Solana Price Faces Potential Pullback Below $200 Amid Selling Pressure

Over the past month, Solana price #SOL surged past the resistance of $200, reaching a three-year high of $225. Despite nearly 40% gains, profit-taking and declining buying pressure may halt the rally, with on-chain metrics indicating a potential pullback below $200.

As of press time, Solana (SOL) is trading at $207 with a market cap of $97.6 billion, reflecting a 5% drop in the last 24 hours. Trading volume has decreased by 22% to $9.38 billion, suggesting waning bullish sentiment compared to the previous week, increasing the likelihood of further bearish action.

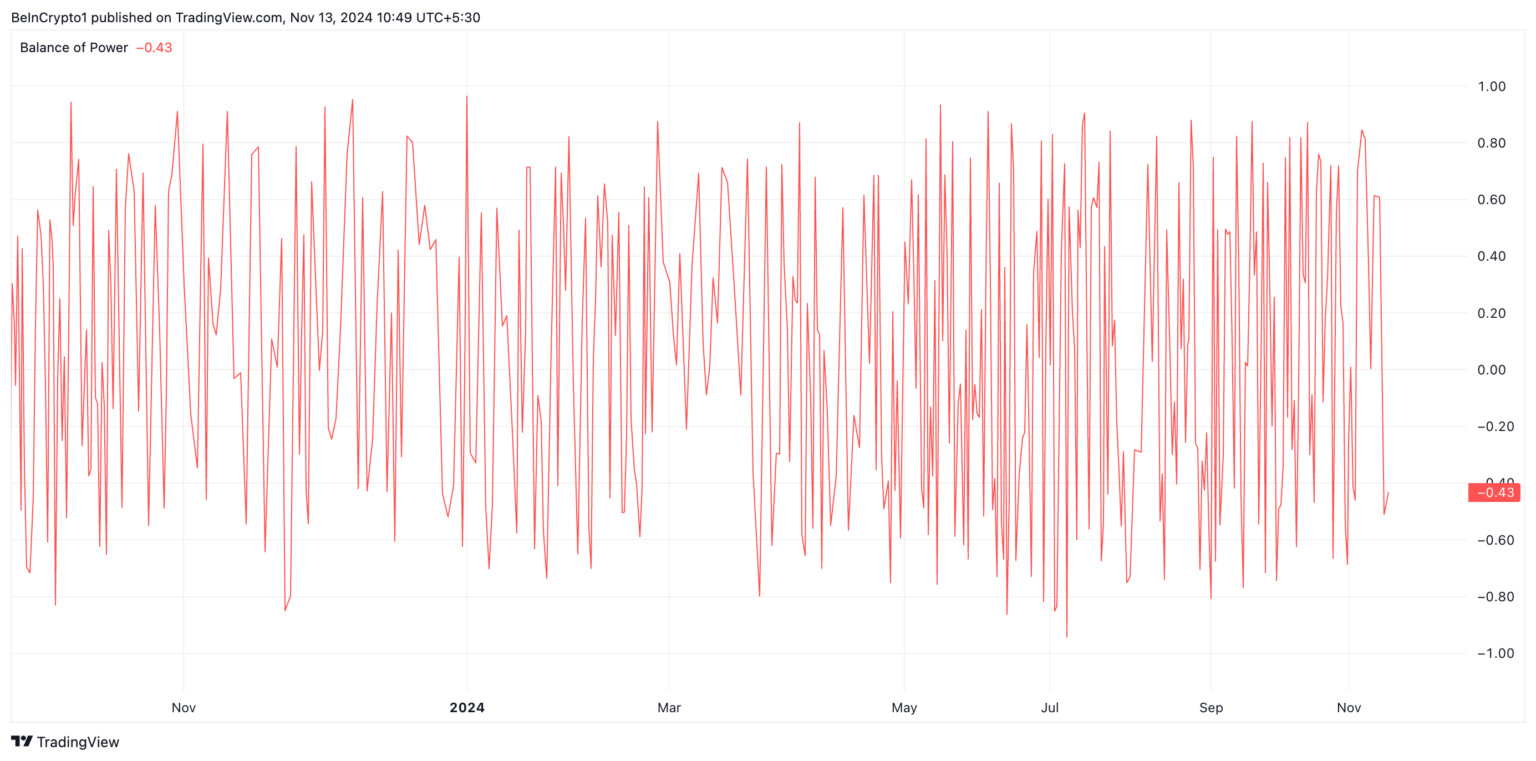

Solana's negative Balance of Power (BoP) at -0.43 indicates sellers dominate, potentially driving prices lower.

-

Courtesy: TradingView

Where Is Solana Price Heading Next?

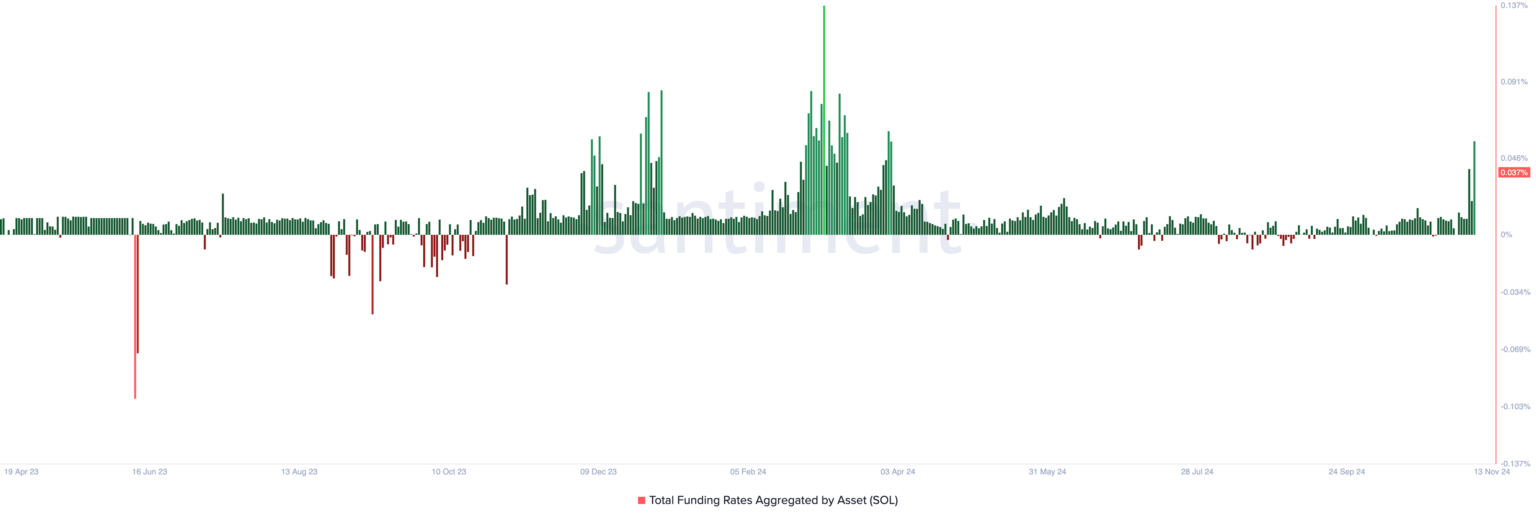

The Solana funding rate has reached an eight-month high of 0.037%, signaling a potential pullback under the $200 mark. This indicator suggests that a sharp rise in the funding rate typically reflects market imbalances, often leading to price declines.

-

Courtesy: Santiment

Currently, SOL is priced at $202.51, above its support level of $193.92. Increased selling pressure could test this support; failure to maintain it may lead SOL down to $169.36.

-

Courtesy: TradingView

A strong defense of the support level could trigger a rebound, enabling SOL to challenge its three-year high of $225.21. Additionally, the Solana blockchain recently surpassed Ethereum in DEX trading volumes, achieving record highs since mid-April.