27 January 2025

0 0

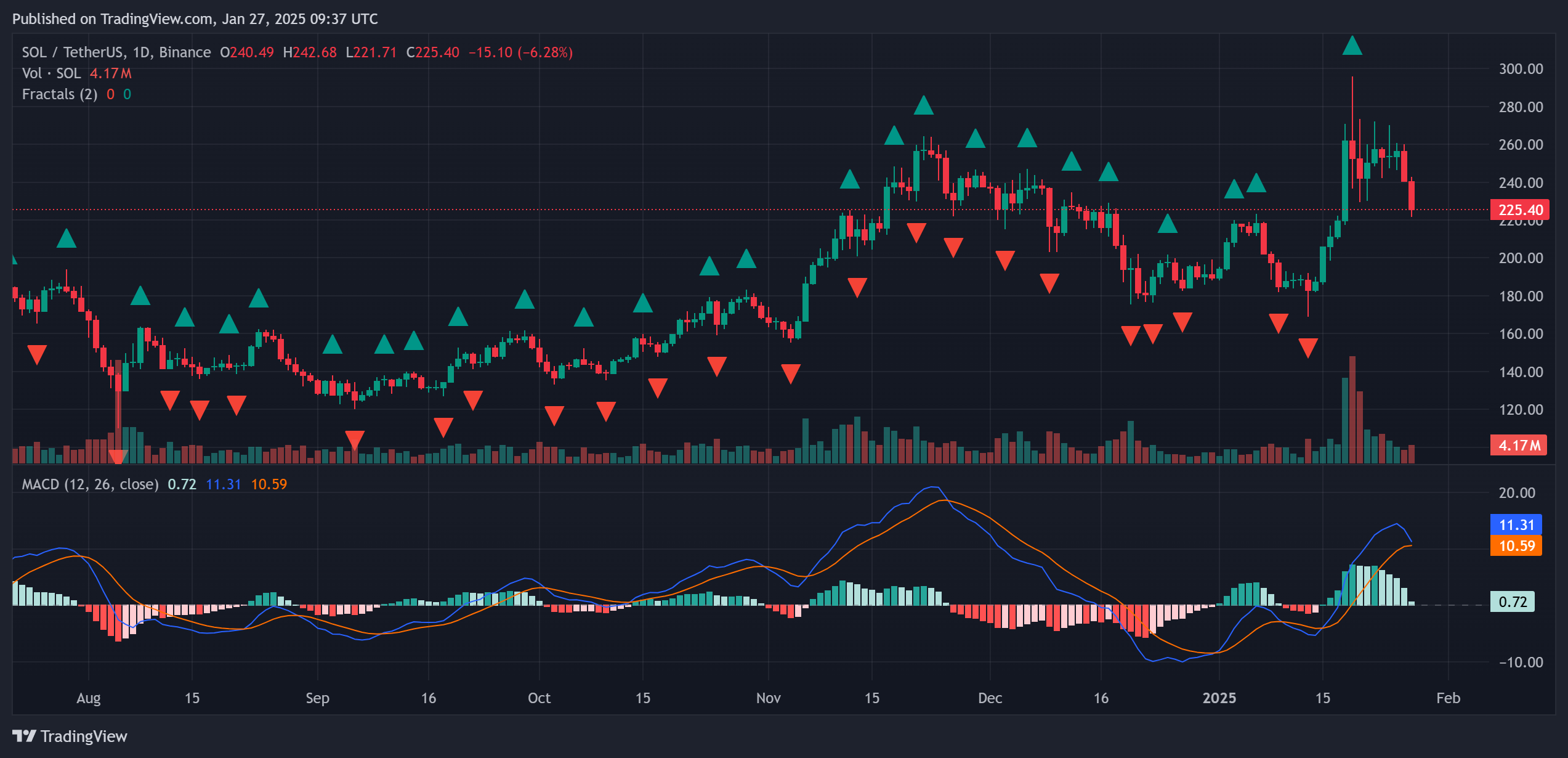

Solana (SOL) Price Drops to $225 Following 12% Decline

Solana (https://holder.io/coins/sol/) has dropped below the key support level of $232, trading around $225, reflecting a 12% decline in 24 hours. Market capitalization is at $109.85 billion, with a 75% increase in trading volume to $7.49 billion due to mixed dip-buying and panic selling.

- Recent stability near $255 resistance was disrupted by this decline.

- Crypto expert Ali Martinez noted a potential 20% breakout if SOL maintains an hourly close outside the $251-$262 range.

Technical Indicators

- The MACD indicator is nearing a bullish crossover, suggesting upward momentum.

- The Accumulation/Distribution line is declining, indicating more selling pressure.

- The Relative Strength Index (RSI) shows a downward trend while remaining neutral at 50.

Conflicting indicators imply short-term volatility for Solana, but a rebound is possible if bullish signals strengthen.

Source: TradingView

What’s Ahead for Solana?

- Long-term prospects are positive, with potential catalysts like Elon Musk's interest in blockchain for government efficiency.

- Analysts suggest Solana could be favored for such applications, possibly leading to a price rally.

- Pending ETF applications from firms like Grayscale and VanEck may attract institutional investments.

- Currently, Solana is 23% below its all-time high of $294 reached on January 19.

Investors are advised to consider the token's long-term growth potential.