6 March 2025

0 0

Strategy Becomes Largest U.S. Convertible Bond Issuer in 2025

Strategy (MSTR), previously MicroStrategy, is the largest issuer of U.S. convertible bonds in 2025, accounting for 30% of the market.

- The company has issued $2 billion in convertible bonds year-to-date.

- The total U.S. convertible debt market is approximately $280 billion.

- Strategy has six outstanding convertible debt offerings with a total notional value of $8.2 billion.

- The average weighted maturity of these bonds is 5.1 years, and the coupon rate is 0.421%.

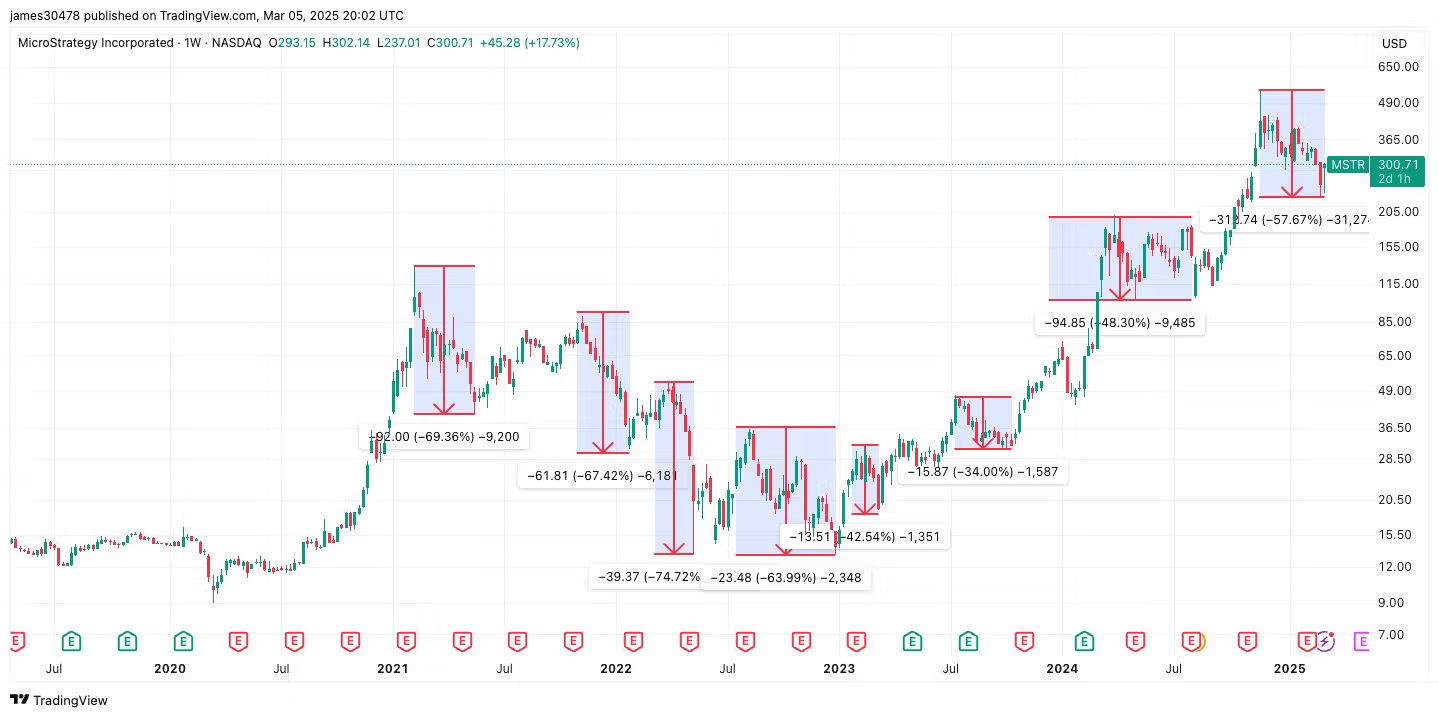

Strategy's stock has shown volatility, rebounding 30% from its February lows but previously declining by 58% from its highs. Since adopting a bitcoin treasury strategy in August 2020, it has faced eight drawdowns exceeding 30%, with the latest being significant.

The company aims for potential inclusion in the S&P 500, contingent on the price of bitcoin reaching at least $96,000 by the end of Q1.