23 March 2025

5 0

Solana Price Action Influenced by Key Support at $112 and Resistance at $144

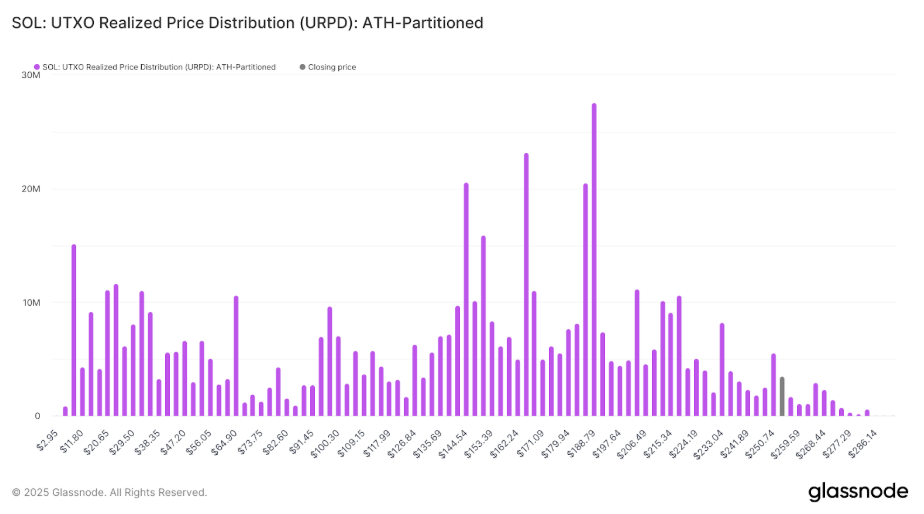

Investor behavior is influencing Solana's price, with significant trading activity at key levels. On-chain data from Glassnode shows clusters of traders impacting short-term movement as overall market participation declines.

$144 Resistance Develops

- 27 million SOL, about 5% of total supply, concentrated at $144, creating a resistance level.

- This level previously held 20.6 million SOL when SOL reached its all-time high on January 19.

- Investors near break-even may sell at this level, posing a psychological barrier to price increases.

- A secondary resistance at $135 holds 26.6 million SOL, capping upward movement without increased volume or demand.

Support Strengthens at $112

- 9.7 million SOL, approximately 1.67% of total supply, now positioned at $112, up from 4 million SOL in January.

- This increase indicates long-term holders are reinforcing their positions amid recent price declines.

- Strong support is likely at $112, but below this, the safety net weakens.

- The $94 to $100 range holds nearly 21 million SOL, while lower levels show significantly less supply, indicating potential for sharp price drops if $100 fails.

Solana's velocity has decreased to the lowest in five months, reflecting reduced investor engagement and exacerbating bearish sentiment. Currently, Solana is trading at $131, fluctuating between $135 and $122 recently.