Solana DEX Volume Surpasses Ethereum Amid Memecoin Trading Surge

Ethereum and Solana represent a significant rivalry within the cryptocurrency space.

Critics of Ethereum argue that Vitalik Buterin's modular scaling strategy, which has led to over 100 satellite blockchains, may not enhance the value of ETH. They question the benefit of transferring on-chain activity away from the mainnet if it does not lead to increased ETH prices.

In contrast, Solana has focused its community on a single chain, resulting in its decentralized exchange (DEX) volumes surpassing those of Ethereum’s mainnet and 13 other networks combined.

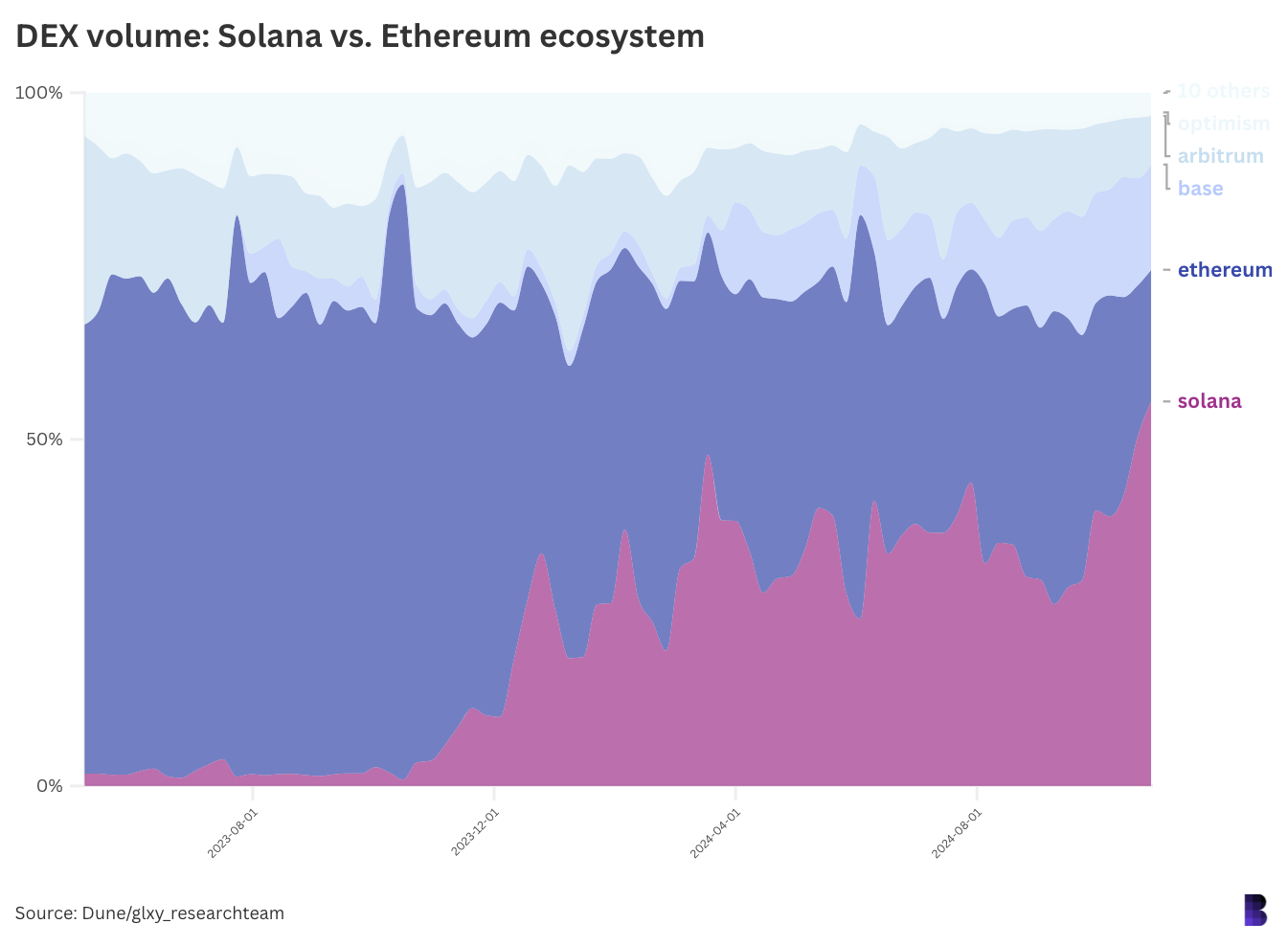

The chart illustrates Solana’s DEX volume market share compared to Ethereum and 13 layer-2 networks over the past 18 months, including Base, Arbitrum, Optimism, Scroll, Mantle, ZKSync, Polygon, Polygon zkEVM, World Chain, Zora, Linea, Blast, and Arbitrum Nova.

Recently, Solana DEXs processed $45.1 billion in volume, driven by record highs on Raydium, while Ethereum and its associated networks recorded under $40.2 billion. Memecoin trading significantly contributed to this volume, with over 80% of weekly DEX activity on Solana being attributed to memecoins, according to Blockworks Research.

This marks the first time Solana's weekly DEX volume has exceeded that of a specific segment of the Ethereum ecosystem.

The public perception of SOL and ETH hinges on two factors:

- The attraction of memecoin traders to these ecosystems.

- The potential increase in native cryptocurrency prices as a result.

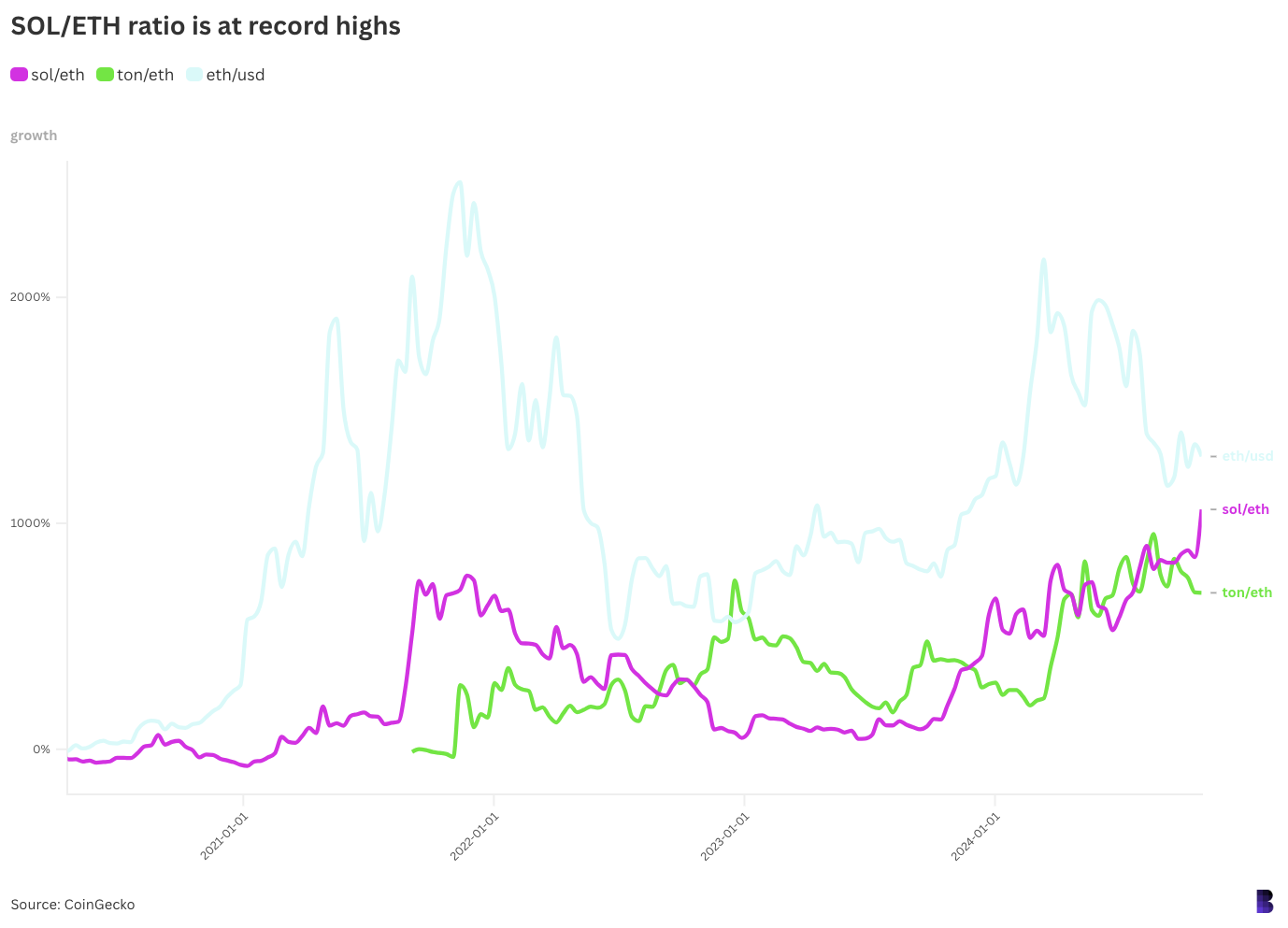

As Bitcoin remains relatively stable until the US elections, monitoring price ratios between cryptocurrencies can reveal more accurate market trends. Currently, the ETH/BTC ratio is at its lowest since April 2021, indicating greater market confidence in Bitcoin compared to Ethereum during this bull cycle.

Additionally, the SOL/ETH and TON/ETH ratios have reached new highs recently, suggesting shifting market dynamics.

This raises the question of whether the crypto markets are efficiently identifying the most promising assets.