8 0

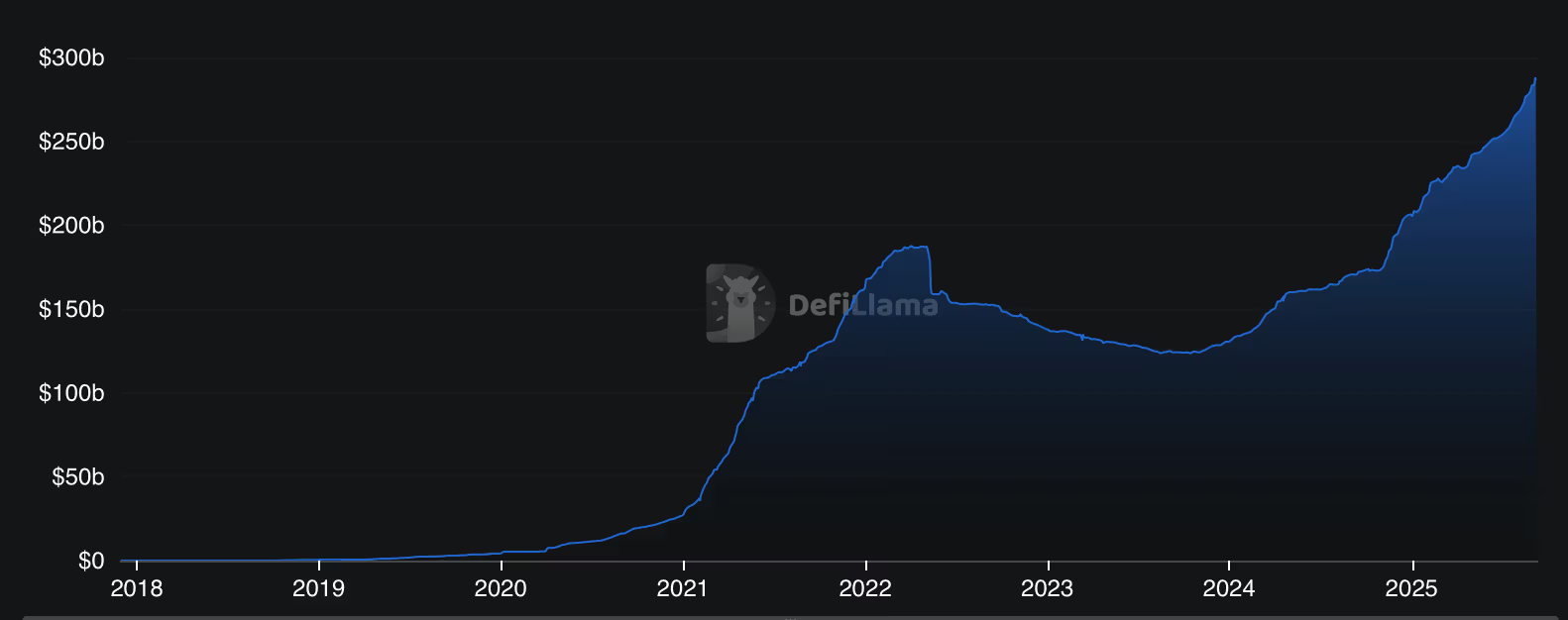

Stablecoin Transactions Reach $264.5 Trillion Amid Growing Issuance

Stablecoins have become a crucial element in the crypto industry, facilitating $264.5 trillion across 18 billion transactions since 2019. They offer a stable store of value and a reliable means for on-chain transactions without volatility concerns.

Recent Developments:

- The GENIUS Act passed in July 2025, providing clarity on stablecoin issuance in the U.S., spurring a wave of new issuances and acquisitions.

- MetaMask introduced mUSD; Stripe launched Tempo; Circle announced Arc Network.

- Stablecoin infrastructure companies like Iron are being acquired by firms such as Stripe.

- Crypto companies are issuing native stablecoins to generate revenue from yield. MegaETH introduced USDm, while Hyperliquid's USDH led to competitive interest.

Reasons for More Stablecoins:

- Financial Inclusion: Over 1.3 billion people remain unbanked. Stablecoins provide global, borderless access to financial services.

- Currency Diversity: Prevents over-reliance on a single currency, reducing dependency on U.S. monetary policy.

- Risk Mitigation: More stablecoin issuers decrease concentration risk, ensuring system stability through redundancy.

Stablecoins are reshaping global finance, enabling instant cross-border transactions with user-aligned incentives. Their growth signifies a shift from speculative focus to foundational financial infrastructure in the crypto economy.