9 0

Solana Gains Attention Amid Fed Rate Decision and Crypto Market Shifts

Key Insights on Solana and Crypto Investments

- Solana (SOL) is gaining attention as Ethereum's rival with potential as a global finance settlement infrastructure due to its high transaction capacity of over 6 billion per day.

- Galaxy Investment's CEO, Michael Novogratz, highlights Solana's speed as a crucial factor.

- Coinbase’s layer-2 network, BaseCamp 2025, plans to launch a token and create a Solana bridge to enhance cross-chain connectivity.

- Pantera Capital values Solana at $1.1 billion, citing it as the fastest and best-performing blockchain in recent years.

- Kyle Samani from Forward Industries intends to support the Solana-native DeFi ecosystem.

- Potential Federal Reserve rate cuts could influence SOL's performance against BTC and ETH.

- SOL trades around $235, having peaked near $250, while other major cryptocurrencies remain static.

Stablecoin Regulation

- The Bank of England proposes limits on dollar-backed stablecoin holdings to mitigate systemic risks.

- Aave’s CEO Stani Kulechov criticizes these regulations and emphasizes community resistance.

- Other countries might adopt similar measures to control traditional bank outflows.

Market Trends and Developments

- Immutable's native token IMX rises 15%, reaching a five-month high amid increased trading volume.

- The SEC dropped an investigation into Immutable, boosting market optimism for the gaming sector.

- Solana futures reach record OI levels; positive funding rates indicate bullish sentiment.

- CME shows growing interest in solana futures, maintaining a premium above 15%.

- BTC and ETH options show decreased bias as traders anticipate Fed rate cuts.

Crypto and Traditional Market Movements

- BTC and ETH remain stable, with slight changes in their prices.

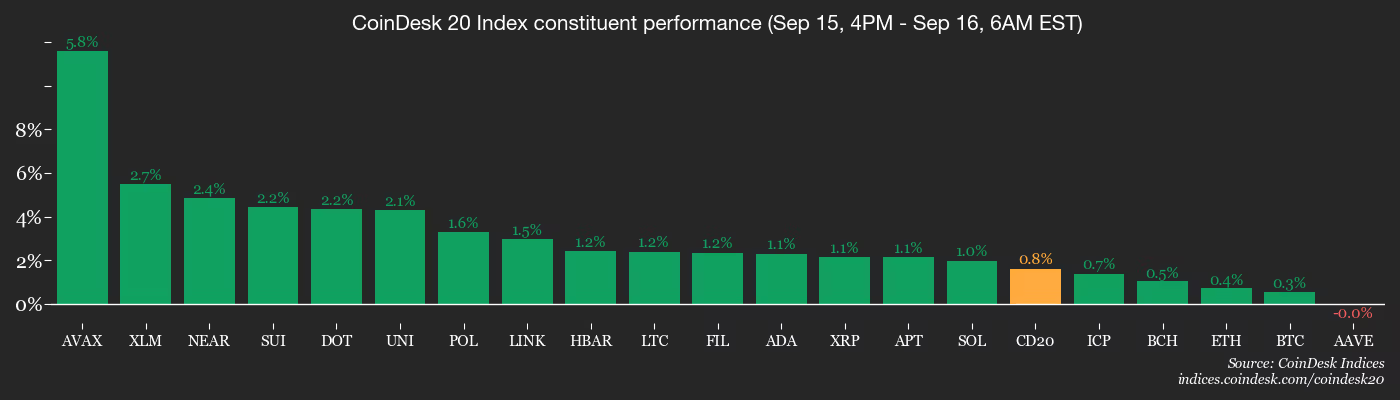

- The CoinDesk 20 index sees a modest rise, while global stock indices show varied performance.

- Gold and silver futures experience minor gains.

Technical Analysis

- BTC continues to challenge the trendline connecting previous bull market peaks.

- A failure to break through could lead to increased selling pressure.

Events and Conferences

- Solana Live event features key industry figures discussing developments.

- Budapest Blockchain Week and Real-World Asset Summit are underway.

ETF Flows

- Spot BTC ETFs see daily net flows of $259.9 million, with cumulative net flows at $57.05 billion.

- Spot ETH ETFs have daily net flows of $359.7 million, totaling $13.74 billion in cumulative net flows.