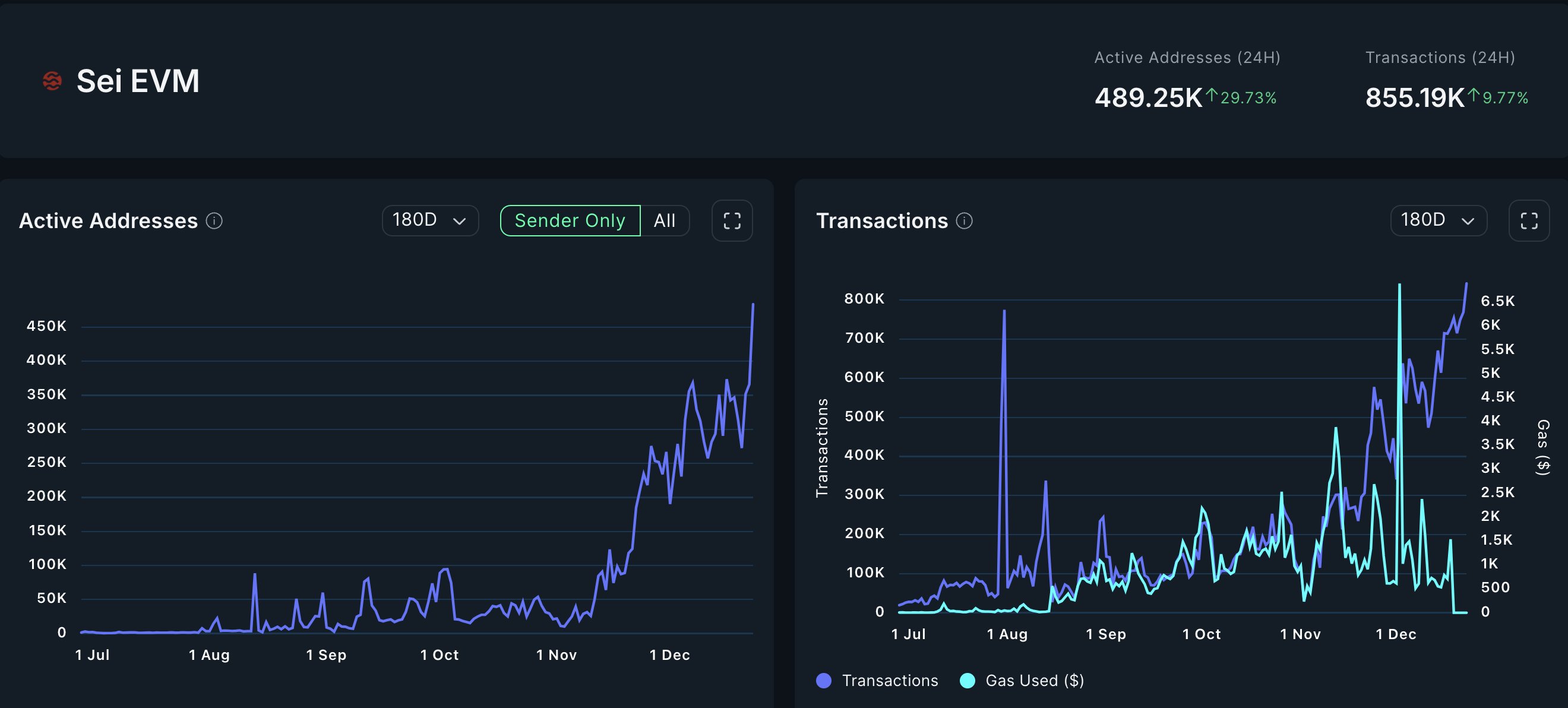

As the likelihood of a bullish cycle in 2025 increases, key metrics for the SEI network are surging. In the last 24 hours, transaction counts rose by 10%, and active addresses increased by 29%.

Active addresses surpassed 450k, reaching 489.25k, while transactions totaled 855.19k.

The total value locked (TVL) in the SEI network stands at $577.15 million, down from its all-time high of $751.67 million. The short-term recovery has led to a 24-hour volume of $26.43 million.

The number of unique active wallets (UAW) on the SEI network has reached an all-time high of 441.85k, reflecting increasing user activity and transactions.

Currently, Spin City, Dragon Slayer, and Archer Hunter lead the dApp rankings on the SEI network this month.

SEI Price Analysis Indicates Potential Bullish Cycle

With a market cap nearing $2 billion, SEI ranks #63 in the crypto market. Daily chart analysis shows higher highs and higher lows in price action.

The price trend forms an ascending broadening wedge pattern, indicating potential volatility. Currently near the support trend line, SEI appears poised for a bullish cycle.

This technical pattern typically suggests bearish tendencies, as prices may struggle to maintain momentum and could drop below the support trendline. A recent 9% increase suggests a morning star pattern, challenging the 200-day EMA line, although SEI is currently trading below it.

SEI Price Targets

If SEI successfully challenges the resistance trendline, it could see an upside potential of nearly 82%, with the overhead resistance around $0.8157. This scenario raises the possibility of SEI reaching the $1.00 psychological mark.

Despite the current bullish sentiment, the overall pattern remains bearish. The overnight price surge enhances the likelihood of a positive crossover in MACD and signal lines. A breakout above the 200-day EMA could target the $0.55 resistance level, while a breakdown below the support trend line could revisit previous lows around $0.33.