3 0

Solana Approaches $140 Supported by ETF Inflows and Network Revenue

Key Points:

- Solana is approaching $140, driven by strong ETF inflows and increased network revenue, indicating a renewed interest in risk assets within the crypto space.

- Institutional interest is growing beyond Bitcoin, often leading to capital flowing into smaller cap and meme coins with high volatility.

- Ethereum-based Maxi Doge ($MAXI) leverages meme culture with staking, contests, and events, attracting traders seeking structured incentives.

- The $MAXI presale has raised over $4M, targeting traders interested in yield-backed meme investments during a bullish market phase.

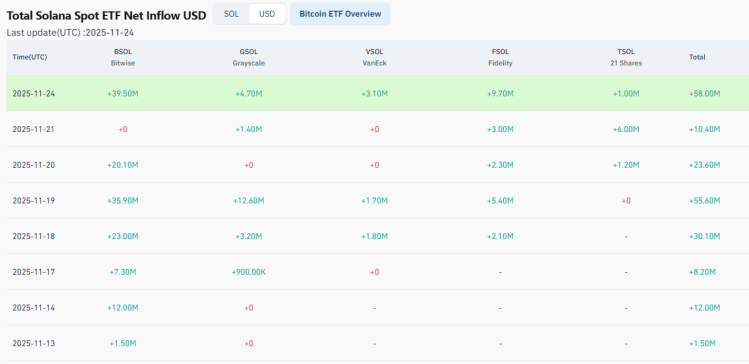

- Solana's spot ETFs have attracted over $480M in inflows, suggesting institutional investors are moving towards opportunity mode rather than survival mode.

- Maxi Doge aims to provide utility and yield, differentiating itself from traditional meme coins. It offers 73% APY through staking and holds trading contests for community engagement.

- The tokenomics focus on growth, with 40% of the supply allocated to marketing and 25% to the Maxi Fund to drive virality.

As Solana demonstrates significant user interest in high-speed trading and NFTs, Maxi Doge positions itself as an attractive option for those embracing the meme-plus-utility trend.