6 0

Solana Liquidity Drops to Bear Market Levels, Losses Surpass Profits

Recent on-chain data indicates that the Solana Realized Profit/Loss Ratio has dipped into a loss-taking zone, suggesting reduced liquidity.

Key Points

- Solana's liquidity levels have contracted to those typically associated with bear markets, according to Glassnode.

- The Realized Profit/Loss Ratio measures the profit and loss realized by SOL investors through transactions.

- A value below 1 in this metric implies that losses are surpassing profits.

- Following a price rally in September, Solana's liquidity decreased, leading to increased investor capitulation.

- The current trend mirrors conditions witnessed during the 2022 bear market, where low liquidity persisted for months.

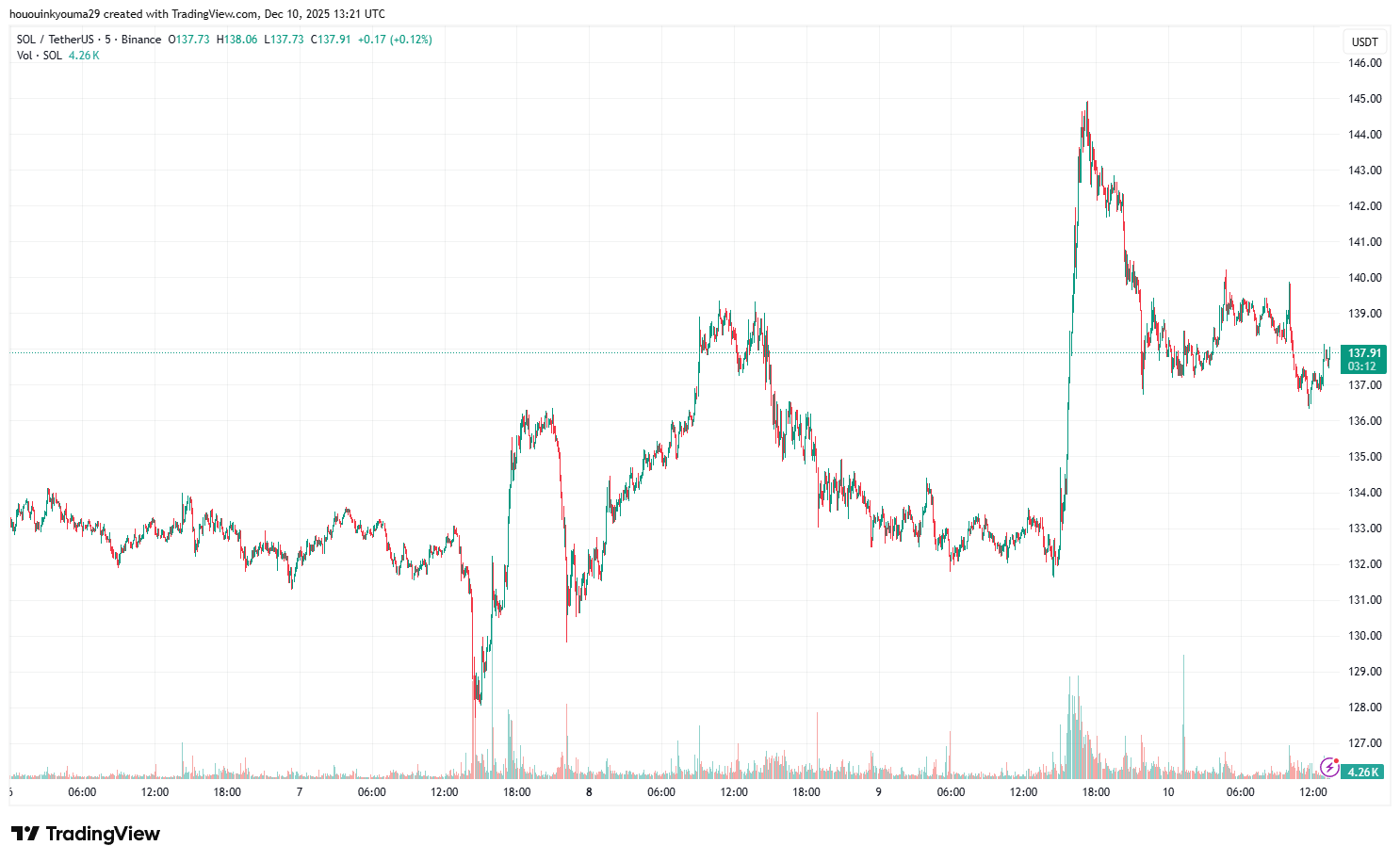

SOL Price Movement

Solana's price surged to $144 recently but has since declined to $138.