8 1

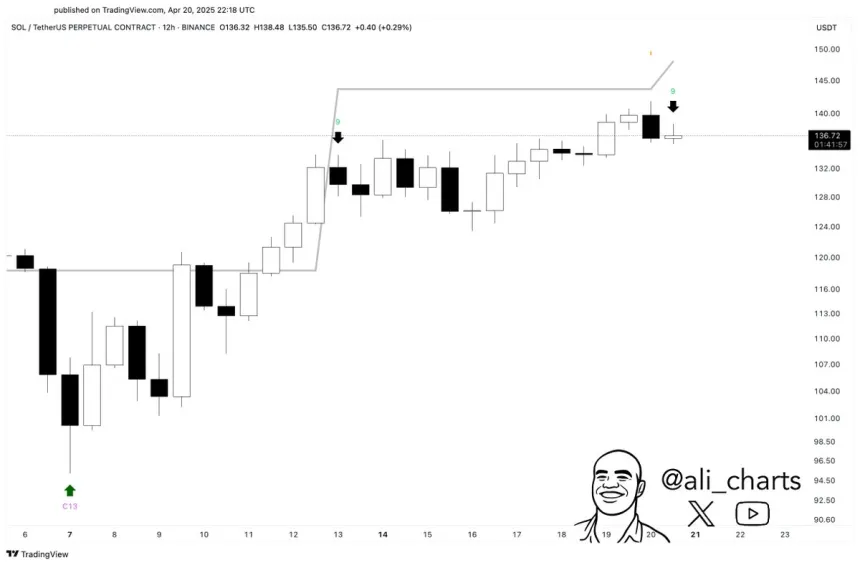

Solana Faces Short-Term Pullback Signal Amid Price Recovery

Solana is testing key resistance levels, showing potential signs of recovery after a 48% surge since April 7. However, the broader crypto market remains volatile due to macroeconomic uncertainties and US-China trade tensions. Investor sentiment is cautiously improving, raising hopes for a recovery rally among altcoins.

Key points include:

- Solana has faced significant selling pressure, losing over 65% of its value since January.

- A TD Sequential sell signal on the 12-hour chart indicates a possible short-term pullback.

- Price must hold above $150 for a breakout; failure could lead to consolidation between $130 and $120.

- If SOL drops below $120, it may face deeper losses with $100 as the next support level.

Market participants are closely monitoring Solana's ability to maintain support above current levels amid mixed signals of recovery and potential risks.