18 4

Stablecoin Market Exceeds $280B, Enters Infrastructure Competition Phase

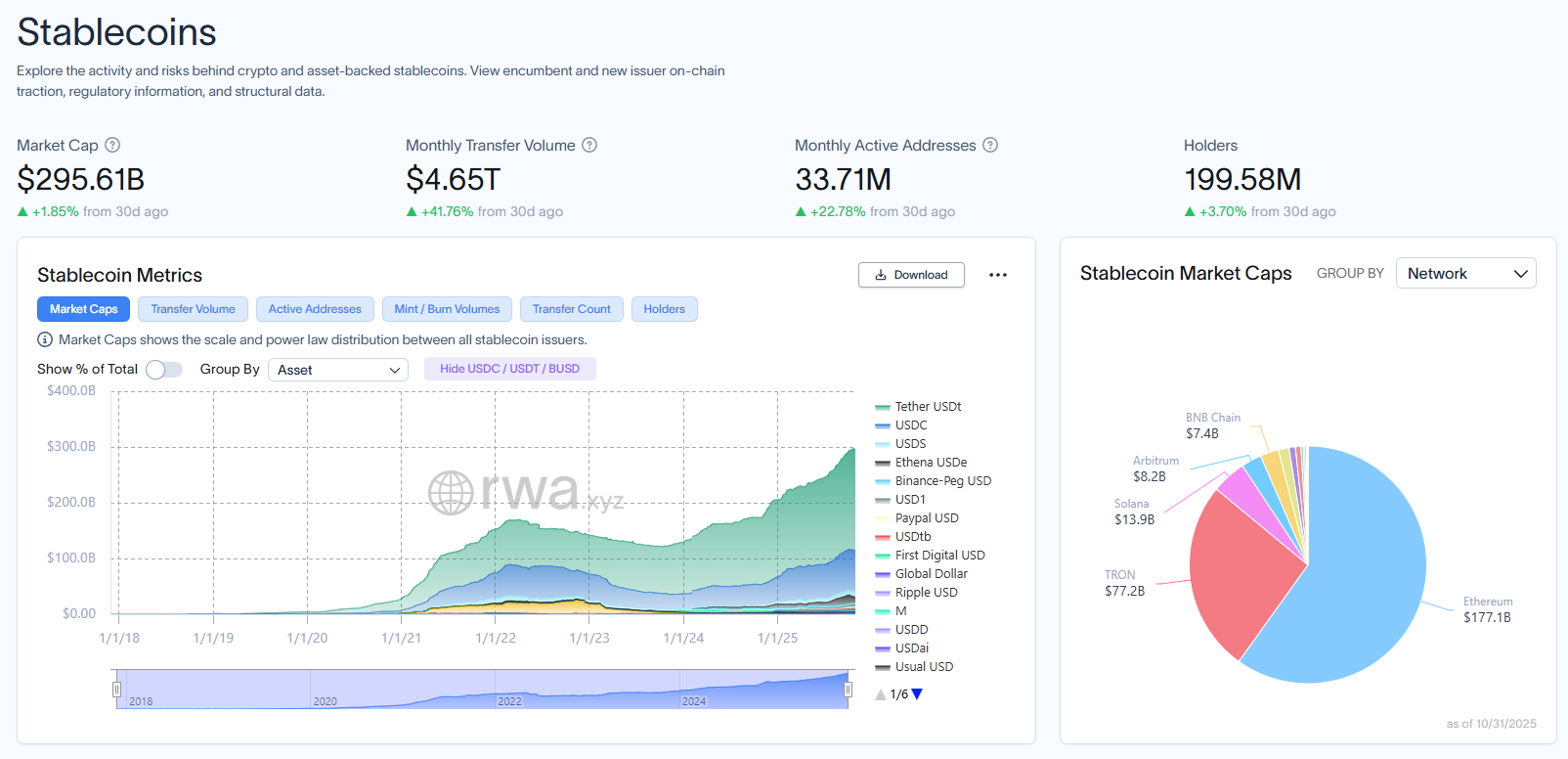

Alchemy Pay and Gate Research's report highlights the stablecoin market's shift to an "infrastructure competition" phase, with a market capitalization over $280 billion as of August 2025.

- Stablecoin market growth: increased 660-fold since early 2019.

- The "Age of Compliance" has begun, driven by regulatory frameworks like the GENIUS Act, MiCA, and Hong Kong's Stablecoin Ordinance.

- Market cap reached $295.61 billion by Oct. 31, with 33.71 million monthly active addresses.

Traditional Finance Integration

- PayPal, Visa, and Mastercard have integrated stablecoins into various payment systems.

- PayPal completed cross-border payroll settlements using PYUSD.

- Visa launched a Global Stablecoin Settlement service for USDC payments on blockchains.

Infrastructure Competition

- Tether and Circle are developing payment networks and infrastructure models.

- Stripe acquired Bridge and is developing Tempo, a blockchain for payments.

- Alchemy Pay launched Alchemy Chain for stablecoin settlement.

- Tether's USDT holds a 60.66% market share with $179 billion in capitalization; Circle's USDC holds 24.64% with $72.8 billion.

- Non-USD stablecoins are projected to grow to 15-20% market share in five years.

- MiCA drives euro-denominated stablecoin development; Japan focuses on yen stablecoins.

- Regional currencies gain traction for reduced dollar dependency.

The report concludes stablecoins are moving from explosive growth to compliance establishment and towards a multi-polar currency landscape.