Updated 5 January

Short-Term Bitcoin Holders Report 10% Profit Amid Price Recovery

The Bitcoin market has seen a modest recovery following a 15.7% correction in late December 2024. Recent activity from short-term holders (STH) indicates potential future trends for Bitcoin.

Bitcoin STH MVRV At 1.1 With More Room To Run

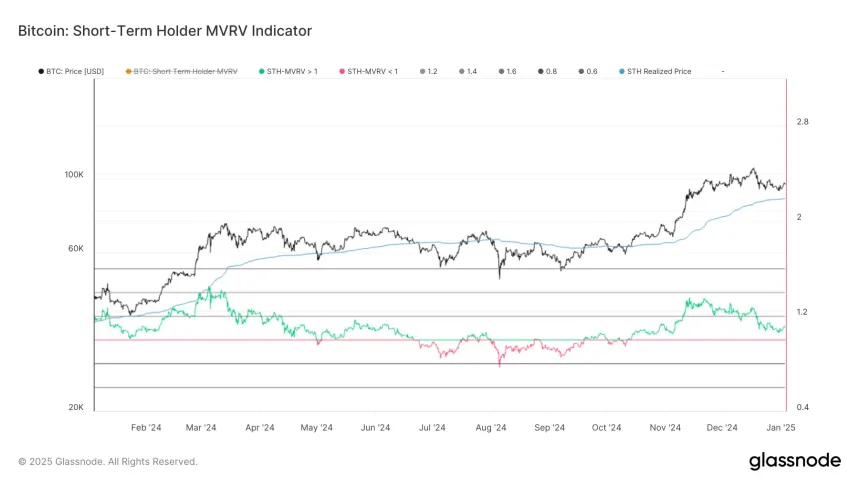

Blockchain analytics firm Glassnode reported that the Bitcoin short-term holders’ market value to realized value (MVRV) ratio is currently at 1.1. This ratio helps assess whether an asset is overvalued or undervalued, with values above 1 indicating profit and below 1 indicating loss.

The current ratio suggests that short-term holders, who acquired Bitcoin within the past 155 days, are experiencing an average profit of 10%. Given recent price declines, there may be selling pressure as these holders seek to realize gains, which could create short-term price resistance. However, previous peaks of the STH MVRV ratio were 1.35 in November 2024 and 1.44 in March 2024, indicating that short-term holders might tolerate higher profitability before a significant sell-off occurs.

If demand continues to rise, the STH MVRV ratio could approach these historical peaks, potentially confirming a resumption of Bitcoin's uptrend.

BTC Must Avoid Fall Below $87,000 – Here’s Why

The STH MVRV ratio indicates that the pivotal value of 1.0, representing no profit or loss, aligns with the $87,000 price zone. Data shows a low trading activity area between $87,000 and $71,000, meaning if Bitcoin falls below $87,000, it would encounter significant resistance only at $71,000, leading to a major price decline.

Currently, Bitcoin trades at $98,081, reflecting a 1.02% gain over the past day. With a market cap of $1.94 trillion, Bitcoin remains the largest asset in the cryptocurrency market.