9 1

Shutdown Delays Data, BTC and Gold Surge Amid Rate-Cut Speculation

Key Developments in Crypto Investments:

- Bitcoin (BTC) is experiencing significant momentum, reaching $120,000 after a 9% weekly increase. This movement is influenced by macroeconomic factors including the U.S. government shutdown and potential Federal Reserve interest rate cuts.

- Gold prices also rose by 2.9%, reflecting investor preference for alternative assets amidst delayed economic data releases.

- The U.S. government shutdown has impacted financial regulators like the SEC and CFTC, with over 90% of SEC staff furloughed.

- On-chain data indicates rising bitcoin demand, with approximately 62,000 BTC acquired per month since July, driven by ETFs and high-net-worth individuals.

- DeFi trading activity is increasing, particularly with renewed participation from Asia, signaling strong market adoption.

Upcoming Events to Monitor:

- Solana and XRP ETF decisions could be delayed due to the U.S. government shutdown.

- Ethereum's Fusaka upgrade is progressing, moving closer to mainnet launch.

- Compound DAO is holding a vote on deprecating Compound V2.

- Immutable (IMX) will unlock 1.26% of its circulating supply, valued at $17.56 million.

- EVAA Protocol (EVAA) will be listed on major exchanges.

Market Movements:

- BTC futures show bullish trends with open interest at all-time highs above $32 billion.

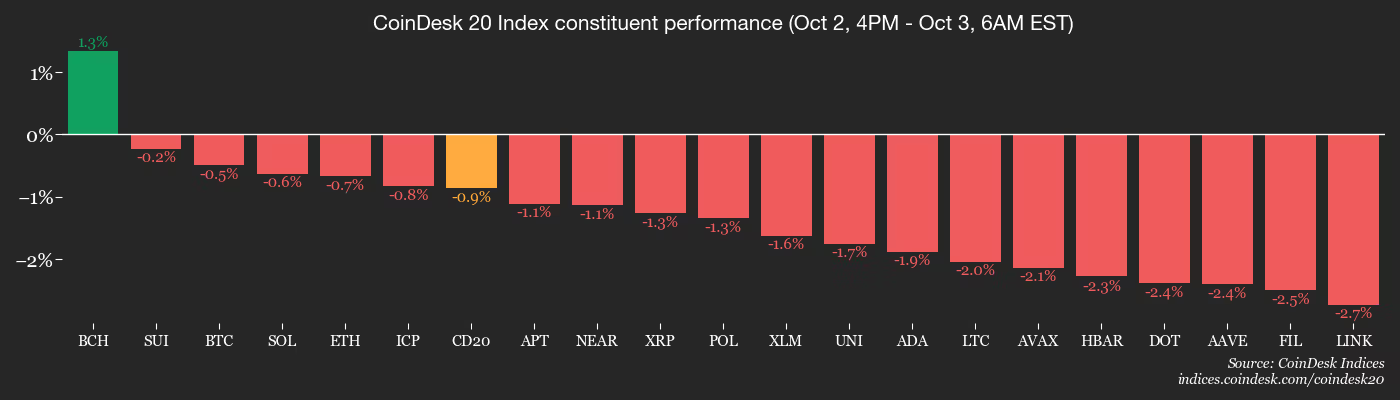

- ETH and other altcoins like SOL and XRP saw gains over 2%, while some smaller tokens experienced substantial increases.

- Notably, MYX Finance (MYX) dropped 43% following leveraged position unwinding.

- BTC price remained relatively stable around $120,378.11, marking a 1.44% increase over 24 hours.

Crypto Equities Performance:

- Coinbase Global (COIN) closed at $372.07 with a 7.48% gain, further increasing slightly in after-hours trading.

- Circle Internet (CRCL) and Galaxy Digital (GLXY) also recorded notable increases.

Additional Insights:

- Spot BTC and ETH ETFs are showing significant net flows, indicating strong institutional interest.

- The BTC dominance remains at 58.79%, with a stable hashrate and total fees collected in BTC.

- Technical analysis suggests Ether is currently in a bearish phase, yet trading above key exponential moving averages.

- Derivatives positioning shows a balanced market with a decrease in put-call volume ratio.

Investors should remain vigilant of upcoming macroeconomic data releases and regulatory developments, as these factors continue to influence crypto market dynamics.