0 0

BEARISH 📉 : Solana crashes as institutions remain cautious on buying

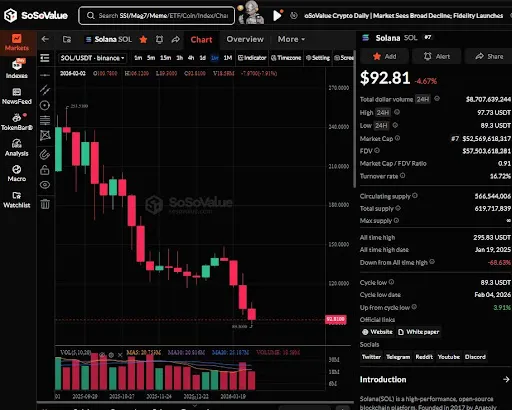

Solana has experienced a significant sell-off, bringing its price into a critical demand zone around $90–93. This decline is reflected on the weekly chart, with weak rebound signals and low volume, indicating limited large buyer participation.

Institutional Behavior

- Institutions remain cautious, showing little interest in accumulating Solana at lower prices, unlike previous aggressive buying at higher levels.

- Their decisions are influenced by trend structure, liquidity conditions, and capital flows rather than predicting exact price bottoms.

- ETFs typically avoid dollar-cost averaging like retail investors and wait for clearer market trends before re-entering positions.

- Lack of new capital inflows limits ETF ability to add positions even at discounted prices.

Sustained Bearish Pressure

- Solana is experiencing step-down declines, reaching a key demand zone between $90 and $95.

- Selling pressure appears to be easing, suggesting an attempt to form a short-term base within this range.

- If the demand zone holds, a relief move toward prior structural levels is possible, indicating a technical rebound rather than a full trend reversal.