14 1

Solana DEXs Hit $8B Volume Amid Price Rebound Above $190

Solana (SOL) Market Update:

- Solana's price increased by 3% on October 8, reaching $190 and a market cap of $100 billion for the first time since September.

- The rebound followed volatility caused by new U.S. tariffs on China, which led to significant liquidations across crypto markets.

DEX Activity and Market Resilience

- Solana's decentralized exchanges (DEXs) processed over $8 billion during the market crash, highlighting the ecosystem's strength.

- Four Solana-based DEXs, including Orca ($2.49B), Meteora ($1.7B), and Raydium ($1.5B), achieved over $1 billion in 24-hour trading volume.

- The network maintained liquidity despite broader market outflows, aiding SOL's price stability and quicker recovery.

Derivatives and Technical Indicators

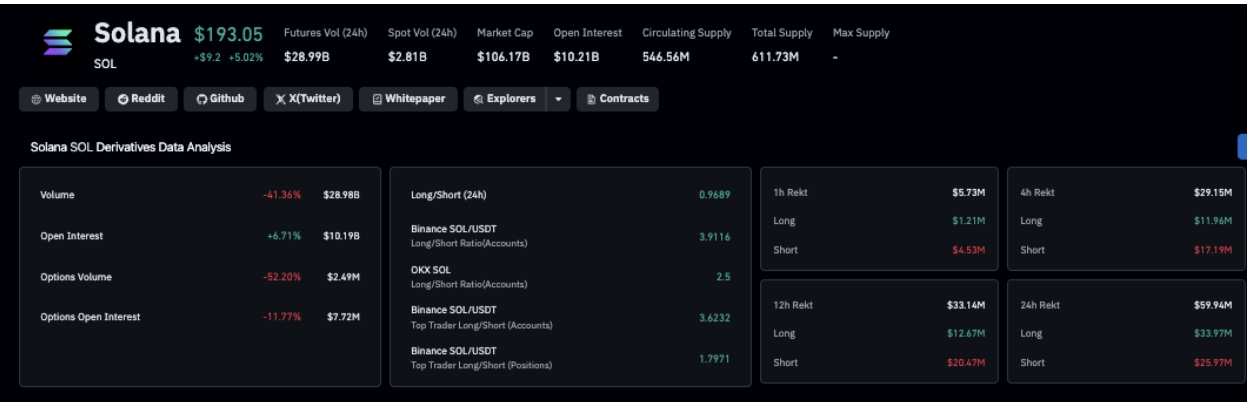

- Open interest in Solana derivatives rose 6.9% to $10.2 billion, indicating renewed long positions despite only a 5% price increase to $192.

- Technical indicators show bullish momentum with SOL rebounding from the lower Bollinger Band support at $181.6.

- SOL is now targeting resistance at the mid-Bollinger level of $213.3, with potential to reach the upper band at $244.9.

- The Relative Strength Index (RSI) has improved, moving from oversold levels to a neutral mark, suggesting cooling downside momentum.