7 0

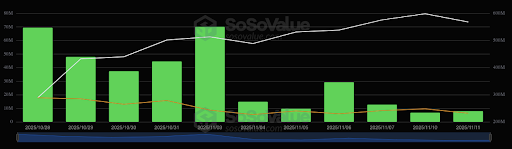

Solana Sees $350.47M ETF Inflows in Two Weeks Amid Institutional Interest

Institutional interest in Solana (SOL) is increasing with the opening of Spot Exchange Traded Funds (ETFs), suggesting a potential positive shift in SOL's market dynamics.

Key Highlights

- Solana has seen 11 consecutive days of ETF inflows, indicating growing institutional confidence.

- The current price of Solana is approximately $156, about half of its all-time high of over $294 set in January 2025.

- US Spot Solana ETFs have recorded a cumulative net inflow of $350.47 million in less than two weeks.

- On November 3, Solana ETFs saw their highest daily inflow of $70.05 million from Bitwise and Grayscale.

- Bitwise’s BSOL ETF contributed $331.74 million, while Grayscale’s GSOL ETF added $18.72 million.

If ETF inflows continue and market sentiment remains positive, there might be further price appreciation for Solana, though reaching $300 remains uncertain.

Grayscale's Expansion

- Grayscale announced options trading for its Solana Trust ETF, offering more opportunities for investors.

- The Solana Trust will feature 100% staking with zero fees and staking rewards averaging over 7%.

This expansion could enhance liquidity and attract more investment into Solana.