Stablecoin Market Capitalization Surpasses $190 Billion This Week

The latest on-chain data indicates the stablecoin market is nearing a significant valuation milestone, impacting Bitcoin and the broader cryptocurrency market.

Can The Increasing Stablecoin Cap Push Bitcoin Price To $100,000?

Market intelligence platform IntoTheBlock reported that the stablecoin market capitalization has surpassed $190 billion, marking its highest level since late April 2022 when Bitcoin was around $40,000. This growth coincides with Bitcoin's upward trajectory toward a six-figure valuation and an overall market cap exceeding $3.4 trillion. Increased adoption of stablecoins has been noted as investors seek riskier assets like cryptocurrencies.

Tether's USDT leads the stablecoin market, holding approximately 72% market share and a capitalization exceeding $133 billion. Demand for USDT is rising, with over $3 billion minted weekly and more than $13 billion minted since November's start, primarily flowing into centralized exchanges.

This influx of liquidity into exchanges correlates positively with market prices, suggesting enhanced buying power for investors. Continued positive trends could be crucial for Bitcoin to reach $100,000. Currently, Bitcoin's price hovers around $96,500, reflecting a 2% increase in 24 hours, though it remains down 3% over the past week.

BTC Market Becoming Stable And Mature: IntoTheBlock

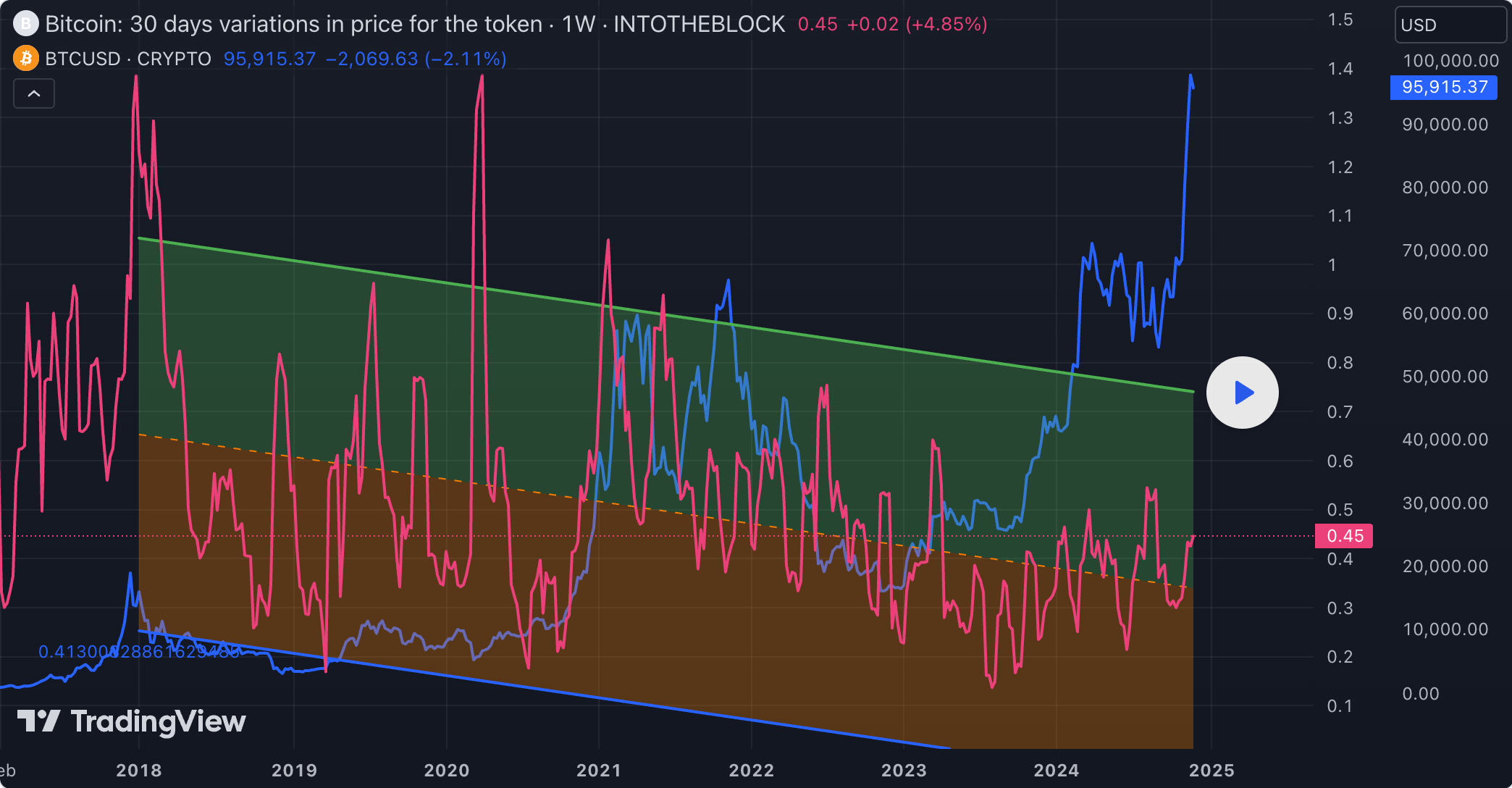

IntoTheBlock also noted that Bitcoin's market is maturing, with volatility decreasing. This trend addresses long-standing concerns about BTC's stability as a store of value. As retail and institutional adoption grows, Bitcoin's price performance may become more stable, enhancing its reliability as a store of value.