18 0

Solana Handles Record Liquidation Event, Ethereum Struggles with High Fees

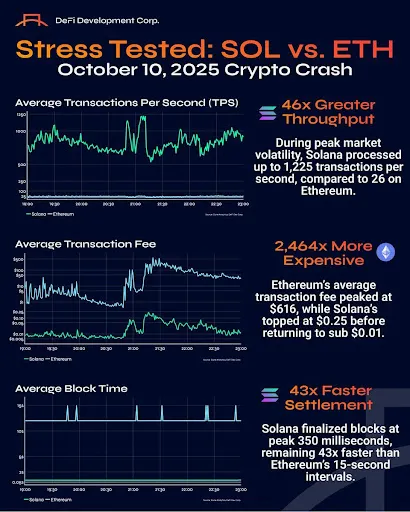

The recent market correction exposed critical differences in cryptocurrency network architectures. While a massive liquidation event affected the whole crypto market, Solana showcased resilience, unlike Ethereum, which experienced significant issues.

Key Observations

- During peak volatility, Solana maintained 1,225 transactions per second and finalized blocks in 350 milliseconds. Transaction fees briefly rose to $0.25 but soon normalized below $0.01.

- Ethereum struggled with demand, processing only 26 TPS. Block times extended to 15 seconds, and average gas fees soared to $616, making the network impractical and unusable during the crisis.

- Despite Ethereum's issues, Solana's continuous upgrades have ensured that it remains accessible, affordable, and reliable even under extreme conditions.

- DefiDevCorp emphasized Solana's ability to handle global value transfers efficiently during market turmoil.

Market Reaction

- A researcher noted that while he faced no issues with Solana, Ethereum was unusable due to high costs during the collapse.

- There is criticism from within the Ethereum community about its performance under pressure.

- Despite Solana's reliability, its valuation does not yet reflect its demonstrated resilience in the digital world.