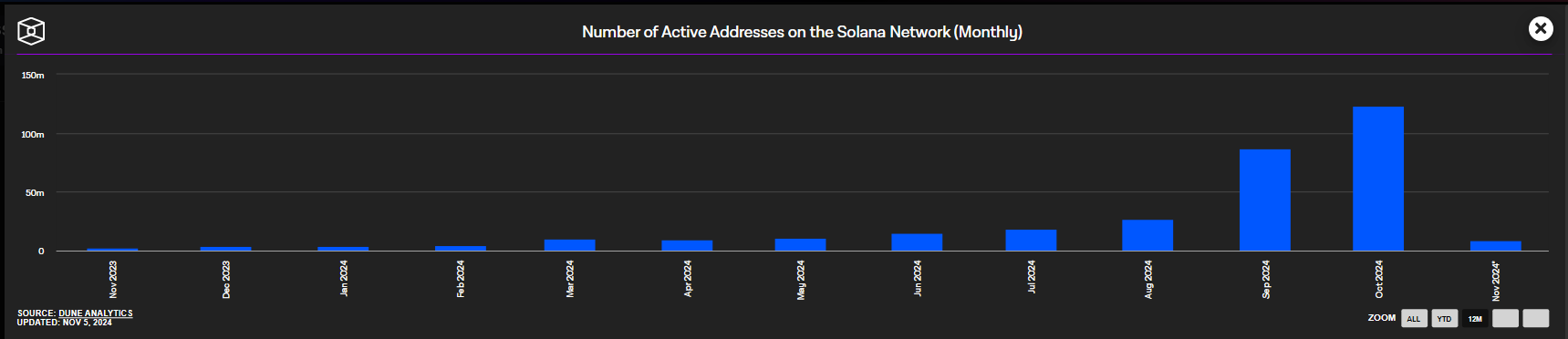

Solana User Base Reaches 123 Million Active Addresses in October

In October, the Solana blockchain recorded 123 million active addresses, marking a 42% increase since September and a significant rise from 12.7 million at the beginning of the year. This growth is attributed to increased trading activity and user interest in memecoins.

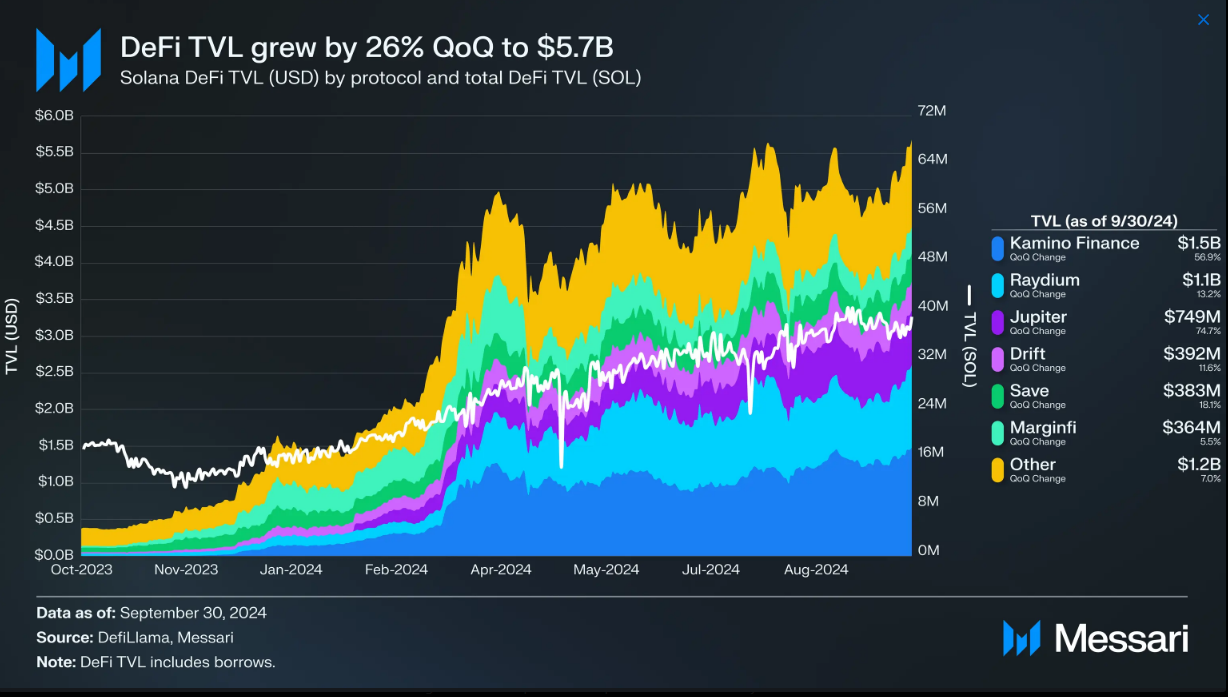

Besides memecoins, Solana's decentralized finance (DeFi) ecosystem has shown considerable progress, with a total value locked (TVL) of $5.7 billion. The DeFi sector grew by 26% in Q3 2024, making Solana the third-largest DeFi network, surpassing Tron, primarily due to innovative platforms like Kamino.

Memecoins Drive Unprecedented Trading Volumes

Platforms such as Pump.fun, a memecoin generator, and Raydium, a decentralized exchange (DEX), have significantly contributed to trading volume on Solana. Pump.fun generated $30.5 million in October, while Raydium reported approximately $30 billion in trading activity. These platforms cater to users seeking low-cost, high-frequency trades, attracting more participants to the network.

However, some industry experts express caution. Eden Au, research director at The Block, noted that the long-term impacts of memecoins remain uncertain. Changing market dynamics and evolving user preferences could hinder progress unless new utility emerges beyond memecoins.

Solana DeFi Ecosystem Flourishes

Alongside the memecoin hype, Solana's DeFi ecosystem is thriving. With a TVL of $5.7 billion and a 26% growth in Q3, platforms like Kamino are playing a pivotal role. Kamino has introduced innovative loan and trading services, enhancing Solana’s DeFi appeal. Additionally, integrations like PayPal's PYUSD have strengthened Solana's stablecoin framework.

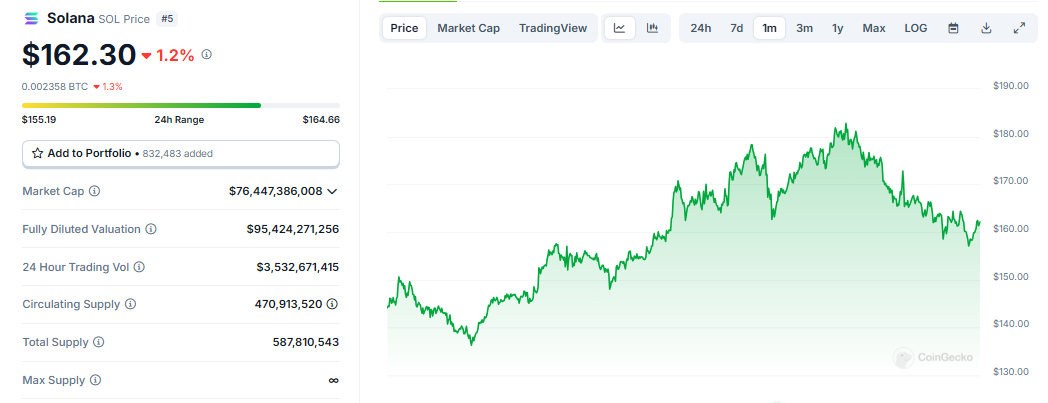

SOL Price Target & Resistance Level

Over the past month, the value of Solana's native token, SOL, has risen by approximately 12%. It is currently priced at $162, according to Coingecko. Analysts are eyeing a resistance level of $185, and if SOL breaks this barrier, price targets may reach between $220 and $240. The upcoming weeks will be crucial for maintaining momentum.

Featured image from MoneyCheck, chart from TradingView