19 0

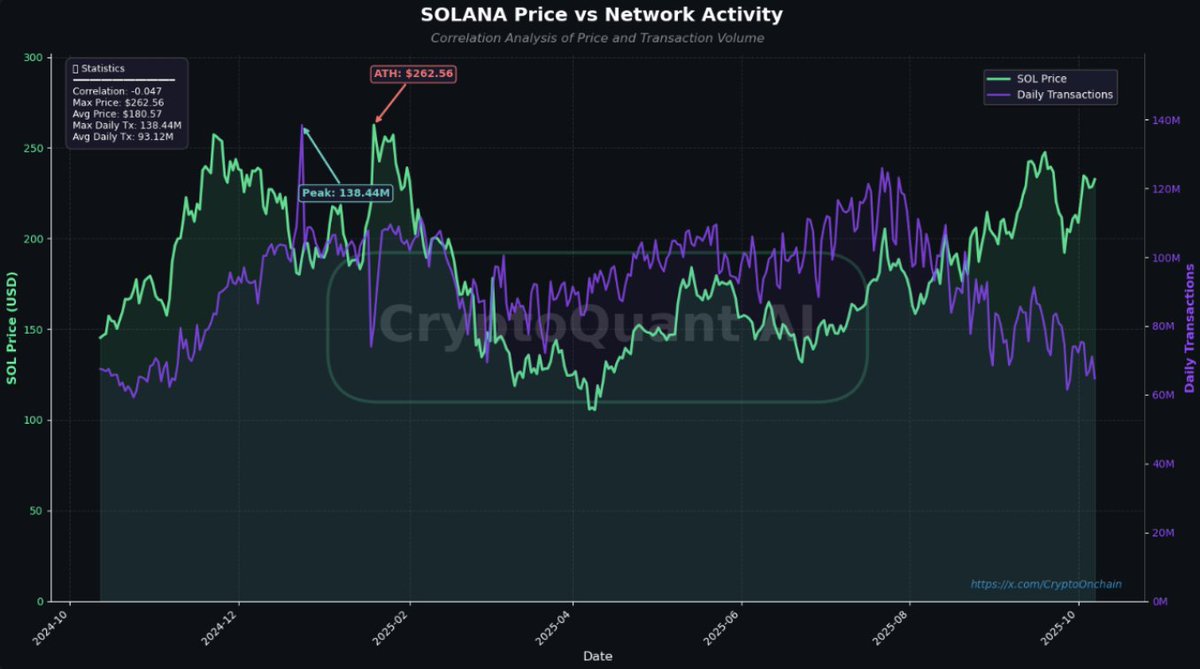

Solana Network Transactions Plunge 50% Amidst Strong Price Rally

Solana is experiencing significant volatility amid broader market uncertainties. Analysts are divided on potential market movements, with some highlighting Bitcoin's challenges in achieving price discovery as a possible obstacle. Solana's recent strong rally shows divergence between its price action and network activity, raising sustainability concerns.

- Crypto Onchain data highlights a negative divergence: Solana's price is rising while network transactions have decreased significantly.

- The daily transaction volume has dropped from approximately 125 million to around 64 million, a nearly 50% decline.

- This pattern suggests that the rally may be driven more by speculative trading than organic growth.

- Market sentiment is mixed; some attribute the transaction decline to changes in network voting activity rather than reduced user engagement.

Price Analysis:

- Solana (SOL) is consolidating after a rally, currently trading near $221, a 3.5% decline for the day.

- Despite the pullback, SOL maintains a bullish structure, trading above key moving averages (50-day, 100-day, and 200-day).

- The $210–$215 zone serves as immediate support; holding this level could lead to attempts at reclaiming $240–$250.

- A drop below $210 could trigger further corrections, targeting near $190.

Overall, Solana's stabilization will depend on maintaining support levels as investors look for confirmation of the next major move.