Solana’s Total Value Locked Reaches $5.7 Billion, Ranking Third in DeFi

A report from Messari reveals the performance of the Solana (SOL) ecosystem in Q3 2024, highlighting both growth and challenges amid cryptocurrency market volatility.

Solana Stablecoin Market Cap Rises to $3.8 Billion

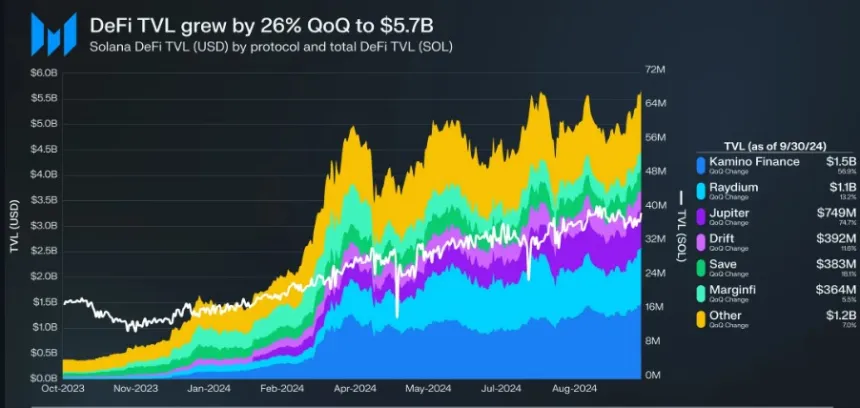

Solana’s Total Value Locked (TVL) in decentralized finance (DeFi) increased by 26% quarter-over-quarter (QoQ) to $5.7 billion, making it the third-largest network for DeFi TVL, surpassing Tron in late September. The TVL in SOL also rose by 20% QoQ to 37 million SOL.

Kamino led the Solana ecosystem with a 57% increase in TVL, reaching $1.5 billion and capturing 26% market share, driven by new tokens like PayPal’s USD (PYUSD) and jupSOL. Conversely, decentralized exchange (DEX) volume fell by 10% QoQ to $1.7 billion, reflecting reduced interest in memecoins, with only WIF and POPCAT ranking in the top ten by trading volume.

Solana's stablecoin market cap grew by 23% QoQ to $3.8 billion, ranking fifth in this category. However, the non-fungible token (NFT) sector saw a 27% decrease in average daily volume to $2.5 million, with Magic Eden's volume declining by 44% while still holding a dominant market share.

Network Activity Thrives

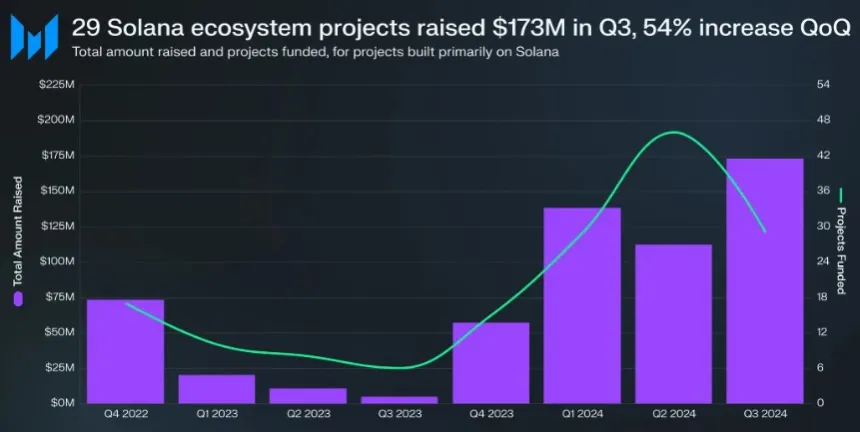

The number of funding rounds for Solana projects decreased by 37% QoQ, totaling 29 projects; however, total funds raised increased by 54% QoQ to $173 million, marking the highest quarterly funding since Q2 2022.

Average daily fee payers rose by 109% to 1.9 million, with new fee payers increasing by 430% QoQ to 1.3 million, indicating a growing user base. The average transaction fee increased by 6% QoQ to 0.00015 SOL (approximately $0.023), while the median fee decreased by 19% to 0.000008 SOL (around $0.0013).

As of October 15, Solana’s market capitalization increased by 5% QoQ to $71 billion, maintaining its position as the fifth-largest cryptocurrency after Bitcoin, Ethereum, Tether, and Binance Coin. However, the Real Economic Value (REV) of Solana dropped by 25% QoQ to 1.3 million SOL (approximately $196 million), with 56% derived from transaction fees.

At the time of reporting, SOL traded at $166, reflecting a 5% decline over the past week.

Featured image from DALL-E, chart from TradingView.com