6 0

SEI Token Surges Over 50% Driven by Institutional Support and Airdrop

Sei's native token, SEI, surged over 50% in the past week, outperforming all other top-100 tokens. Analysts attribute this rise to multiple factors:

- Wyoming designated SEI as the settlement layer for its dollar pilot, enhancing institutional credibility.

- Airdrop snapshot for version 2 and an increase in staking APY by 9% from core validators.

- Increased on-chain capital flow into centralized exchanges exceeded $3 million.

The Wyoming Stable Token Commission shortlisted SEI and Aptos for its stablecoin pilot program, scoring SEI 30 points based on key metrics. The proposed state-backed stablecoin, WYST, aims for a U.S. dollar peg and is developed with LayerZero.

Current metrics include:

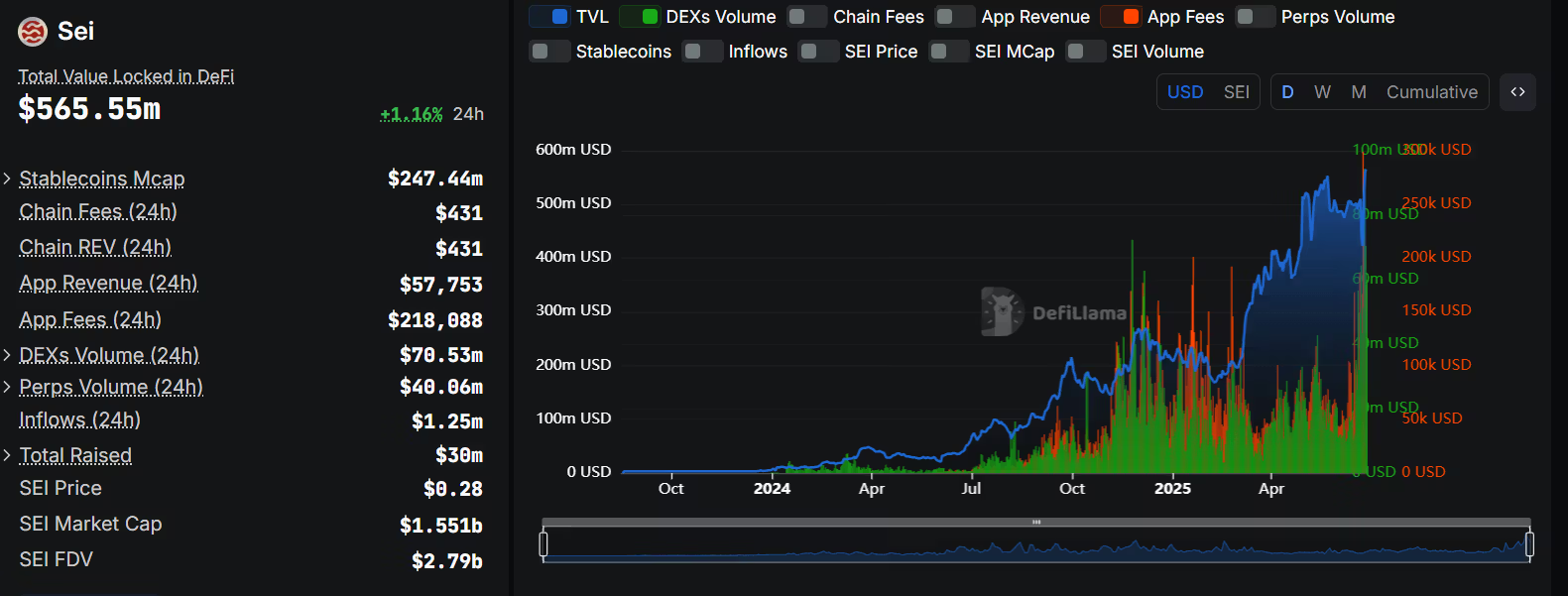

- Total value locked (TVL) on Sei exceeds $540 million, steadily rising since January.

- SEI-based decentralized exchange (DEX) volumes surpassed $60 million.

Analysts caution that if funding rates exceed +0.05% or open interest outstrips spot, it may indicate over-leverage. However, positive fundamentals suggest momentum could continue into July.