8 1

Staking Nears Asset Class Status with Over $500 Billion Staked

Staking is evolving into a recognized asset class as scale, volatility, and diverse participants converge:

- Over $500 billion is staked across proof-of-stake networks. Ethereum alone accounts for over $100 billion.

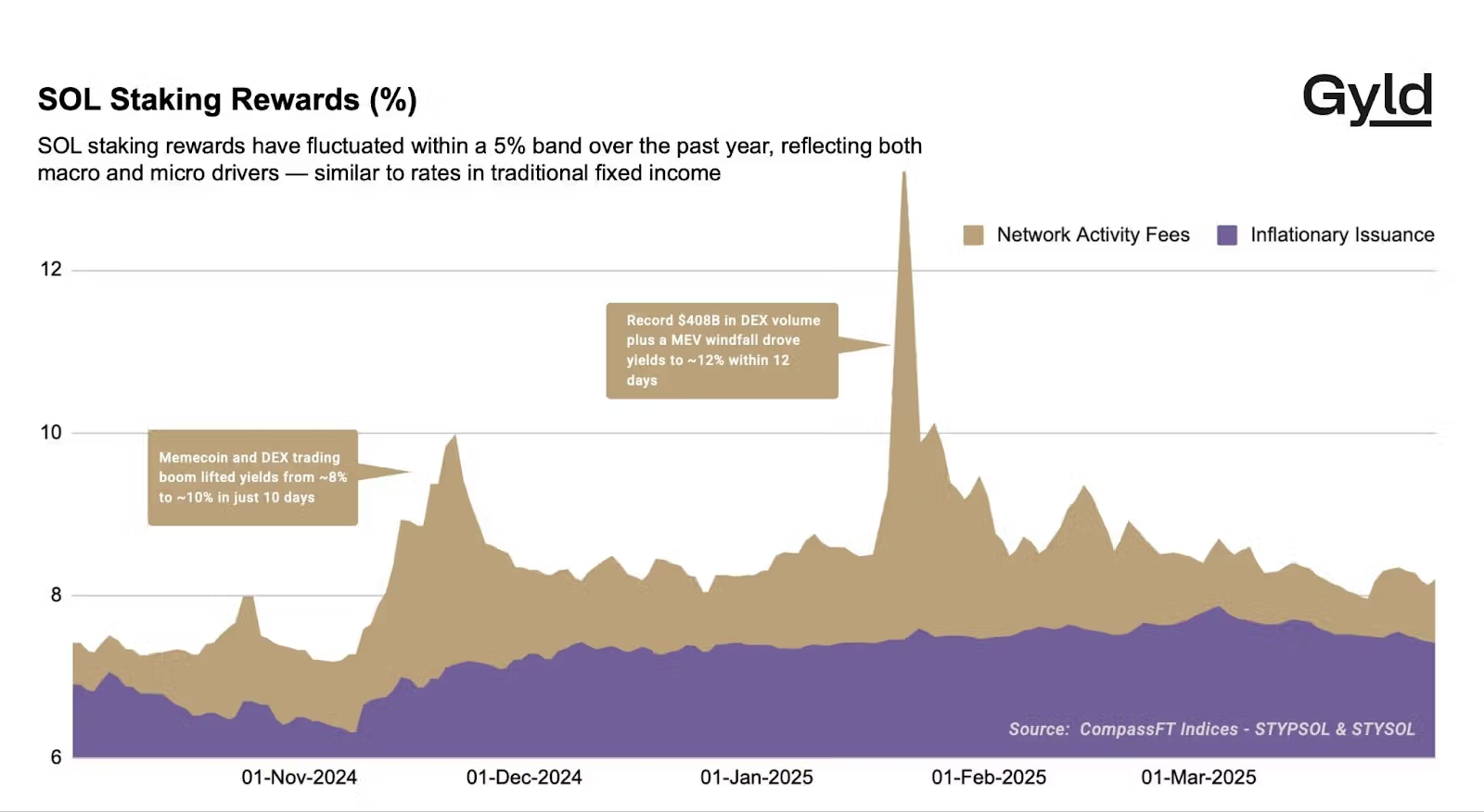

- Volatility is evident with staking returns varying significantly; Solana's rewards range between 8% and 13% annually.

- Participant diversity drives market dynamics: ETPs, ETFs, digital asset treasuries, retail stakers, and speculators each have different objectives influencing market behavior.

These elements contribute to price discovery and the formation of efficient markets. Staking's trajectory mirrors the evolution of fixed income markets from illiquid lending agreements to standardized bonds and thriving secondary markets.

For institutional investors, staking offers diversification with returns influenced by network usage, validator performance, and protocol governance rather than traditional crypto price beta.

Staking is transitioning from a technical function to a financial market, poised to emerge as a true asset class.